March 2026 Events

Ag Recognition Banquet: Kiwanis Club of Seward invites you to Celebrate Agriculture by attending the 58th Annual Ag Recognition Banquet! It will be held on Monday, March 23 at the Seward County Fairgrounds Ag Pavilion. 5:30 p.m. is the social with prime rib meal at 6:30 p.m. and program/awards at 7 p.m. Being recognized this year for Outstanding Farm Family is Havlat Farms and recognized for the Agribusiness Award is Baack Ag Services. Past award winners who wish to attend should contact Nick Bauer at 402-429-6119 or nick.bauer@fcsamerica.com. Tickets can be purchased and table sponsors can request tables at the following website: https://sewardkiwanis.org/events/ag-recognition-banquet.

Getting Started Farm & Ranch Transition Planning will be held on March 11th from 11:30 a.m.-1 p.m. at the Bremer Center in Aurora. There is no charge and includes a free lunch. RSVP is request to 402-694-6174. Transition and estate planning is one of the most important topics we face in agriculture!

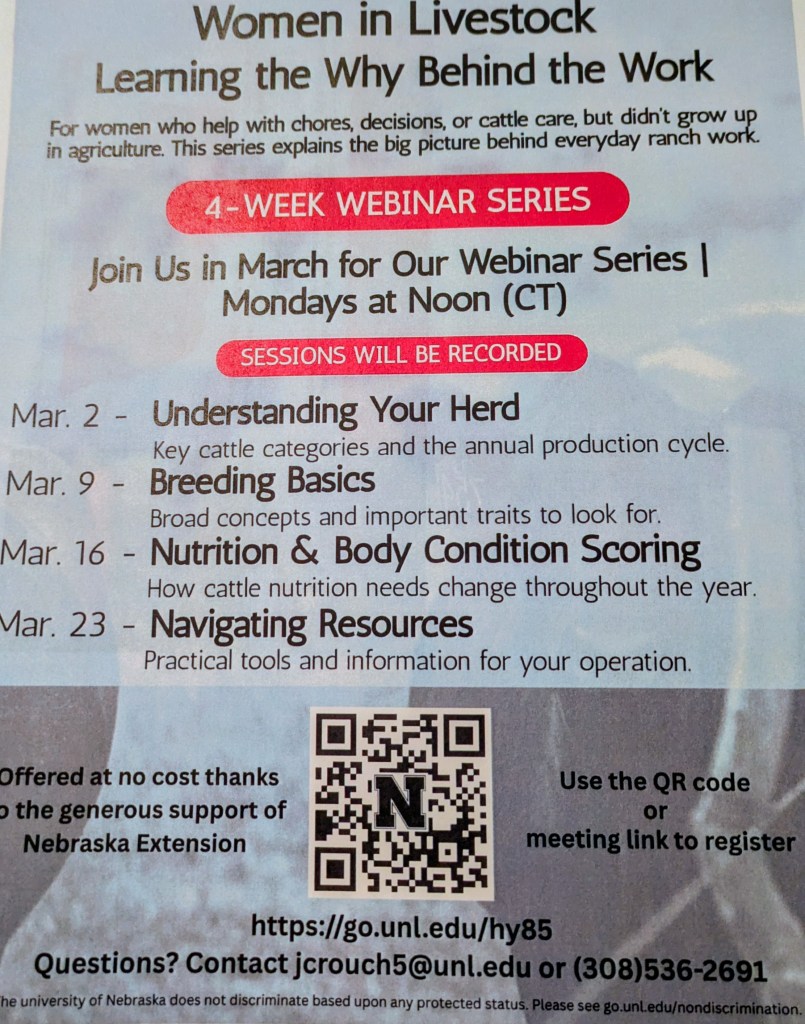

“Learning the Why Behind the Work” are webinars held each Monday in March at noon CST. The webinars are geared for women who help with chores, decisions, or cattle care but didn’t grow up in agriculture. All are welcome though. Each webinar has been recorded in case you missed one. For remaining webinars: March 9 is on breeding basics; Mar. 16 is on nutrition and body condition scoring; and Mar. 23 is on navigating resources. There is no cost but please go to https://go.unl.edu/hy85 to register and receive the zoom links.

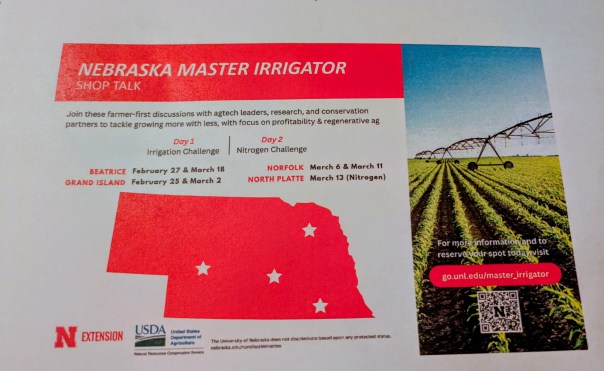

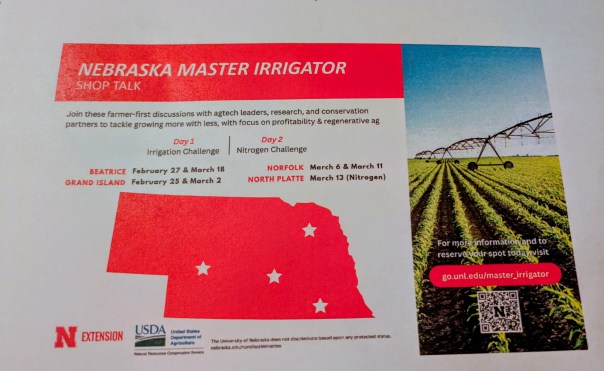

Master Irrigator Nitrogen discussions will be held at a variety of locations this month including March 11th in Norfolk, March 13th in North Platte, and March 18th in Beatrice. More info. at: https://go.unl.edu/master_irrigator.

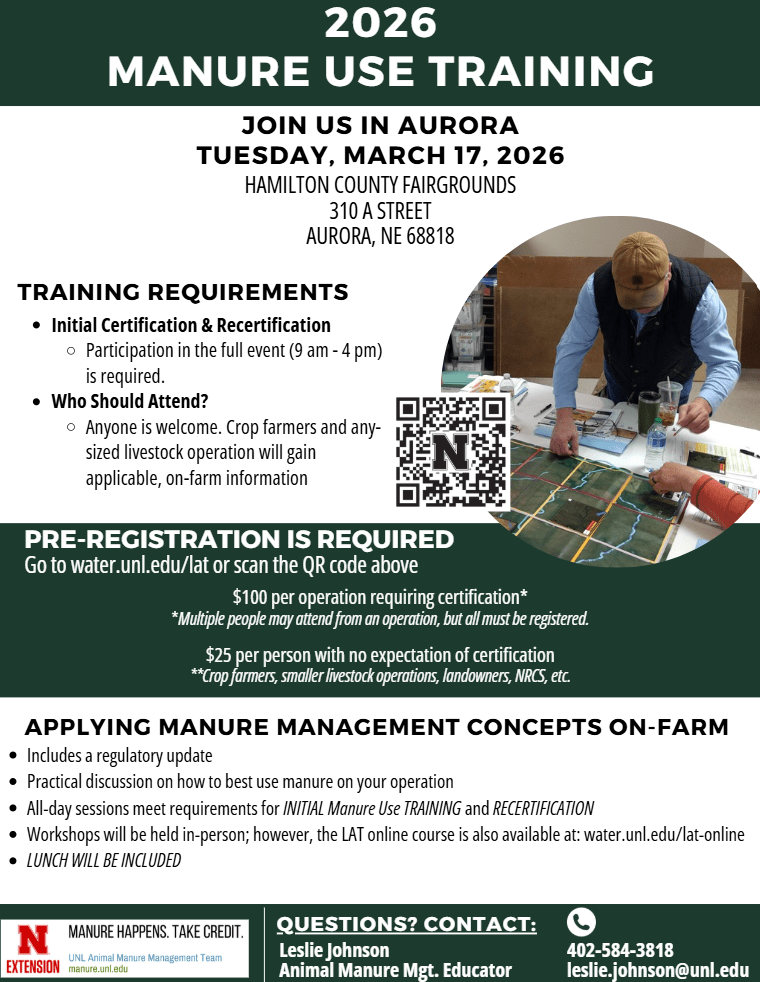

Manure Management on Crop Ground in Aurora March 17th: Turning manure nutrients into improved crop yields while protecting water and soil quality will be the focus. The day-long sessions, held from 9 a.m. to 4 p.m. local time, provide DWEE Land Application Training certification. Participants must attend the full program, which includes lunch, to earn certification. Sessions will cover regulatory updates and strategies for using manure effectively on cropland. While certification is available, anyone may attend, including crop farmers and smaller livestock operators seeking practical guidance for their operations.

