Life is Not Guaranteed

Posted by JenBrhel

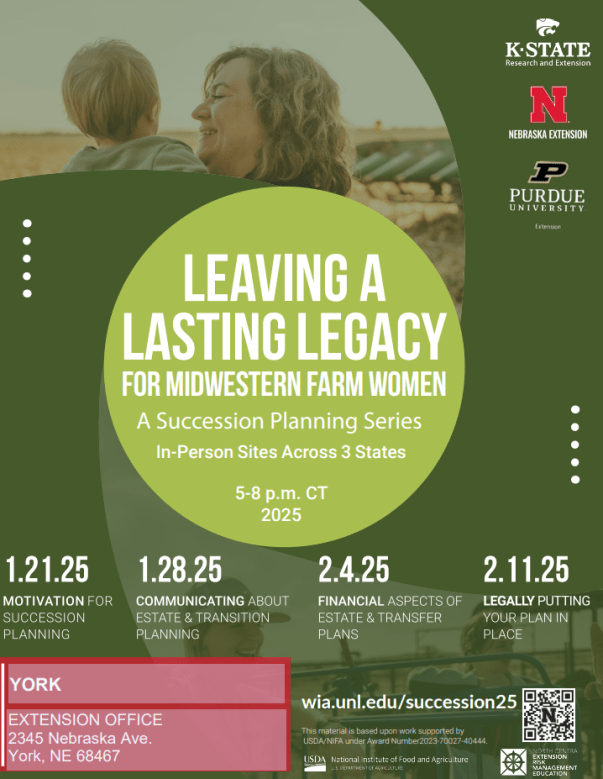

Last Tuesday night was our first Farm Succession Program “Leaving a Lasting Legacy”. That night was an incredibly impactful night for me. We heard from two women who became widows in their 30’s with young children. They were incredibly courageous in sharing their stories of loss, grief, difficulty navigating bills and decisions, etc. I left that night with so much on my mind. My husband and I have talked much since then. I’ve also shared with my siblings as we talked through how would our next of kin be able to navigate our accounts, passwords, etc. if something would happen to us.

The ladies shared several things that I felt would be beneficial to all for me to share here.

- At minimum, have a will in place that shares your desires for who receives your belongings, guardians for your children, etc.

- All vehicles and property should be listed as “joint tenancy with right of survivorship”.

- Both widows nearly dealt with probate. One widow lost both her father and husband in a plane crash and both were part of the family dairy business. The trust had been started but never completed by the father. They were able to avoid probate on the things the father had in the part of the estate plan written down but are still paying hefty fees on the parts that weren’t written in order to keep the family business. She emphasized the importance of finishing estate plans!!! Then review them every 2-3 years.

- In the case of the other widow, the husband had an off-farm job as a life insurance agent in addition to the farm. She shared the blessing of how well he provided for her by having such a large life insurance policy that helped her pay off debt and keep/manage the farm while raising her children at home.

- All accounts need to have both people listed. For example, the family phone plan was listed under the husband. She wasn’t able to access it with the phone company since she wasn’t listed and had to start over with new phones and accounts.

- The husband’s work email was used for several accounts at home (electric, heat, etc.). When he passed, his email was discontinued and the wife had no access to the accounts, nor was she listed on them. They both shared the difficulty paying bills and keeping their homes because they weren’t listed on accounts, on top of the immense grief they experienced.

- Ensure all account usernames and passwords are in a place where your next of kin can access them. There are tools for this including Nokboxes from Dave Ramsey.

- Medical: Many lawyers have templates for this, but if not, one document tool (paper or digital) you can use is from 5 Wishes. One wife whose husband was non-responsive had no idea if he would want experimental drugs used, if he wanted to be on dialysis for the rest of his life, and then if he wanted to remain on life support. She shared how having to make those decisions for him still haunts her, especially discontinuing life support.

There’s so much more I could share. Life is so short. Tomorrow, our next moments, nothing is guaranteed. My hope is that this column creates conversations amongst loved ones. Do you and your spouse/next of kin have a will in place? Do you have access to each others’ bank accounts, have a place where usernames/passwords are stored, have the names necessary on all accounts?

If you’re interested in attending, we will still take people each Tuesday night for the next three weeks. Please contact the Extension Office closest to you if you’re interested. More info: https://wia.unl.edu/succession25/.

Share this:

Related

About JenBrhel

I'm the Crops and Water Extension Educator for York, Seward, and Fillmore counties in Nebraska with a focus in integrated cropping systems.Posted on January 26, 2025, in Discussion Topics, JenREES Columns, Reflections, Stories and tagged estate planning, farm transition, succession planning, transition planning. Bookmark the permalink. 2 Comments.

This could be some of the most important informati

Thanks David! I felt it was incredibly important to learn for myself and to share with others too!