Monthly Archives: February 2025

JenResources 2/23/25

I’ve appreciated all the emails and phone calls related to the series of columns I did on the “Leaving a Lasting Legacy” series. There’s so much more I didn’t share in these columns. Comments have included how families are currently working through various issues and situations that I shared and also stories of heartbreak. I realized one thing I never cleared up was the difference between a succession plan and estate plan. Polly Dobbs, Attorney, shared,

“If you’re breathing, and deciding who takes over the farm operation as you slow down towards retirement, that’s a succession plan. For example, perhaps the successor is buying equipment, on installment over time. Or, perhaps you’re giving up some acres to the successor.

If you die, the plan about who gets what, that’s an estate plan. It must complement the succession plan. Does the successor have to keep buying the equipment, or just get it? Does the successor have a right to lease your land? Does the successor need to buy your land? Have option to buy?”

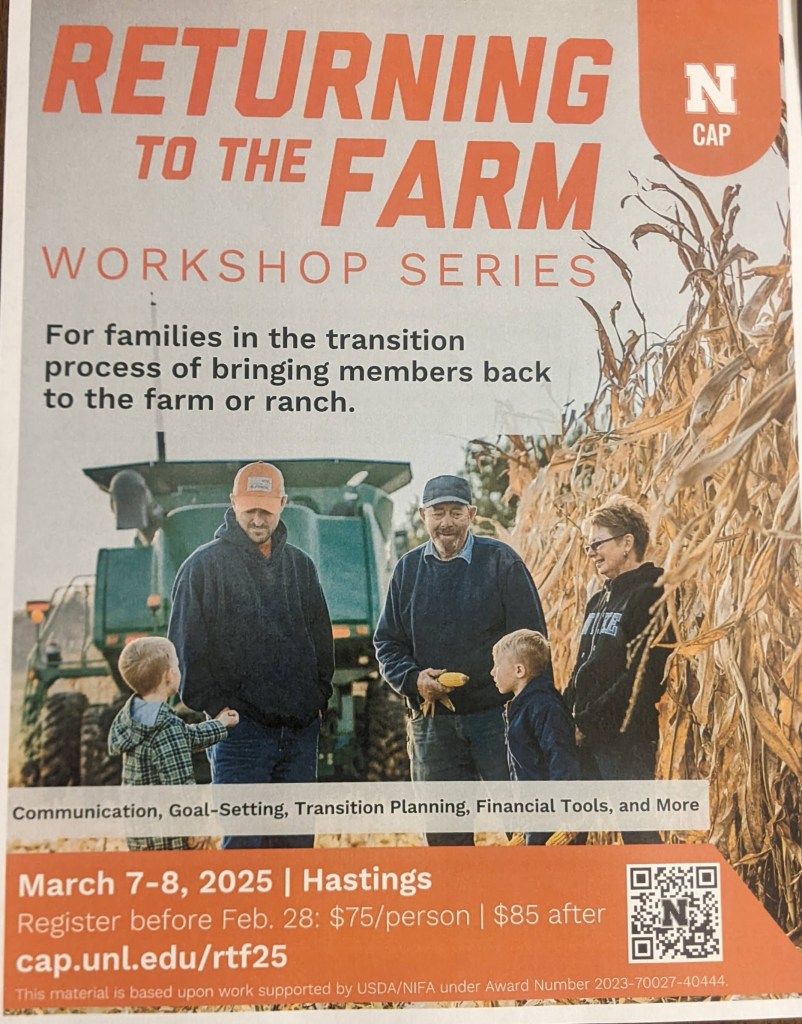

Has your successor put in sweat equity? Think of the succession plan as deferred compensation. If you don’t have a related successor, do you want to find an unrelated one? Income tax consequences of selling equipment and final harvest require a team approach with your CPA well ahead of retirement. Reminder: Returning to the Farm Workshop is March 7-8 in Hastings. Info: https://cap.unl.edu/rtf25.