Hands-on activities will help participants evaluate which fields are best suited for manure application. Each session will present a scenario in which attendees assess potential fields and determine whether manure use would be beneficial or if certain limitations make the site less desirable. Participants will then rank fields by priority based on factors such as nutrient value, transportation cost, soil health, water quality, neighbor proximity, and odor concerns. Regulations and record-keeping requirements for manure storage and application will also be covered. Registration is available at https://water.unl.edu/lat. The cost is $100 per operation requiring certification—typically larger livestock facilities—or $25 per person for attendees not seeking certification, including smaller livestock producers, crop farmers, NRCS staff, and landlords.

Crop-Livestock Integration Case Study

Happy March! We had a great Friday February conversation again. I think the power in that conversation was watching how ideas from previous years of conversations came to fruition with actual data including stocking rates and economics from several growers. The following is a case study where a grower who enjoys cattle wanted to find a way to raise his herd in the Utica, NE area where corn/soy/seed corn is plenty and pasture is limited. He thought outside the box, challenged the status quo and split a pivot into four quarters in 2024.

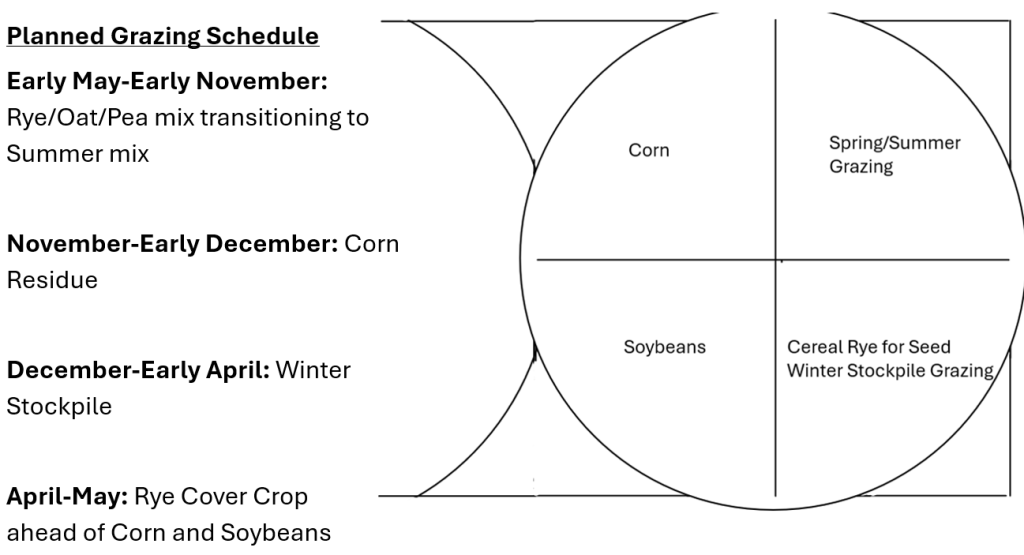

On one quarter he planted corn, the next quarter was a year of annual forages for strip grazing, the next was cereal rye for seed followed by winter stockpiled annual forages, and the final was soybeans. The pivot corners consist of pasture and one farmstead. The crops on each quarter are rotated clockwise each year. For example, the quarter that was strip-grazed annual forages in 2024 was planted to corn in 2025. Volunteer rye and vetch were grazed before corn was planted in that area and the cows were moved onto oats/peas he planted into the annual forage quarter. As they were dying out, he followed the cows with planting an annual forage summer mix that contained multi-species but was heavier on millets so he didn’t have to worry about removing cows during light frosts (he was avoiding the potential of prussic acid poisoning by using the millets instead of sorghum species). Now the cows are on the winter stockpiled forage that was also a muti-species mix but heavier on the sorghum species side. For a stocking rate, he figures 1 pair per acre (around 33 pairs if he stayed on this quarter system). This would also be a great system for stockers.

Splitting a pivot into quarters wouldn’t perhaps be the easiest set-up for most. His goals were to keep his cows on this one pivot for the entire year and to see what his stocking rate could be as he grew his herd. He also wanted to determine the economics and soil health of this system by the end of four years to see if he could scale it to other pivots on his farm. The beauty of this is that the system could be adapted to each producers’ goals and needs. Pivots could be split in half or converted entirely to suit the individual’s goals.

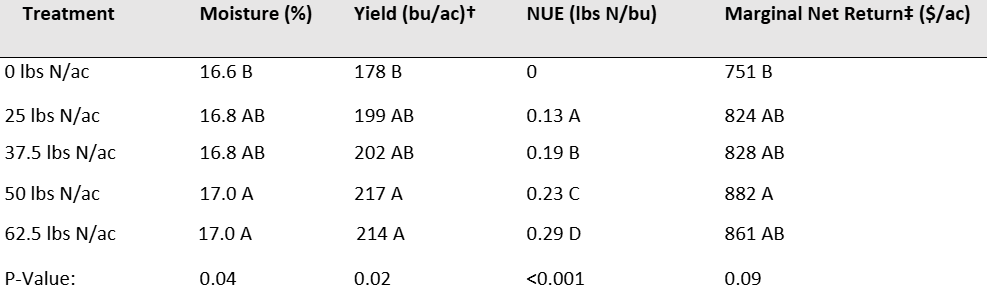

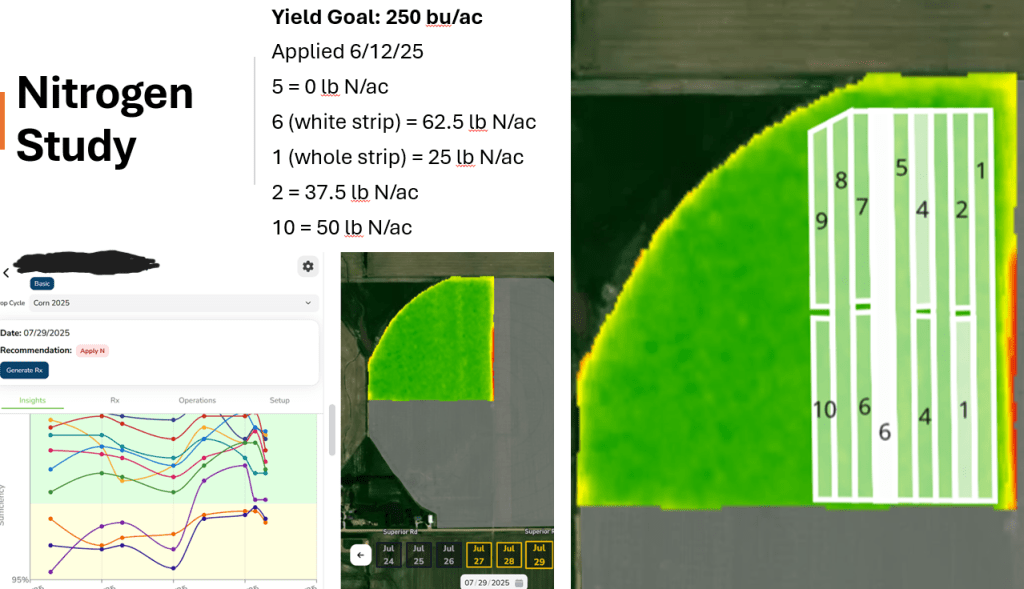

This grower also wanted to see how much nitrogen…and other nutrients over time…the annual forage grazing contributed to the succeeding corn crop. We’ve heard a potential of 100 lb/ac of nitrogen could be credited, so that was considered in addition to the residual soil nitrate and nitrate in irrigation water. He set up a side-dress on-farm research study where he applied starter fertilizer but no other nitrogen until V2-V3 corn. He had 4 reps including rates of 0, 25, 37.5, 50, and 62.5 lb N/ac applied. The goal was to apply these same rates to the same strips the next time he side-dressed. He then used Sentinel Ag to sense the timing of when he would need additional nitrogen. However at side-dress time, the Sentinel Ag imagery said he only needed nitrogen on the 0 lb and two of the 25 lb/ac strips. So, the grower decided to let it go and see what happened. His yields? While they were down like many in the area, he raised 217 bu/ac on 50 lb N/ac and 178 bu/ac on 0 lb N/ac! For the annual grazing with cow-calf pairs, his economics came to a profit of $683/ac (that was using $300/ac rent cost). Think about his corn and grazing economics for your own system. It’s exciting to me to see a case study like this where crops and livestock are integrated so well to show the benefits of diversity not only for the land and reduced inputs but economically!

