Author Archives: JenBrhel

Planting 2025 Considerations

Planting Considerations: The warmer air, wind, and warming trend of soil temperatures are allowing for planting to begin. The winds have removed a great deal of surface moisture making for dry conditions where seed will be placed. I recommend putting corn and soybeans in the ground at 2” (our research recommends 1.75” for soybean). This allows for buffered soil moisture and temperature conditions when planting. Bob Nielsen, emeritus professor at Purdue said corn can be seeded 2.5-3” deep if that’s where uniform soil moisture is located in order to achieve uniform germination and emergence, particularly for non-irrigated fields. In the droughts of 2023 and 2024, we had farmers successfully plant corn at 3.5” deep just to be in uniform soil moisture. We don’t recommend planting soybean deeper than 2.5”.

Seed germination occurs in two stages. The first is imbibition in which the seed takes up water quickly. Soybean needs to uptake 50% of its seed weight during this stage and this typically occurs in less than 24 hours if the seed is placed into good soil moisture. Corn uptakes 35% of its seed weight which can occur in 48 hours when placed into good soil moisture. It’s this phase where we get concerned if we receive a cold rain or snow within 24-48 hours of planting as the soil temperature can be reduced the seed can imbibe cold water leading to cold shock, reduced germination, and potentially death.

The second phase of germination is the osmotic phase. In this phase, a much slower uptake of water occurs. Seedlings in this phase are quite tolerant of soil temps as low as 35-40°F. Extended low temperatures and/or saturated excess moisture can lengthen the germination to emergence timeframe and can lead to greater soil-borne pathogens.

Agronomically we’ve come a long way with genetics and seed treatments. Because of this, some don’t worry about soil temps. Yet every year I think most agronomists would say we can trace various problems back to a specific planting date(s) or planting window. So, I still feel they’re an important consideration.

We often hear a preference of planting corn and soybeans in as close to 50°F or greater soil temperatures as possible. Below 50°F, I prefer to see corn planted on a warming trend of 5-7 days. The consideration is for soil temps in the mid-40’s on a warming trend with no chance of a cold snap (cold rain/snow) within 8-24 hours for soybean and 48 hours for corn. The time-frame is due to the imbibition (critical water uptake) time-frame for corn and soybean mentioned above. Soil temps for your field can be monitored by using a thermometer or checking out CropWatch soil temps at: https://cropwatch.unl.edu/soiltemperature.

Since 2004, we’ve shared the importance of planting soybean early (mid- to late-April or first week of May) to increase yields. We’ve seen a shift to planting soybean earlier than corn or at least at the same time as corn, which is encouraging to me. A question I have and that an increasing number of producers have, is around soybean seed treatments. With tight economics and reasons including impacts to pollinators, some growers have tested full seed treatments vs. a biological seed treatment vs. untreated seed. We have 6 site-years of data in York, Seward, Polk, and Hamilton Counties thus far showing no yield differences between these treatments. Planting dates ranged from May 2 to May 22. I’m hoping to have more studies on this topic in 2025. Please let me know if you’re interested in trying a few strips of untreated or biological treated soybeans compared to your treated seed so we can obtain more local data.

JenResources 4/6/25

Storm Damaged Trees have been an increasing concern for homeowners. The cedar windbreaks seem to be the greatest affected and it’s hard to know how much damage has been done until you start the cleanup process. This is a resource from the Nebraska Forest Service on storm damaged trees: https://nfs.unl.edu/snow-and-ice-damage-trees/ and https://nfs.unl.edu/immediate-care-storm-damaged-trees/. Additional resources: https://nfs.unl.edu/pruning-large-trees/ and all Forest Service Resources at: https://nfs.unl.edu/nfs-publications/.