Webinar: “How to pay for long-term care without selling the family farm or going broke!” is a free webinar being held this week on February 27, 2025 at Noon CST. Adam Dees is a practicing Kansas Elder Law attorney and will be sharing on this topic including: how to protect your spouse and family, health information and how to choose decision makers, and Medicaid essentials. He also authored a booklet, “The Consumer’s Guide to Supplemental Needs Planning” focused on helping people with families who have special needs plan for their care, and also educates people through seminars like “Estate Planning Secrets,” “Don’t Lose the Farm: How to pay for Long-Term care without going broke,” and “Doing Dementia Differently.” Registration is required at: https://us02web.zoom.us/webinar/register/WN_Ui5GgEWSTqemPu5uALZb2Q#/registration

Pruning Workshop March 1st: Many gardeners have questions at this time of year about spring pruning…

- Will early pruning cause fruit tree leaf and flower buds to develop earlier and possibly be damaged by normal spring frosts?

- Should pruning still be done in March and early April or should it be done earlier if conditions have been warm?

- What about shade trees? Should any adjustments in the time of pruning be made in response to warm conditions?

Join Sarah Browning Saturday, March 1, for the NRD’s annual Spring Gardening Workshop. The topic will be Mastering the Basics of Pruning. The free class will be held at the 4-H building at the York County Fairgrounds from 10 a.m. to noon. Walk-ins are welcome but pre-registration to 402-362-6601 is helpful for printing materials.

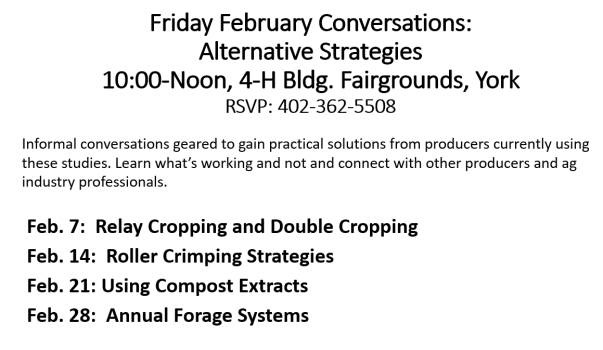

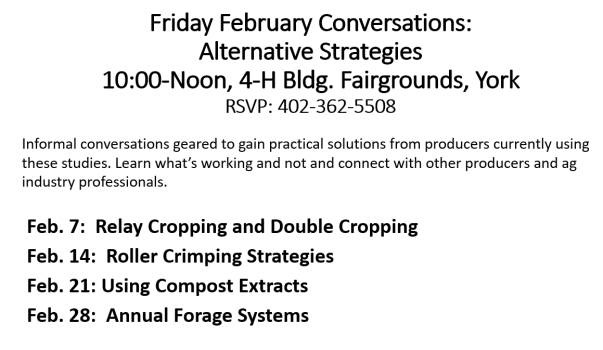

Also, our last Friday February conversation is this Friday, Feb. 28 from 10-Noon at the 4-H Bldg in York on Annual Forage Systems. Come hear from farmers making this work! Please RSVP to 402-362-5508.

Legal Considerations for Planning

Our last session of the “Leaving a Lasting Legacy” series was with lawyer Polly Dobbs. She was a straight-shooter. Please talk with your trusted team about the following information.

Most Important: If a farm spouse has passed away in the past five years, she recommended to “use portability to avoid a potential multi-million dollar estate mistake”. A surviving spouse can make a portability election in order to “port” over any unused federal estate tax exclusion (called “Deceased Spousal Unused Exclusion Amount” DSUE) from the first spouse. Election MUST be made after the death of the first spouse, which requires filing a Form 706 Federal Estate Tax Return…she said it has been extended to five years till 2026. Many CPAs and lawyers are unaware of portability. Please, if your spouse/one of your parents died in the past 5 years, file a Form 706 and elect portability. I have examples that show why on my blog at jenreesources.com. And please share this with others you know!

There was a great deal of discussion about ignoring tax changes. The current tax law (until 2026) says upon death, up to $13.99 million will pass exempt from Federal Estate Tax ($27.98 million for a married couple). During lifetime, you may give away up to $13.99 million of your assets ($27.98 million if married) exempt from Federal gift tax, which would reduce the amount of your exemption remaining at death. The estate tax reverts to half this level in 2026, but anything could happen between now and then. You may have a false sense of security that your total assets are under the estate tax threshold. What’s your farm ground really worth today? Also, life insurance proceeds count towards the total assets of the estate! Another tool, ask your advisors about SLAT (Spousal Lifetime or Limited Access Trust) yet in 2025.