And, it’s another example of how Sentinel Ag’s satellite imagery can be used to help with nitrogen management. With March pre-plant nitrogen applications, consider the nitrogen challenge: only apply 50-100 lb N/ac pre-plant and use Sentinel Ag to determine the remaining needs this growing season. Please contact me if you’re interested in more information.

Crop Ground to Annual Forage Grazing

Converting Crop Ground to Annual Forage Grazing: A handful of producers have been doing this in the area with more considering it for 2026. Why? With the high input costs and low commodity prices, producers are searching for alternatives. The economics of grazing covers is good compared to planting corn and soybeans. Pencil it out for your operation. Input costs for grazing annual forages include cover crop seed and seeding, land costs, potentially one herbicide application between rye and planting a summer cover crop, water and fence infrastructure, and irrigation for establishing covers on irrigated ground. Here’s a potential rotation to make this work: rye planted in the fall or oats planted in March. Strip graze the rye or oats in April-May. Plant a summer annual cover crop mix in June/early July. Strip-graze the summer mix in late July-October. Some people will move livestock off the crop ground between light frosts until a hard freeze if sorghum species are in the summer mix (to avoid any prussic acid poisoning). Then livestock can continue grazing any remaining forage after frost with minimal loss in quality. If cool season cereals like rye/wheat/oats were added to the summer mix, they will come on in the fall and add additional quality to the forage into the winter. Or, a cool season cereal can be planted in the fall after the summer annual forages are grazed off. There’s multiple options for doing this!

Those cash renting ground were often able to pay for the cash rent of irrigated or non-irrigated crop ground in 1 to 2 grazings. How to figure costs? UNL farm real estate reports share an average cost of $68/cow-calf pair/month to graze on pasture in Eastern and Central NE. Annual forages would have a higher quality, so that should be taken into consideration for the value received. If you would graze cattle for someone else, such as grazing custom cattle, you can expect to receive anywhere between $1.50-$2.50/1000 lbs of cow (standard animal unit)/day depending on one’s location. This is also the value you’re creating if you’re using your own cattle to graze the covers. If you own cattle and want to retain your calves and add weight after weaning, consider putting the calves on the forages for the highest value return and gains. Pencil it out for your operation. We converted half our crop acres this year to forages for custom grazing cows. And, the benefits are beyond a single year of economics. I’ve seen how strip-grazing plants with animals can improve ground through improving pH, improving water infiltration through better soil aggregation, increased soil microbial communities, and nutrient release. A risk for consideration is lack of rainfall on non-irrigated ground to establish covers and maintain growth. Producers will also share specific examples with their economics on this Friday’s Feb. 27th conversation from 10-noon at the 4-H Building in York.

Farmers Bridge Assistance (FBA) Program: This program provides $11 billion in one-time bridge payments to row crop producers in response to temporary trade market disruptions and increased production costs. The FBA enrollment period opens Feb. 23 and closes April 17, 2026. There will not be mailed prefilled applications anymore. Producers are encouraged to use/create a login.gov on farmers.gov to apply or they can still apply in person in the office. More info: https://www.fsa.usda.gov/news-events/news/02-20-2026/usda-announces-enrollment-period-farmer-bridge-payments?utm_campaign=022026fbaenrollment&utm_medium=email&utm_source=govdelivery.

Master Irrigator Program: Nebraska Extension invites farmers, agricultural professionals and conservation partners to participate in a local 2026 Nebraska Master Irrigator “Shop Talk” discussion. These will be two‑day, discussion‑based programs focused on tackling today’s most pressing irrigation and nitrogen management challenges. The first day of each location will focus on irrigation and the second day will focus on nitrogen. Registration and info at: https://go.unl.edu/master_irrigator. Walk-ins are welcome. Closest sessions include: Grand Island Extension Office on Feb. 25 & Mar. 2; Extension Office in Beatrice on Feb. 27 & Mar. 18.

Week of Feb. 15th Events

This beautiful weather resulting in a warm, dry winter, provides an important opportunity to be watering evergreen trees and lawns. Our horticulture educators have the following information to share. Now is the time to water trees and lawns to prevent desiccation, especially with warm temperatures in the extended forecast. If you want to prevent evergreens from turning ever-brown, take time over the winter to provide supplemental water. Any time air temperatures are above 40°F you can do a slow soak of water around your evergreen trees and shrubs (and even lawns). Allow enough time for the water to infiltrate before temperatures drop below freezing. For information about this and other winter tree care tips read more here: https://water.unl.edu/article/lawns-gardens-landscapes/tree-care-during-winter/.

Friday Conversations: This past week’s conversation on nutrient balance could’ve lasted much of the afternoon as it went two hours over the scheduled time. Will write on that topic next week. Friday Feb. 20th’s conversation will be on Cows, Compost, and Covers. Hear from growers who have converted crop ground to annual forages for grazing and the economics of that, especially compared to corn and soybeans this year. There’s still time to make that change for 2026. We’ll share options for different classes of cattle, including custom grazing if you don’t own/have enough cattle. I’ve heard some growers struggling with landlords/lenders to make that decision. If you are in that situation, please contact me and I’d be happy to talk with them and you. We need more diversity in our operations to spread risk and reduce pests! You’ll also hear how we’re using compost extracts on our farms to aid in biology and other benefits. You’ll also learn from the growers why they use various species of cover crops in their operations and what each species does for their soils and their system. If you’re interested, please join us from 10 a.m.-noon this Friday, Feb. 20th at the 4-H Building in York. RSVP to 402-362-5508 isn’t required, but is helpful to ensure I have enough handouts.