When I look at each tree situation, I look at the overall structure of the tree, if there’s any shelf fungi (look like dinner plates) on the trunk or main branches (indicator of heart rot), any other major signs of decay/disease, and seek to visualize how the tree will look upon being properly pruned. I’m not a forester, but these are quick things I’m looking for. Most of the trees I’ve recommended to keep unless they had obvious heart rot or other issues. Of key importance is to trim the trees back to the bark branch collar to allow for sealing over the pruning cut. There are places in trees with large gaping wounds from the sheer weight of branches tearing and falling. I don’t know how they will all heal and seal, but trees are pretty amazing at what they can withstand. Some of these trees have an odd-shape after pruning, but you can always make the decision to remove them later.

There have been some fungus gnat outbreaks after removing trees, especially entire windbreaks. The decaying organic matter in the soil in addition to exposed moist soil can allow for fungus gnats to thrive. They typically only live 7-10 days, but in that time-frame, the female can unfortunately lay hundreds of eggs multiple times. Thus, why a few are reporting “millions” of gnats in their farm yards. I don’t have a good answer for you on managing this. Numbers will be reduced once the soil dries out in the top two inches or so. Unfortunately, this situation will most likely take three to four weeks to potentially resolve until the gnats find a new home and/or die. If they get into your home, you can use yellow sticky traps to catch them and also shallow pans of dishwater.

Vegetable Planting Guide that was compiled by emeritus Extension Educator Gary Zoubek can be found at: https://go.unl.edu/vegetableguide.

Ground covers: The following is information from April’s ProHort Update at:https://hles.unl.edu/update042025/. Ground covers can be a great alternative to mulching the landscape bed while providing habitat for pollinators and season-long interest. They will spread and cover the ground via rhizomes or stolons while also reducing soil erosion. That makes them a great option instead of grass on a steep slope where it is hard to maintain turf. There are many native or well adapted groundcovers to choose from. Here are a few groundcover options for spring color:

- Prairie smoke (Geum triflorum), grows great in sunny, dry locations, blooms from May to July

- Sweet woodruff (Galium odoratum), grows great in dry shade, blooms April-May

- Carpet bugleweed (Ajuga reptans), grows in moist shade with blue blooms from May to June

- Creeping phlox (Phlox stolonifera), good bloomer in shade with purple blossoms in spring

- Pasque flower (Pulsatilla patens), very early spring bloomer with purple blossoms in full sun

- Candytuft (Iberis sempervirens), showy April-May bloomer in full sun

- Lungwort (Pulmonaria officinalis), small pink-blue blooms in April-May in part to full shade

Garden Tips

Garden Tips: This past week we got onions in the ground. Something new I tried, after hearing Kelly Feehan, Extension horticultural educator and Gary Zoubek, Extension educator emeritus recommend it, was to start onions from transplants instead of sets. It’s a tip for growing large onions that store well. Onions are biennials. In year one, they grow leaves and bulb and then set seed in year two. Sets grown for sale removes one season from the growth, so when we plant sets in our gardens, they want to go to seed, so you may see blooming in mid-summer, which limits the onion bulb size. If you do grow onions from sets, look for dime size or smaller sets as they would be less likely to bloom. This year, I’m looking forward to seeing what the transplants do.

Kelly Feehan shares, “Late March through April is typically the time to plant cool season vegetables. These vegetables germinate and grow in cooler soils and can tolerate light frosts. They include onions, potatoes, radish, lettuce, carrots, beets, peas, broccoli, and cabbage.

Potatoes are planted in April, sometimes late March or early May. A tip for increasing potato yields is hilling potatoes after they begin to grow. Once they are 12 to 20 inches tall, carefully scrape soil up around the plant to create a hill. Potato tubers grow on stolons, underground stems, above the roots. Hilling provides more space for tubers to grow and maintains cooler soil temperatures, especially if hills are mulched. As a cool season crop, cooler soil will increase tuber production.

If potato hills are spaced closer together, tubers grow smaller. If hills are spaced farther apart, tubers grow larger. The recommended spacing is 12 inches between hills and 3 feet between rows. The 12-inch spacing will result in smaller tubers. An 18 to 24 inch spacing will result in larger tubers.”

