Legal Considerations for Planning

Our last session of the “Leaving a Lasting Legacy” series was with lawyer Polly Dobbs. She was a straight-shooter. Please talk with your trusted team about the following information.

Most Important: If a farm spouse has passed away in the past five years, she recommended to “use portability to avoid a potential multi-million dollar estate mistake”. A surviving spouse can make a portability election in order to “port” over any unused federal estate tax exclusion (called “Deceased Spousal Unused Exclusion Amount” DSUE) from the first spouse. Election MUST be made after the death of the first spouse, which requires filing a Form 706 Federal Estate Tax Return…she said it has been extended to five years till 2026. Many CPAs and lawyers are unaware of portability. Please, if your spouse/one of your parents died in the past 5 years, file a Form 706 and elect portability. I have examples that show why on my blog at jenreesources.com. And please share this with others you know!

There was a great deal of discussion about ignoring tax changes. The current tax law (until 2026) says upon death, up to $13.99 million will pass exempt from Federal Estate Tax ($27.98 million for a married couple). During lifetime, you may give away up to $13.99 million of your assets ($27.98 million if married) exempt from Federal gift tax, which would reduce the amount of your exemption remaining at death. The estate tax reverts to half this level in 2026, but anything could happen between now and then. You may have a false sense of security that your total assets are under the estate tax threshold. What’s your farm ground really worth today? Also, life insurance proceeds count towards the total assets of the estate! Another tool, ask your advisors about SLAT (Spousal Lifetime or Limited Access Trust) yet in 2025.

A common mistake made is treating all kids exactly the same. She stressed that “fair” doesn’t mean “equal” ownership amongst kids. Equal tenants in common ownership will set the stage for a family feud. Partition actions can allow one tenant in common to trigger a court ordered auction, no matter how small an interest he/she owns. She stressed if your kids aren’t in business together during life, don’t throw them in business together after death.

Do “off farm children get bought out?” If the decision is yes, then set the price and terms. If the successor has put in sweat equity and earned a break, one can think of the succession plan and estate plan like Deferred Comp. It’s OK for the sale to be at a discount with payment on installment over time. If the decision is no, it’s OK to give operating business assets to the successor child and give different assets (lesser value) to the other children, or not. Fair doesn’t have to be equal.

Like the previous speakers, she stressed a team approach with the others on your team: accountant, banker, lawyer, financial planner, insurance agent, etc. She said you will save time and money if they’re talking to each other. She also stressed that income tax consequences require team approaches with CPA well ahead of retirement. Also, not every estate plan attorney knows elder law. It’s important to price long term care insurance and consult with an elder law attorney to learn of options to avoid the nursing home taking the farm. Elder Law attorneys: https://www.naela.org/FindALawyer.

For all operators, consider asking your landlords about “first right of refusal”. This allows the farm to not be sold without first being offered to the holder of the first right. Additional Resources at: https://cap.unl.edu/succession/. And, consider the Returning to the Farm Workshop at: https://cap.unl.edu/rtf25/.

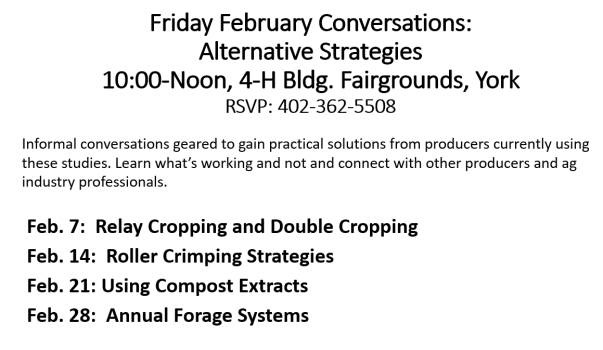

Reminder of On-Farm Research Meetings beginning this week https://on-farm-research.unl.edu/about/2025-meeting-information/ and the Friday discussion on Compost Extracts from 10-noon at the 4-H Building in York.

The following are slides that were shared about portability and the important tax implications to the successor generation if this is not made in the previous generation. Please talk with your trusted team about this.

Posted on February 16, 2025, in farm transition, JenREES Columns and tagged legal considerations for succession planning, portability. Bookmark the permalink. Leave a comment.

Leave a comment

Comments 0