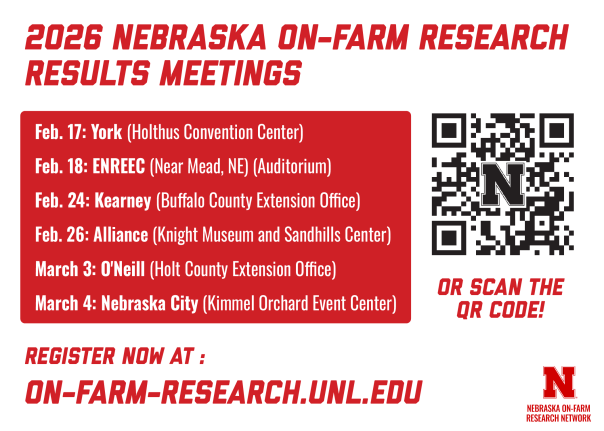

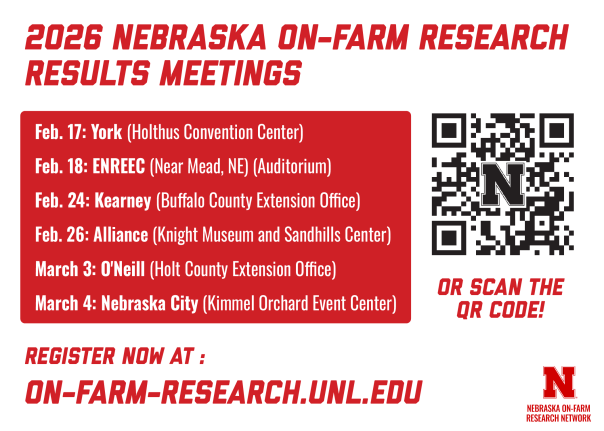

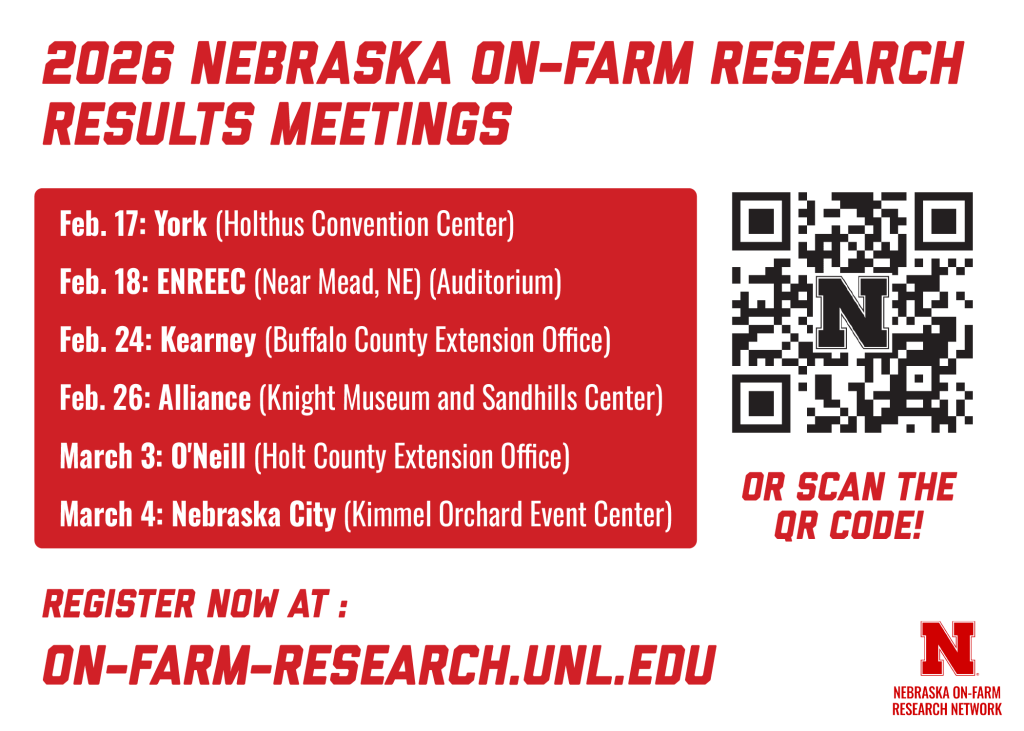

On-Farm Research Updates: There’s several on-farm research updates upcoming with the first being this Tuesday, Feb. 17th at the Holthus Convention Center followed by Feb. 18th at ENREEC near Mead. Program starts at 9 a.m. with registration at 8:30 a.m. If you’re looking to hear what other growers are trying on their farms and their results, it’s a great opportunity. More info.: https://on-farm-research.unl.edu/.

Central Nebraska Soil Health Conference will be held Feb. 18th in Hastings at the Lochland Country Club with program beginning at 9 a.m. and registration at 8 a.m. At that meeting, you will hear from some of our producers utilizing cover crops for grazing with the economics and how they are also reducing inputs in the corn the following year after that cover crop grazing year. You will also hear from growers who are reducing inputs in soybeans using soil health practices. The keynote speaker will share on biochar. More info. and RSVP: https://go.unl.edu/2026soilhealthcon.

York Co. Corn Grower Tour will be held Wed., Feb. 25. We’ll meet at the York Co. Extension Office at 9:40 a.m. First stop will be Timpte Manufacturing in David City. Lunch will be at La Carreta in Seward followed by tours at Hughes Brothers Inc. and Bottle Rocket Brewing Co., both in Seward. Please RSVP to the Extension Office at 402-362-5508 if you’re interested in attending.

Beginning a Soil Health Journey

This was the topic of last week’s Friday February conversation. $700 million has been designated by USDA for regenerative ag and soil health. USDA’s defintion: “Regenerative Agriculture is a conservation management approach that emphasizes natural resources through improved soil health, water management, and natural vitality for the productivity and prosperity of American agriculture and communities.” From the website at: https://www.nrcs.usda.gov/programs-initiatives/regenerative-pilot-program, participants work with their local NRCS office to determine a whole farm plan addressing soil, water, and nutrient concerns. A soil sample is required in the first year and last year of the program. I’m grateful there’s finally a program that helps farmers who are either beginning or more advanced. For those beginning, practices such as reduced tillage, cover crops, etc. can be implemented. Those more advanced have additional options such as soil amendments. The original application was due Jan. 15 to qualify for 2026; however, several NRCS staff have told me to contact your local NRCS to fill out an application if you’re interested.

Why does this matter? The soil is a big deal! The majority of food and feed is raised in the soil. Healthier soil can lead to healthier people and animals. There’s an increasing number of labs that are documenting the nutrition density of foods grown in conventional vs. regen/organic systems. As I continue to learn results from these labs, it’s sad to hear how much we’ve lost in food nutrition. It’s also important for us to steward the resources we’ve been given well.

The following are a few thoughts shared by the farmers from the conversation. The greatest obstacle to overcome is one’s mindset…all the reasons we tell ourselves that we can’t change in addition to the social implications (family and friends) of doing something differently. We are only given so much time and so many seasons to farm. If you’re thinking about any change, try it now!

Advice to begin: Focus on one or two fields and continue the practices (reduced tillage or cover crops) on them for several years. It takes at least three years to see changes based on their experiences and our on-farm research studies. Planting cover crops on this or that field without consistency each year leads to frustration as one may not see improvements over time.

- Cereal rye before soybeans is the easiest way to start. Before corn, we’d recommend planting winter wheat or winter barley in the fall or spring oats.

- Either plant your crop into dead brown covers or green growing ones; don’t plant into the in-between stage. If terminating pre-plant, use clethodim to allow more structure to the covers and follow label restrictions before planting corn.

- Money savings can occur through reduced herbicide, fungicide, and seed treatment costs. Also through reduced irrigation if reducing tillage, which improves soil structure.

- Challenges are markets for alternative crops or to be paid for raising crops with less inputs.

- Challenges are also economics. Choosing to continue using the same amount of inputs with reduced tillage and covers makes the economics challenging. Personally, I see how growers on this journey could reduce inputs more; however fear is a factor in addition to advisors uncomfortable with recommending less.

- Peer support is key. You don’t have to do this alone! If you’re interested in being connected to others, please reach out to me (jrees2@unl.edu). Another resource working to establish producer groups is the Nebraska Soil Health Coalition: https://www.nesoilhealth.org/. This Friday’s conversation (Feb. 13) is on nutrient balance from 10-Noon at the 4-H Bldg in York. The Central Nebraska Soil Health Conference is Feb. 18th at the Lochland Country Club in Hastings beginning at 9 a.m. (Reg. at 8 a.m.), RSVP: https://go.unl.edu/2026soilhealthcon.

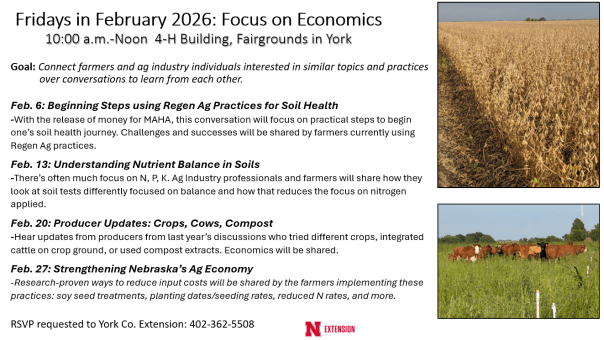

February 2026 Events

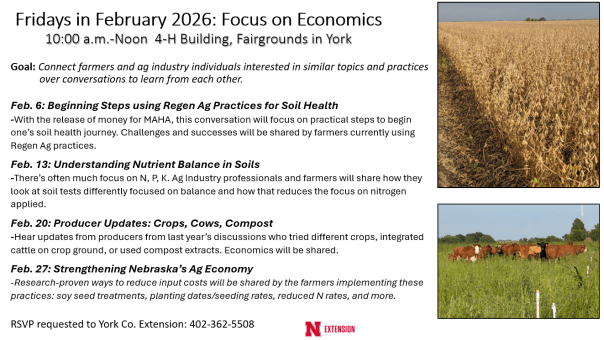

Fridays in February are conversations held each Friday in February from 10 a.m.-Noon at the 4-H Building in York. Farmers and ag industry professionals share their experiences around various topics. I ask a few people to lead the conversation and the discussion ensues from there. These are very informal and they’ve spurred increasing changes to producer operations. Topics this year are focused on economics. Walk-ins are welcome, but RSVP is preferred to 402-362-5508 to ensure enough handouts for the discussions.

Fri. Feb. 6: Beginning Steps using Regen Ag Practices for Soil Health. With the $700M designated for soil health practices, this conversation will focus on practical steps to begin one’s soil health journey. Hear from farmers about the challenges, successes, and their recommendations regarding beginning one’s soil health journey.

Fri. Feb. 13: Understanding Nutrient Balance. For years, the focus has been on Nitrogen, Phosphorus and Potassium in ag, but too much of these nutrients create imbalances with other nutrients in the soil and plants. There’s an increasing number of ag professionals sharing how too much N contributes to increased disease and insects in the system due to plants lacking in availability of other critical nutrients. Hear from a few farmers and ag industry professionals about what nutrient balance looks like to them and how they go about it in fields.

Fri. Feb. 20: Producer Updates: Crops, Cows, Compost. This session is an update of last year’s conversations. Hear from the producers who made changes in their operations as a result of the conversations and the economics of these changes in their system. Some changes include: adding alternative crops in rotation, converting crop ground to annual forages for grazing, and using compost extracts on fields.

Fri. Feb. 27: Strengthening Nebraska’s Ag Economy. These conversations will share research-proven ways to reduce input costs without impacting yields. Information will be shared by producers and Extension educators who studied these topics via on-farm research. Come learn ways to reduce input costs on your farm this year and try some of these ideas for yourself!