A common mistake made is treating all kids exactly the same. She stressed that “fair” doesn’t mean “equal” ownership amongst kids. Equal tenants in common ownership will set the stage for a family feud. Partition actions can allow one tenant in common to trigger a court ordered auction, no matter how small an interest he/she owns. She stressed if your kids aren’t in business together during life, don’t throw them in business together after death.

Do “off farm children get bought out?” If the decision is yes, then set the price and terms. If the successor has put in sweat equity and earned a break, one can think of the succession plan and estate plan like Deferred Comp. It’s OK for the sale to be at a discount with payment on installment over time. If the decision is no, it’s OK to give operating business assets to the successor child and give different assets (lesser value) to the other children, or not. Fair doesn’t have to be equal.

Like the previous speakers, she stressed a team approach with the others on your team: accountant, banker, lawyer, financial planner, insurance agent, etc. She said you will save time and money if they’re talking to each other. She also stressed that income tax consequences require team approaches with CPA well ahead of retirement. Also, not every estate plan attorney knows elder law. It’s important to price long term care insurance and consult with an elder law attorney to learn of options to avoid the nursing home taking the farm. Elder Law attorneys: https://www.naela.org/FindALawyer.

For all operators, consider asking your landlords about “first right of refusal”. This allows the farm to not be sold without first being offered to the holder of the first right. Additional Resources at: https://cap.unl.edu/succession/. And, consider the Returning to the Farm Workshop at: https://cap.unl.edu/rtf25/.

Reminder of On-Farm Research Meetings beginning this week https://on-farm-research.unl.edu/about/2025-meeting-information/ and the Friday discussion on Compost Extracts from 10-noon at the 4-H Building in York.

The following are slides that were shared about portability and the important tax implications to the successor generation if this is not made in the previous generation. Please talk with your trusted team about this.

Farm Finances and Succession

Finances was the third week’s topic of the “Leaving a Lasting Legacy” series. A statistic was shared that surprised me. Did you know that only 27% of land is inherited or gifted? I was surprised this number wasn’t higher. It was suggested that with cost of living, nursing homes, etc., it may not be feasible for owners to “gift” land when they’re in their sunset years (meaning, the final years of a person’s life that may include retirement or “slowing down”). A UNL survey in 2017 asked farmers why they were retiring later: 62% said they can’t afford to retire. That’s a sad statistic as well.

Regarding the other ways land is obtained, 4% is purchased at an auction, 18% is purchased from a relative, with 50% being purchased from a non-relative. So, the question for those hoping to farm in the future becomes, How are you preparing yourselves to financially buy land…including buying out siblings, etc.?

For the owner generation, “sunsetting” means to step back and support without necessarily stepping away. It’s important to know your ultimate goal for the farm/ranch for the future. If you desire succession of the farm/ranch, documents need to be in writing and everyone on your team needs to know your goals and what the documents say. Your family also needs to know.

Your “team” can include people like a lawyer, tax professional, banker, financial planner, and others such as a facilitator/mediator. The key: You Know them, Like them, Trust them. These professionals should provide options but not tell you what to do. Your situation is unique. Not every tool in the toolbox is the right tool for you and your situation. Of importance, the term “financial advisor” is not regulated. They recommended to look for a designation called “Certified Financial Planner” (CFP).

Transitioning is a balancing act. The owner generation can’t bring the next generation into the operation at financial jeopardization of the owners. An income statement (profit-loss) statement is a way to know the profitability of the farm and the ability to support two families or not. This is not what is in the bank account. An income statement shows the net farm income, which is the profitability of the business.