Soil Temperatures can be found at: https://cropwatch.unl.edu/soiltemperature. This is helpful for knowing when to plant vegetables, when to plant crops, and what the soil temp is when applying fertilizer to fields. It’s also helpful for homeowners to wait to apply crabgrass preventer for lawns until soil temps are at least 50-55F for 5-7 days straight. In spite of the warmer temps, it’s too early for crabgrass preventers (normally we wait for last week of April to early May)!

Lawn Seedings: For those who didn’t seed or overseed turf grass last August-September due to the dry conditions, aim to seed or overseed as soon as possible.

Household Hazardous Waste Collection will occur on April 12, 2025 from 8 a.m.-Noon at the City of Seward Storage Lot (880 S. Columbia Ave. in Seward) and 1:30-4:30 p.m. at the Butler Co. Fairgrounds in David City (62 L Street, North Entrance). Items accepted include: acids, cyanide, fluorescent bulbs, lead acid batteries, pain/stain/varnish, poisons, banned pesticides, antifreeze, flammables, Gas/oil, mercury, pesticides, and yard fertilizers. Farm chemicals will be allowed in quantities less than 150 lbs/55 gal. Please have your items in boxes (paint in one box and other materials in a separate box). The event in Seward is also taking additional items including electronics, etc. so please check out https://www.cultivatesewardcounty.com/news/seward-annual-clean-up-day/ for info. on that clean up location. For general questions, please contact the Four Corners Health Dept. at (402) 362-2622.

Reflections

This past week’s blizzard event is one that will forever be etched in our memories. We truly have so much for which to be thankful! Grateful for the way neighbors and others checked in on each other and helped in the midst of power outages. Grateful for all the linemen, city and county road crews, and first responders! Many shared with me stories from 1976 and there will no doubt be many stories shared for decades to come from this storm too. Continuing in prayer for those without power and for all the linemen continuing to restore power.

Last week I shared a column on Celebrating Ag Week. Strong agriculture and a strong ag economy are incredibly important as a backbone to any nation.

As an Extension Educator, my role has been to serve Nebraskans to the best of my ability in answering questions and sharing research-based information. I’ve also shared my observations, particularly when it comes to what I’m seeing in the field and when research doesn’t yet exist.

Throughout my nearly 21-year career, plenty of controversial issues have been faced with the people I serve. I’ve sought to listen to all sides of issues, serve as a moderator at meetings, and share what I hear from both sides and share the research, when it was available. For the past six months, I’ve been asked to bring in groups and moderate discussions on industrial scale solar, but I have refused these requests.

There is a meeting on Monday, March 31st from 7-8 p.m. at the Holthus Convention Center in York. You can also RSVP for a zoom link at this website: https://neconserve.org/news-events/event-calendar.html/event/2025/03/31/the-changing-landscape-of-renewable-energy-in-nebraska/519078. It’s being hosted by Conservation Nebraska and is titled, “The Changing Landscape of Renewable Energy in Nebraska”. My colleague John Hay, Extension Educator specializing in energy, renewable energy and biofuels will be the main speaker. John is a great colleague and friend of mine. He does a great job of knowing the research and answering questions. I also wish to be very clear that locally, as a Nebraska Extension Educator, I’m not involved with this meeting, nor am I partnering on it. I plan to attend.

As your local Extension Educator, I’ve listened to the stories of why people chose to sign leases and chose not to, listened to research and debate…and I’ve shared both perspectives and other information in news columns. I can appreciate the “why’s” on both sides and I have friends and acquaintances on both sides. Ultimately, I serve you all. But since last summer, I’ve been quiet on this issue. In addition to my career as an Extension Educator, I’m also human.