Chemigation Training for the York area will be held on Thursday, Feb. 5th at 1 p.m. in the 4-H Building at the Fairgrounds in York. There are also chemigation trainings on Feb. 19th at 1 p.m. in Davenport at the Community Center, Feb. 19th at 1:30 p.m. at the Extension Office in Grand Island.

On-Farm Research Updates will be held Feb. 17th in York at the Holthus Convention Center, Feb. 18th at ENREEC near Mead, and Feb. 24 at the Extension Office in Kearney. The program at each location begins at 9 a.m. with registration at 8:30 a.m. Hear from the producers who conducted the research to learn what they tried and the results they found. No charge, but please RSVP at: https://on-farm-research.unl.edu/.

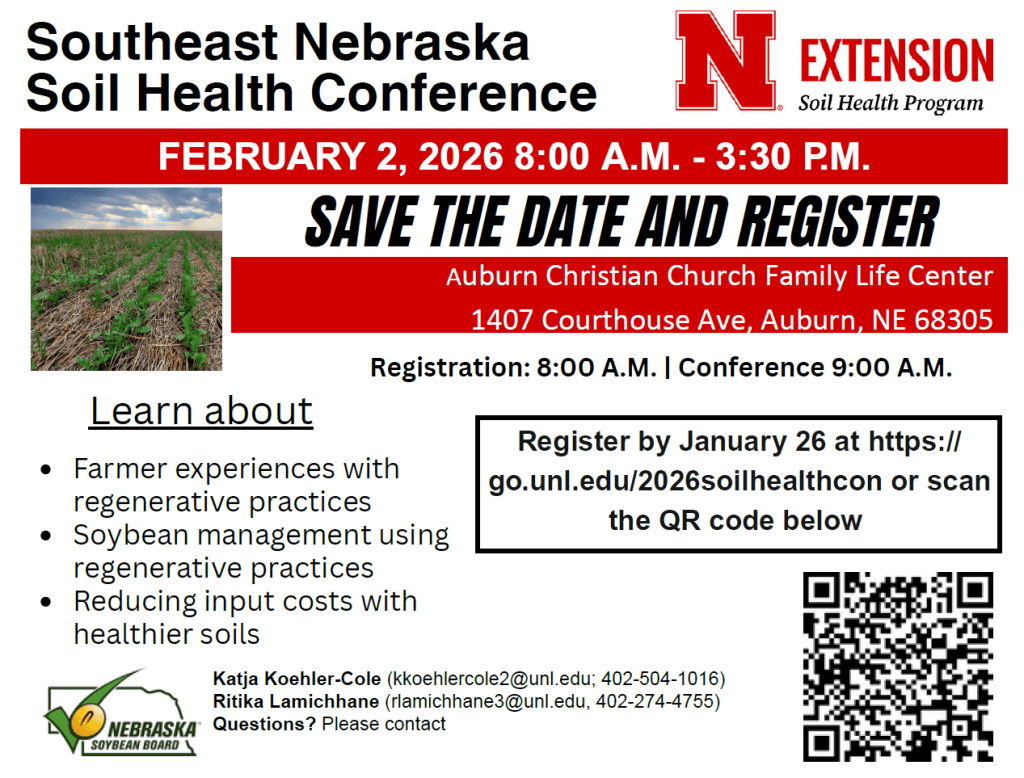

Central Nebraska Soil Health Conference will be held on Feb. 18th at the Lochland Country Club in Hastings. The conference will run from 9 a.m. to 3:30 p.m., with registration beginning at 8 a.m. Local growers will share information on converting crop ground for grazing, regenerative ag practices in raising soybean, and a producer panel. The keynote will share on biochar in ag. No fee, registration is requested for lunch count: https://go.unl.edu/kx80.