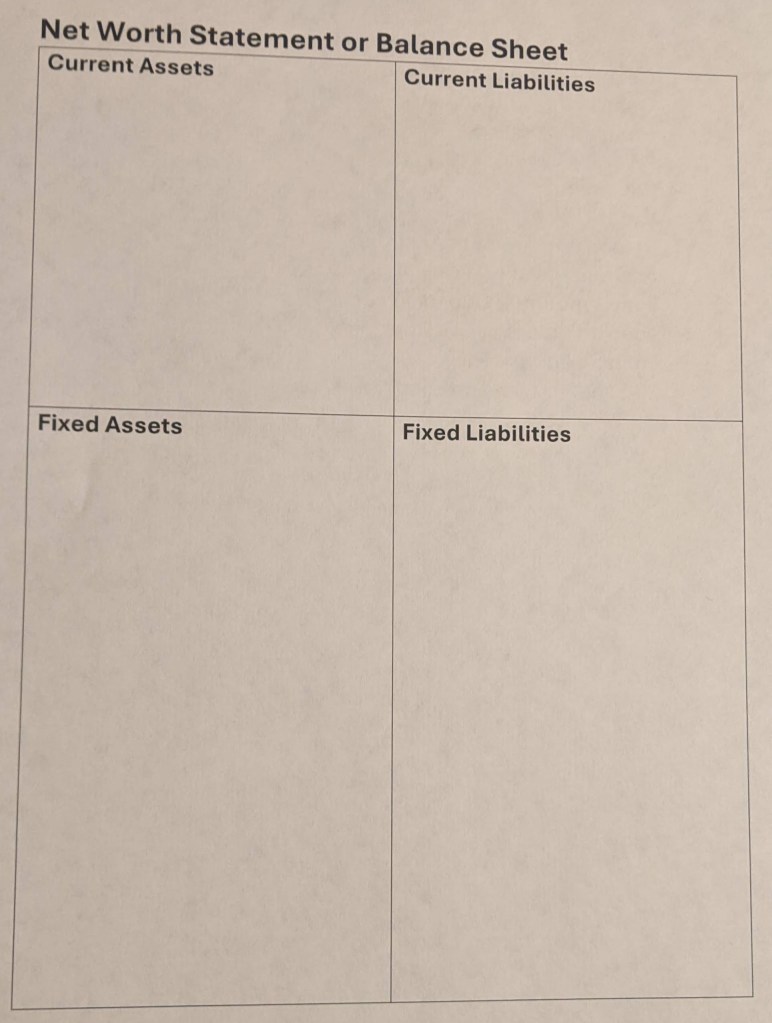

We also walked through balance sheets (also known as net worth statements). Balance sheets don’t show profitability; they show what we OWN (assets) or OWE (liabilities) and are a snapshot of the situation for a moment in time. While this may not be new to some, I appreciated a visual activity we did where we split assets and liabilities into quadrants that included current (the current year) or fixed (more than one year). I think for many not involved with the day-to-day operations of a farm or business, it’s hard to visualize the large numbers being mentioned. I have an example photo of this more visual way of looking at a balance sheet on my blog at jenreesources.com.

On-Farm Research Update will be held on February 18, 2025 at the Holthus Convention Center in York. It’s one of my favorite meetings of the year to hear from the farmers themselves about why they tried the studies they did and what they learned. Often the results will show no differences compared to the check treatment, which can frustrate people. However, that’s important information to test it on smaller acres first before investing a lot of money on larger acres. We did have some studies with promising results as well, though. If you’re interested in attending, please call (402) 362-5508 to pre-register as we need RSVP for lunch count.