I am against utility scale solar farms removing agricultural ground from production. Solar can have a variety of uses, including in ag, but I’m against replacing farm ground with thousands of acres of solar panels for industrial scale solar. It has eaten at me to serve as your agricultural Extension Educator and not feel I could take a stand, but I can’t consciously do that any longer. I think about the potential impacts this could have on all of York/Fillmore County ag and surrounding counties in the future…the precedent set. I agree with the York County Zoning Committee’s setbacks that have been proposed. I also believe landowners have the right to choose what they do with their land. It’s difficult when it involves removing farm ground from production at this scale in a very strong Ag County such as York County. What tears me up the most are the damaged relationships as a result of this issue. Praying for wisdom for those making decisions, for the outcome, and that ultimately, relationships can one day be restored.

Ag Week 2025

Happy National Ag Week and National Ag Day (March 18)! What happens in ag impacts all Nebraskans as 1 in 4 Nebraska jobs are connected to ag. A strong ag economy (Nebraska ranks #1 in farm cash receipts of all commodities/capita) helps Nebraska’s overall economy. In 2023, Nebraska agriculture generated $31.6 billion in sales, with livestock accounting for 58% and crops for 42%. In 2024, Nebraska had 44,300 farms and ranches, the average size of which was 993 acres. The following are from the 2025 Ag Facts card: https://nda.nebraska.gov/facts.pdf and brochure: https://nda.nebraska.gov/publications/ne_ag_facts_brochure.pdf.

#1: Nebraska’s largest ag sector is beef production with Nebraska leading the nation in beef and veal exports and commercial cattle slaughter. We are #2 in all cattle/calves, commercial red meat production, and all cattle on feed. “Calves born on one of Nebraska’s 17,000 cow/calf ranches typically spend the majority of their lives on grass before being sent to a feedlot for finishing.”

#1: Nebraska regained the top production in popcorn, is 1st in Great Northern bean production, and has the most irrigated acres in the nation at 7.86 million. We are 2nd for pinto bean production and 4th in the nation for all dry edible bean, dry edible peas, and light red kidney bean production.

#2: Nebraska is #2 in ethanol production capacity. Nebraska produces around 2.3 billion gallons of ethanol annually from 24 ethanol plants. Nebraska is also #2 in bison production, no-till cropland acres, proso millet and alfalfa hay production.

#3: Nebraska is #3 in corn production and exports, cash receipts of all farm commodities, and jumped up to #3 in all hay production.

#4-7: Nebraska is ranked #4 land in farms and ranches, in sorghum and sunflower production, and for cover crop acres. We rank 5th in soybean exports and production. One bushel of soybeans can make 1.5 gallons of biodiesel. We also rank 6th for production of sugar beets. Nebraska is 6th for all hogs and pigs on farms and in commercial hog slaughter. “Six of the most common cuts of pork have, on average, 16 percent less fat and 27 percent less saturated fat than 20 years ago.” Nebraska ranks 7th in pastureland acres.

Nebraska is the 11th largest winter wheat producing state. “The average bushel of wheat weighs 60 pounds and can make 64 loaves of bread.” We are also ranked 11th in potato production with 1/3 of the state’s potatoes being made into potato chips. We are ranked 12th for organic cropland acres.

Nebraska ranks 14th nationally in egg production with more than 9.1 million birds in commercial egg laying facilities producing more than 2.6 billion eggs a year. We rank 25th in total milk production. There are around 78,000 sheep and lambs raised in Nebraska and also more than 24,000 meat goats and around 3,500 dairy goats.

Nebraska has more than 30 wineries and tasting rooms located across the state. There are more than 575 produce growers in Nebraska and we have “approximately 100 farmers markets, 167 roadside stands and 33 u-pick operations.” There are also approximately 39,000 bee colonies in Nebraska. There’s so much to be proud of regarding agriculture in Nebraska! May we seek to celebrate and support ag now and in the future! Happy National Ag Week! Reminder of the Seward County Ag Banquet on Monday evening, March 24th at the Fairgrounds in Seward (5:30 p.m. social hour, 6:30 p.m. meal and program) to celebrate ag locally!

Farm Bill 2025

Farm Bill: Have received a number of calls the past few weeks on the farm bill election decisions. Normally I write this column in February, but the deadline this year is April 15, 2025 to make a determination on farm bill programs.