Pesticide App Regulations Part 2

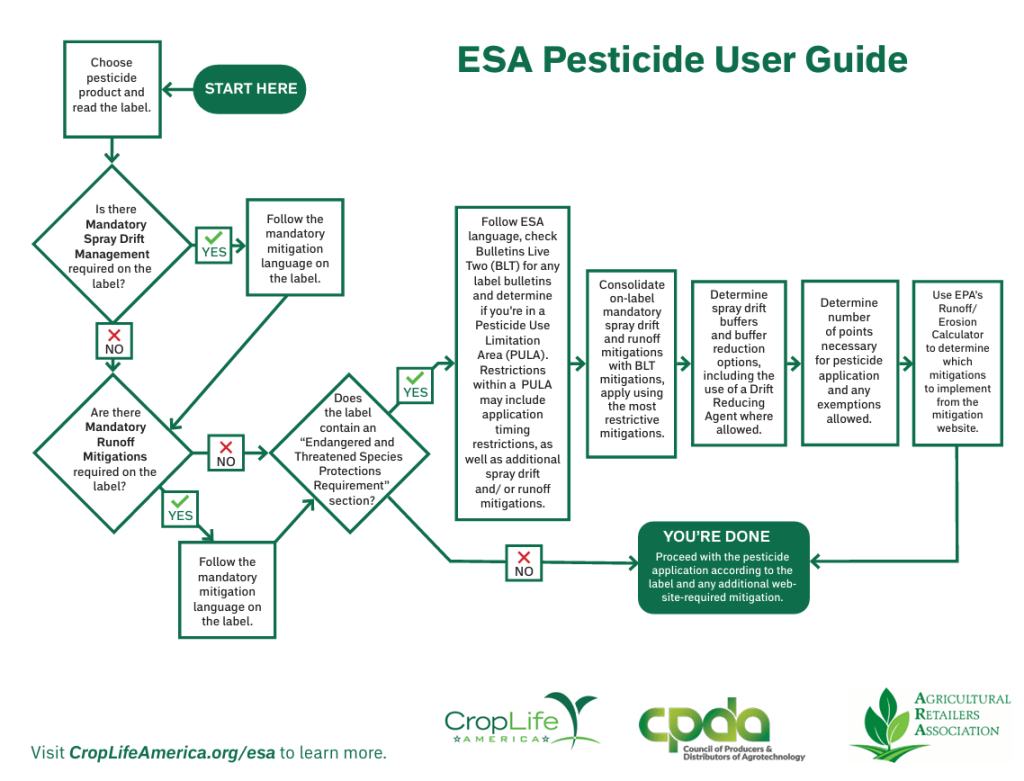

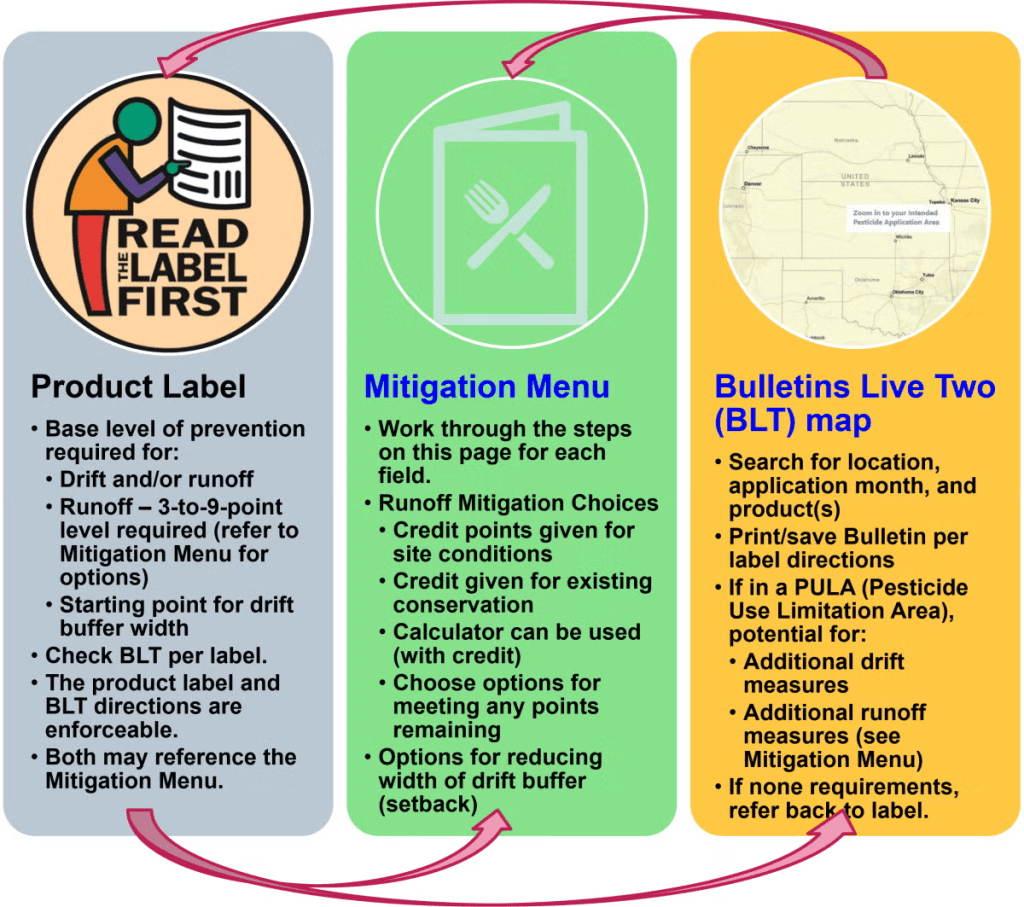

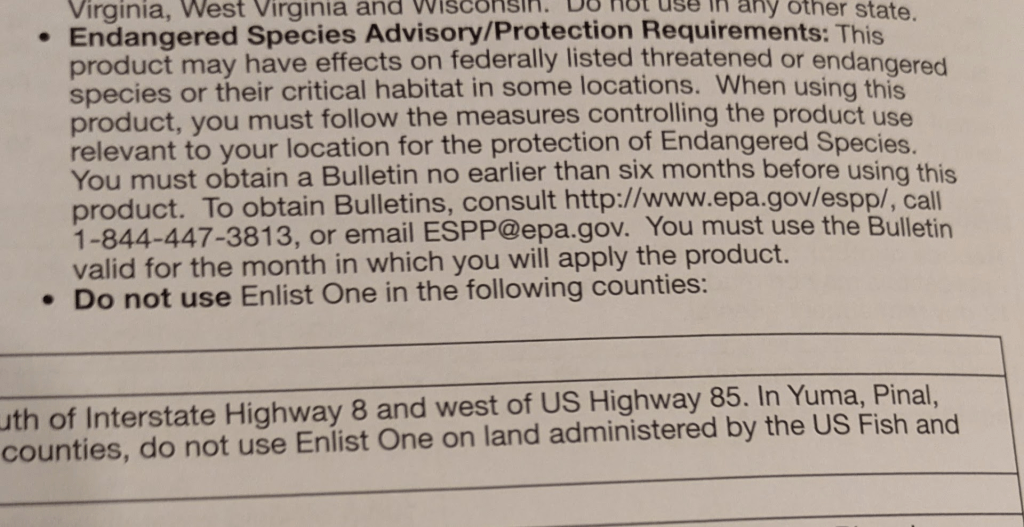

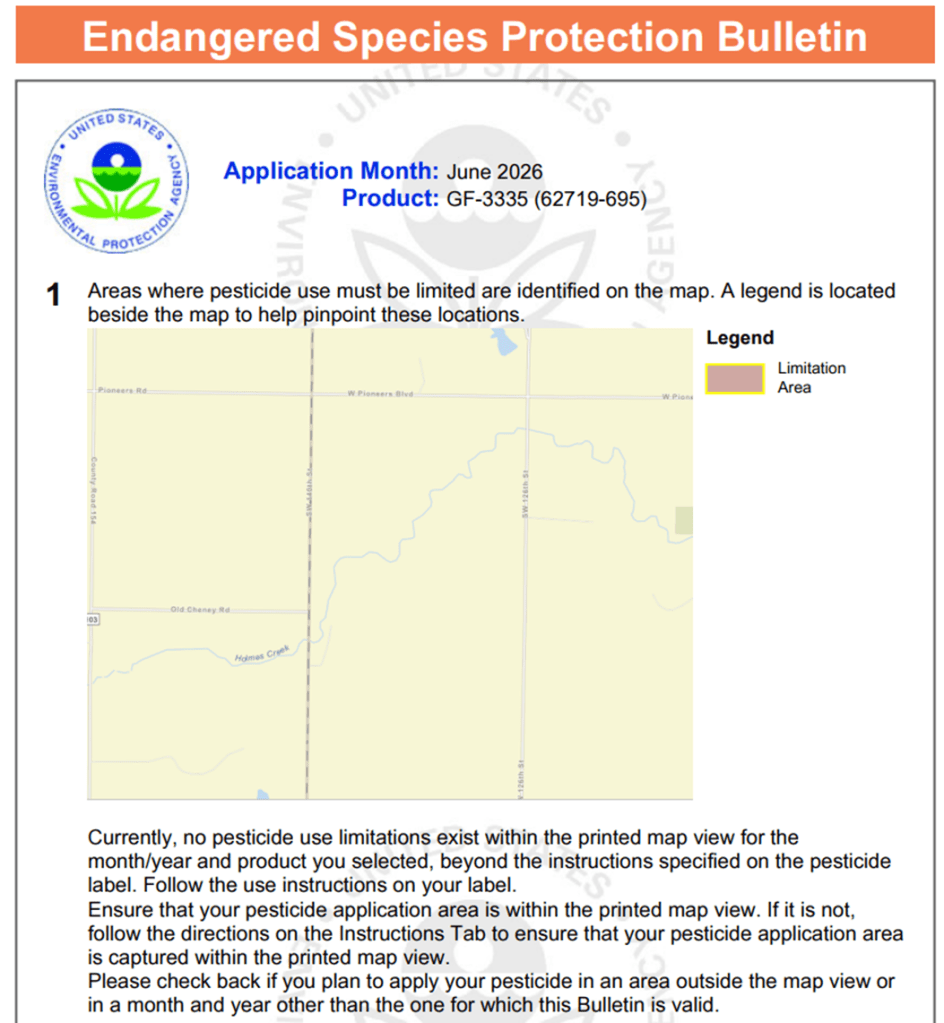

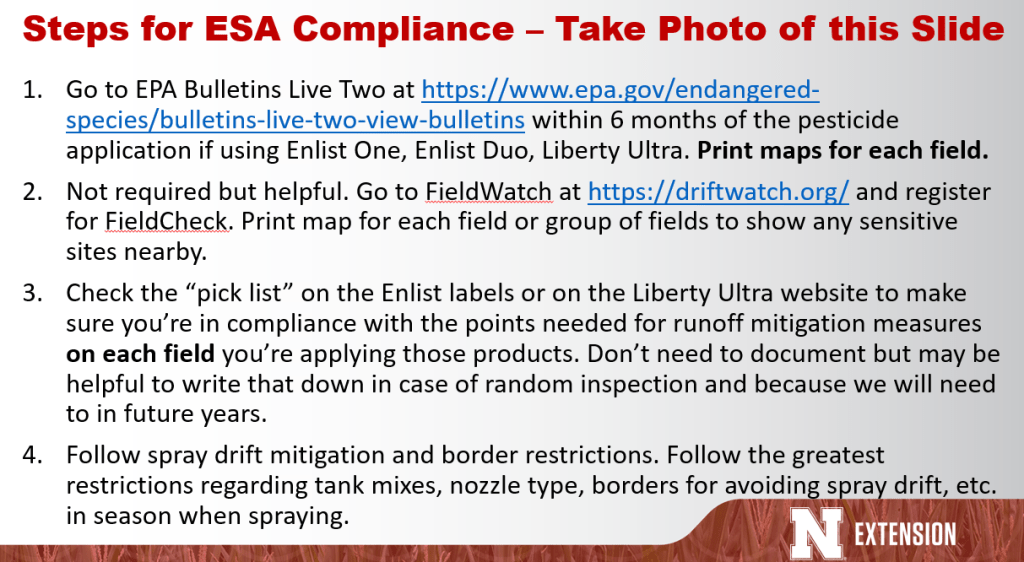

Last week I shared the background information on the Endangered Species Act (ESA) language. There’s easier to understand graphics I’ve included at jenreesources.com. The following are what growers need to do to comply with rules for 2026.

I know there’s a lot of concern about these new rules. IF compliance with ESA is needed for a specific product, the product label will state Endangered Species in bold letters (pictured below). The only way to know is to read the product label. Enlist One, Enlist Duo, and Liberty Ultra all have ESA language on them. Ultimately, if the product label says you need to comply with the Endangered Species Act, then you must go to Bulletins Live Two and print off bulletins for any field that product will be applied on in 2026. If it doesn’t specify ESA, then you don’t need to do this step.