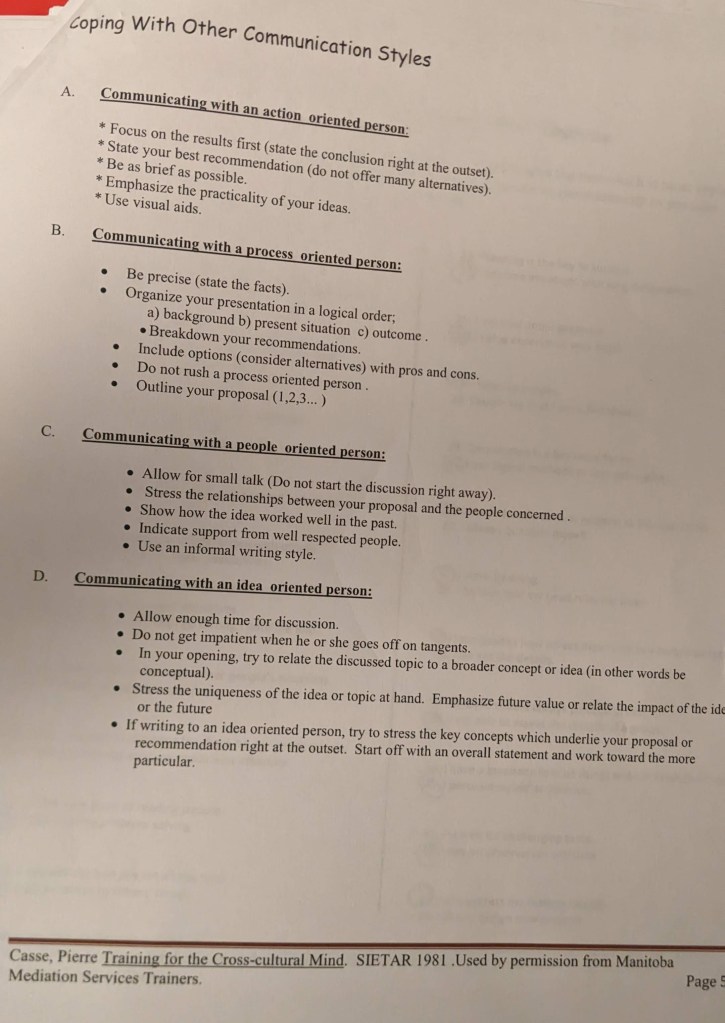

Communication

The information we’re learning about in the “Leaving a Lasting Legacy” program is important for every person. Communication was the topic of last week’s program. It’s so important as with each conversation we either build or break trust and relationships.

How we speak counts more than what we say. I was reminded of that this past week.

- 7% is WHAT we say…the actual words

- 38% is the tone of voice…HOW we say it

- 55% is body language…also HOW communication comes across

Communication (or lack thereof) is the #1 issue raised by families in general. Why is family communication so difficult, especially when a family business is involved? Four potential reasons include: we don’t understand different perspectives, we’ve had difficult past experiences trying to talk about family and/or business affairs, the threat of loss of control, and a reluctance to change. How we can improve is by seeking to listen to understand and also understanding different personality traits and perspectives of others.

I find personality tests fascinating as I really like to know what makes each individual unique. One free tool that was recommended to us that is science-based was the DISC personality assessment at: https://www.123test.com/disc-personality-test/ . Perhaps consider each person in your family take this and then discuss your results as a family. These tools help provide insights into others.

When it comes to communicating with people of different generations, it’s important to know what they value. To engage Baby Boomers (born 1945-1964), encourage them to provide mentorship and learn together. Gen Xers (born 1965-1980) are independent, resilient, and adaptable. To engage them, give them opportunities for leadership. To engage Millennials (born 1981-1996), include them in management and allow autonomy and flexibility as family and social impact is important to them. Generation Z (born 1997-2015) are naturally adapted to technology and are financially driven. To engage them, show them opportunities for work-life balance and career advancement.

They spoke a lot about family meetings. Originally, I thought this was more complicated. However, it can be as simple as touching base via the phone or having breakfast/lunch together a few times a month. Family meetings can be as simple as talking through the coming week’s plans, any goals for the farm, prioritizing bills to pay, etc. It’s also really important to be a family beyond whatever role each person plays in the farm or business! Check out https://cap.unl.edu/succession/ for additional resources.

Friday February 7th Conversation: Relay Cropping and Double Cropping: There’s been increasing interest of how to improve the economics of small grains with either relay cropping or double cropping soybeans with either rye or wheat. Hear from growers who are trying this in a variety of ways and what they have learned. Conversations are held each Friday from 10 a.m.-Noon at the 4-H Building in York. Please RSVP to 402-362-5508

Nitrogen Challenge Meeting will be held Monday, February 10th at the Holthus Convention Center in York from 9 a.m.-Noon. Hear the latest on-farm research results, about the technology from Sentinel Nutrient Management, information about chemigation certification, and from a larger farmer panel. There’s no charge for this meeting, but please RSVP to (402) 362-5508.