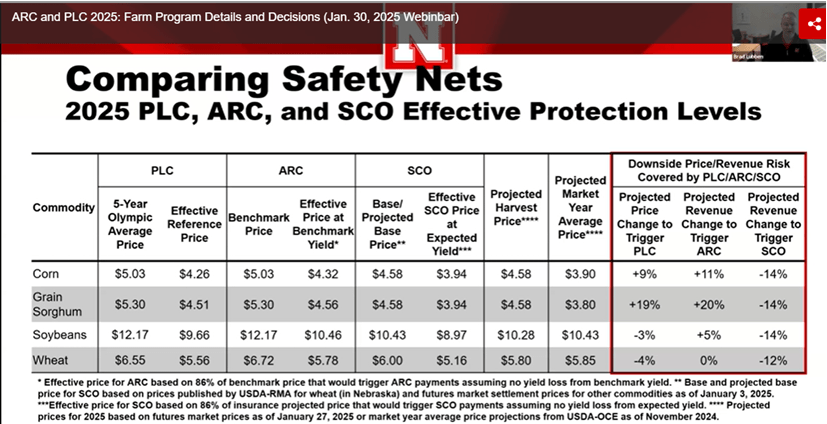

The greatest change for this year is the increase in the effective reference price again for all crops, which may impact on how decisions play out.

The following are PLC reference prices for commonly grown commodity crops in the area: Corn $4.26; Grain Sorghum: $4.51; Soybeans $9.66; Wheat $5.56.

The following are ARC-Co Effective Prices at Benchmark Yields for grown commodity crops in the area: Corn $4.32; Grain Sorghum $4.56; Soybeans $10.46; What $5.78.

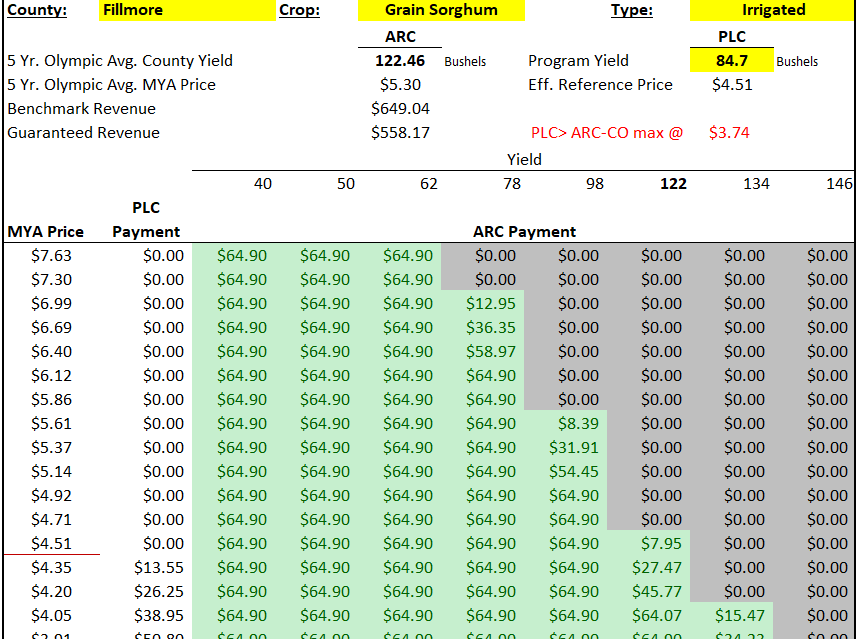

For those who are more visual like me, the easiest way for me to look at these decisions is via the K-State Ag Manager Spreadsheet tool found at: https://www.agmanager.info/ag-policy/2018-farm-bill/tradeoff-between-20252026-arc-and-plc. I added some photos of these decisions at jenreesources.com.

Please look at this for yourself for your specific state and county. When I look at it, because of the higher ARC-Co effective prices compared to PLC for all crops, ARC-Co is triggering before PLC, regardless of irrigation or not, for the counties in this area of the State. And, the payments increase rapidly hitting the cap with any potential for lower prices and/or county average yields. ARC-Co also triggers sooner if prices don’t tank but in the event of lower county-average yields due to drought, hail, etc.