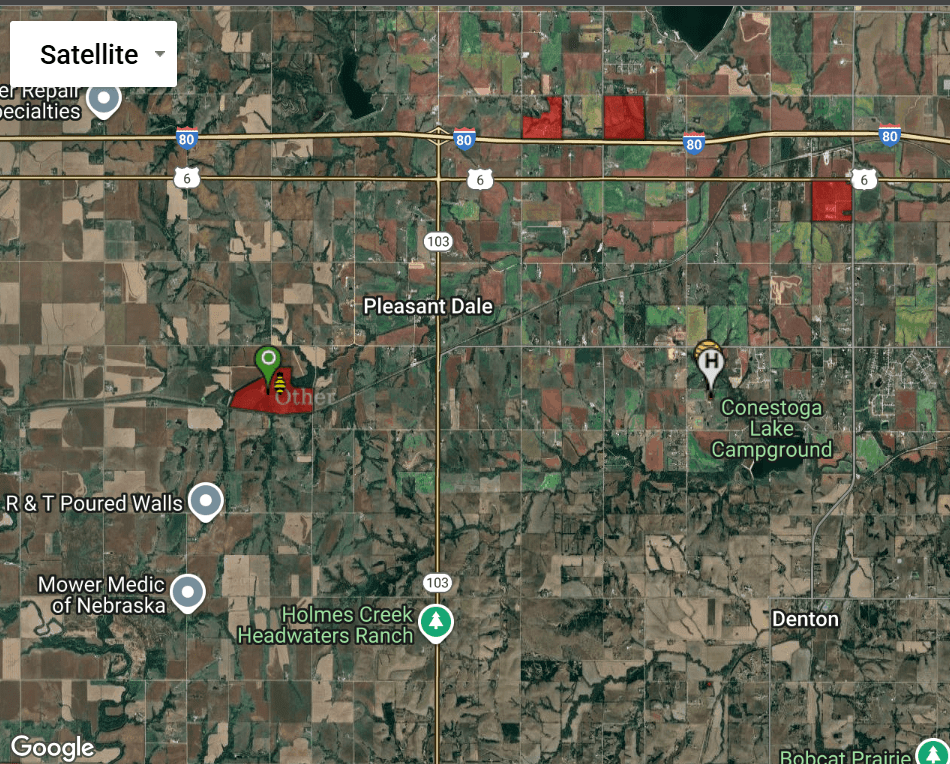

1-Go to EPA Bulletins Live Two at https://www.epa.gov/endangered-species/bulletins-live-two-view-bulletins within 6 months of the pesticide application if using Enlist One, Enlist Duo, Liberty Ultra or any product that specifies ESA language. When you get to the website, use the map or search feature to zoom in to your fields. Add the EPA registration number for the product you will be applying. It will then select the product. Select the month when the product will be applied. It will then show you a map of any Pesticide Use Limitation Area (PULA). If any exist, you must follow the specified restrictions. The map can then be downloaded and printed. Keep the map with your pesticide records. You need to print maps for each field you are using these products on. If you are applying these products in different months on the same field (ex. May and June), the bulletin needs to be printed for each of those months and kept with your records.

2-This step is not required. However, I’m unsure how we all comply with the sensitive site restrictions and buffers if we don’t do this step. Go to FieldWatch at https://driftwatch.org/ and register for FieldCheck if you’re not already registered. This is the old DriftWatch site where we as pesticide applicators can view any sensitive sites around our fields to avoid off-target movement to sensitive crops. You can select this field by field or if you have several fields in an area, you can draw an area on the map that encompasses all the fields. That’s what I did and then I’m going to label the fields on the map I printed. It provides a time stamp of when you check this site, so I’m just printing it and keeping it with our pesticide records.

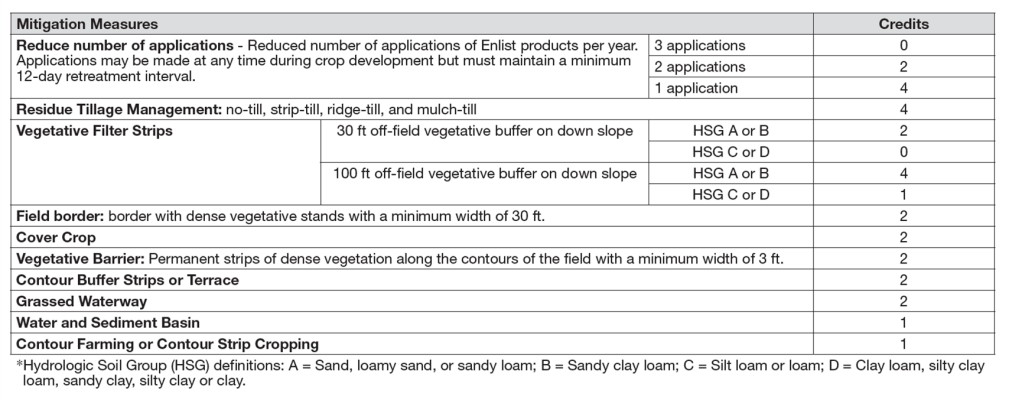

3-Check the “pick list” on the Enlist labels or on the Liberty Ultra website to make sure you’re in compliance with the points needed for runoff mitigation measures on each field you’re applying those products. You don’t need to document this for 2026, but I’d encourage us to write these down in our records as we will need to document this in future years. The number of points required and the mitigation measures from which to choose will vary depending on the specific label, so you must read the labels.

4-Spray drift mitigation and border restrictions also need to be followed. Follow the greatest restrictions regarding tank mixes, nozzle type, borders for avoiding spray drift, etc. in season when spraying.

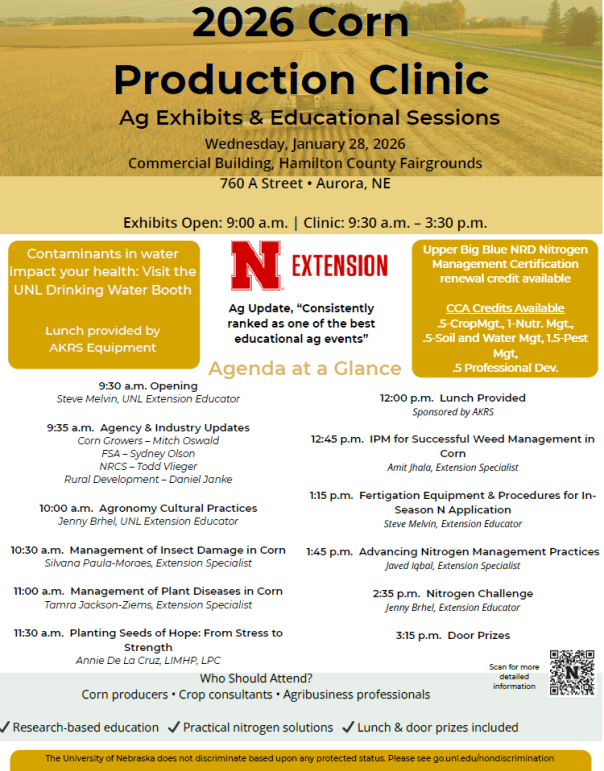

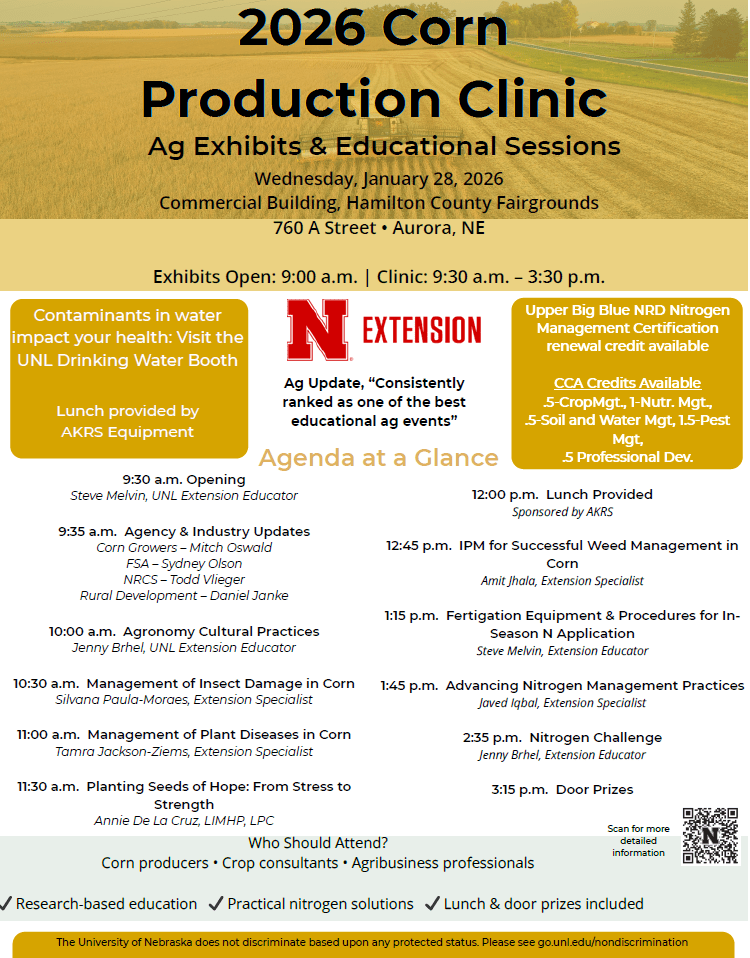

Upcoming Meetings: A quick note of upcoming meetings including the Nebraska Corn Clinic in Aurora on Jan. 28, Eastern NE Soil Health Conference in Auburn on Feb. 2, and my first Friday in February conversation on “Beginning your soil health journey” on Feb. 6th in York. Flyers are below or can be found at https://jenreesources.com/upcoming-events/.

Pesticide App Regulations Part 1

Last week was the kickstart to meeting season for me and it was great to see those of you at pesticide trainings and the Nitrogen Challenge meeting. For this column, I wanted to share a little more detail about the changes for this coming growing season regarding pesticide label language and requirements for the endangered species act (ESA) to mitigate drift and runoff. The information below came directly from a CropWatch article (https://go.unl.edu/skj7) written by Dr. Milos Zaric with UNL Agronomy, Greg Puckett with the UNL Pesticide Office, and Craig Romary with the Nebraska Dept. of Ag. Next week I will simplify this into specific steps to help you be in compliance for the 2026 growing season.

“Both Enlist One® and Liberty® ULTRA include ESA compliance requirements on their labels. These are not optional; they are enforceable use directions intended to protect federally listed species and their habitats (as well as other non-target plants and animals) from potential exposure due to off-target pesticide movement.

Before applying any listed product with ESA compliance requirements, applicators must consult the EPA BLT (Bulletins Live Two) map web tool to determine whether any application restrictions apply to the time and location of their planned application. A valid bulletin must be obtained within six months of the application, and the version specific to the planned month of application must be followed.

When applying multiple pesticide products as a tank mix, applicators must follow the most restrictive label requirements, including any ecological spray drift, runoff and erosion mitigation measures associated with either product. This added responsibility means users must verify compliance before making applications, particularly when operating in areas designated as vulnerable under the EPA’s mitigation framework.

The runoff and erosion mitigation measures will have a point system: each mitigation measure carries a point value, and to comply, the points for each site must meet the points for the product. Ecological spray drift mitigation will have a starting distance for a buffer or setback. Each mitigation measure allowed by the label will reduce that starting distance by a specific percentage. Depending on the level of mitigation implemented, buffer distances may be reduced — and in some cases to 0 feet — if the cumulative mitigation credits meet or exceed the required threshold.

Understanding and implementing these practices helps maintain compliance, reduce off-target movement, protect threatened and endangered species, their habitats, and other non-target plants and animals, and ensures continued access to essential row-crop protection products. This list is not exhaustive, and as new products are introduced or re-evaluated during registration renewal, they may include updated ESA-specific language and additional mitigation requirements.”

2026 Pesticide Training

Pesticide Training: This is the big year for pesticide training where the majority of people in the State need private applicator certification. There are a number of trainings available if you’re unable to attend the dates/times in the county you reside in. All trainings are listed at: https://go.unl.edu/psep26.

I apologize for the confusion and need to correct something I wrote regarding pesticide training. What I shared was the way we had always been taught was the law, but I was told by Nebraska Dept of Ag this week that the way it’s been written doesn’t share the whole information. When it says certified applicators are ones who “purchase and use restricted use pesticides”, the “purchase” is referring to “purchase by a retailer”. Thus, for those of you who are solely relying on a Coop or ag retailer to apply your restricted use pesticides and you are not applying them yourselves, you technically do not need a private applicator license. Feel free to call if you have specific questions regarding your situation.

The first trainings in York are this Thursday, January 15th at 9 a.m. and 1 p.m. at the Cornerstone Event Center (Fairgrounds) in York. We have been asking for RSVP to 402-362-5508 to save on the time for registration at the door, but walk-ins are welcome. Attendees need to bring a valid driver’s license or legal identification and $60/person. Those who are recertifying should also bring your NDA barcode letter, but we have other paperwork if you don’t have that for some reason.

If you don’t prefer to do the face to face training, other ways one can certify as a private applicator include an online self-study course and exam (cost $100) or attend the all-day Crop Production Clinic (cost $110) RSVP: https://agronomy.unl.edu/cpc/.

Crop Production Clinics: Especially for commercial and non-commercial applicators, Crop Production Clinics is the easiest way to recertify for the 00 and 01 categories. Please register at: https://agronomy.unl.edu/cpc/ for the location you wish to attend.

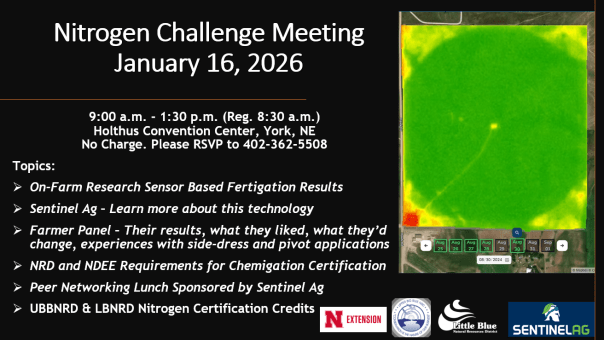

Also a reminder of the Nitrogen Challenge this week on Friday, Jan. 16th beginning at 9 a.m. at the Holthus Convention Center. If you’re interested in learning more about better managing nitrogen resources on your farm and most likely saving on nitrogen inputs, I hope you will consider joining us. Please RSVP to 402-362-5508 for meal count.

Reducing Nitrogen Inputs

With higher input costs and low commodity prices, I’ve been thinking how to be of help to the farm community I serve during these times. A small group of farmers and I met before Christmas. We talked about the difficulties the farm economy is facing yet also talked about realistic things that can be done to save money right now. One of those is around nitrogen and thus, we planned a Nitrogen Challenge Meeting on Jan. 16th at the Holthus Convention Center in York beginning at 9 a.m. The goals of this meeting are to share the research-based results from using in-season nitrogen management via Sentinel Ag, understand how to use this technology, and share testimonies from growers utilizing this technology. They wanted to create a peer network of famers supporting farmers during the growing season with this technology-so the first step will be a peer networking lunch sponsored by Sentinel Ag. The NRD is providing nitrogen certification credits. There is no charge but please RSVP for the meal count to 402-362-5508 or jrees2@unl.edu.

Why have I stressed nitrogen so much? In the Upper Big Blue NRD newsletter, Terry Julesguard wrote an article about nitrogen in the NRD based on the information provided by the Phase 2 and 3 reports. You can read the full article at: https://www.upperbigblue.org/increased-nitrogen-efficiency-brings-new-questions. In this excerpt Terry shares, “The numbers that stand out are the residual nitrate nitrogen in the soil:

- Corn-on-corn field increases from 33 lbs/A average to 86 lbs/A, an increase of 202%.

- Corn/bean rotation field increases from 32 lbs/A average to 86 lbs/A, a 212% increase.”

I know most farmers are seeking to do their best. The data is showing we’ve increased soil nitrate post-season by over 200%, meaning we’re overapplying N. We talk about the nitrate legacy from past generations, but this is the legacy we’re leaving right now in the soil for our kids and grandkids.

Soil tests in this area of the state from the 2025 season are showing residual soil nitrate is available to reduce the amount of nitrogen applied next growing season. This provides an opportunity to save on nitrogen input costs. No agronomist, including myself, can tell you exactly how much nitrogen you will need because we don’t know the weather/soil conditions for each piece of ground each year. This is why sensing what the plant needs is so powerful using technology like Sentinel Ag.

We have an opportunity to change the nitrogen story now-with us! On-Farm research with Sentinel Ag (2022-2024) in our part of the State showed an average 56 lb N/ac savings without impacting yields, while leaving an average of 5 ppm Nitrate in the top two feet. No other product or practice has proven that in our area of the State via on-farm research. It’s about using technology to manage the nitrogen the plant needs to the best of our ability. Thus, the Nitrogen Challenge in which I’ve asked growers to consider only applying a base rate pre-plant of 50-100 lb N/ac and apply the rest of the nitrogen in-season using a sensor-based technology like Sentinel Ag. Sentinel Ag uses satellite imagery to sense when a corn plant is becoming nitrogen stressed before our eyes can see it. The research was originally developed at UNL and the grad student (Jackson Stansell) then developed a company (Sentinel Ag) around it. Please consider learning more by joining us for the Nitrogen Challenge meeting on Jan. 16th. Farmer testimonials at: https://go.unl.edu/f3si.