So, this year, beyond considering crop insurance, the decision appears somewhat clearer in spite of not knowing for sure what will happen with market year average prices. Again, I would still recommend you try running the spreadsheet for yourself.

If you are concerned about spreading risk with your farm bill decision and you’re concerned about prices tanking, you could put your highest proven PLC yielding fields for different crops into PLC and the rest into ARC-Co. This is also a consideration if you’re concerned about hitting payment caps with ARC-Co.

As you make crop insurance decisions, the following webinar may be of help if you’re considering Supplemental Coverage Option (SCO) or Enhanced Coverage Option (ECO). SCO can only be used with PLC elections. https://www.agmanager.info/ag-policy/2018-farm-bill/making-farm-program-and-crop-insurance-decisions-2025-webinar-slides-and.

Pruning Fruit and Shade Trees

Pruning Fruit and Shade Trees: Sarah Browning, Extension Horticulture Educator, shared great information at the spring gardening program last Saturday! February-March is a good time to prune most trees. It’s best to not remove more than 12-15% of a tree at one time, no more than 20% if it’s pruned heavier.

She shared a study where they found that wood rot enters trees more through improper pruning cuts vs. other damage to the tree. I have a diagram sharing how to properly prune using the 3-cut method at jenreesources.com. Sarah shared the following below in an article she wrote:

“Many gardeners have questions at this time of year about spring pruning…it’s important to understand woody plant leaf and flower buds were formed last fall. They are already present on branch twigs, so you should be able to find dormant buds when doing a close examination of your plant now. The presence of buds now is normal and does not mean plants are actively growing yet. Does pruning cause early leaf and flower bud development? No, pruning actually has a slight delaying effect on bud growth.

After pruning, a plant has to adjust and begin sending growth hormones to new buds, since the preferred buds at the tips of branches removed are now gone. This process could take about 10 days, so bud development is slowed down a little. Note: it’s risky for growers to use pruning to slow down and “protect” flower buds.

Best time to prune fruit trees: Less winter-hardy fruit trees like peach, apricot, and sweet cherry, should always be pruned late, usually mid-March to early April, no matter how much warm mid-winter weather we experience. Pruning is done just before new growth starts. This is also the best practice for the more cold-hardy fruits, like pear, apple, plum, and tart cherry, as well as shade trees. Pruning at this time has two big benefits. First, there is less chance of cold damage at the pruning sites. Second, plants heal pruning wounds much faster if the cuts are made just before new growth begins.

There’s still plenty of time for cold late winter temperatures and freezes, which will slow bud development down. Early pruning leaves plants susceptible to cold temperature injury at the pruning sites.

Best time to prune shade trees: For homeowners who can choose the ideal time to prune, shade trees should also be pruned just before growth begins in spring. If you need to hire an arborist to prune a large tree, anytime before early May would be a great time to do it. When seeking a tree company, ask if they have someone on staff that is certified with the Nebraska Arborist Association or International Society of Arborists. It’s best if the company is not only a member of one of these associations but also has a certified arborist on staff.

Additional resources with diagrams on which limbs to prune can be found at: Pruning Fruit Trees (https://go.unl.edu/z75s) and https://byf.unl.edu/pruning-trees-shrubs/.

Seward County Ag Banquet will be held Monday, March 24, 2025 at the Fairgrounds in Seward. Tickets for the prime rib dinner are $35 and can be purchased by contacting Nick Bauer (402-429-6119) or Shelly Hansen (402-643-3636). Come out and enjoy an evening celebrating agriculture and the Kiwanis Farm Family, SDDP Agribusiness, and youth scholarship award winners!

ridge and angles down and slightly away from the stem, avoiding injury to the branch collar. Do not make flush cuts that remove the branch collar.”

JenResources 2/23/25

I’ve appreciated all the emails and phone calls related to the series of columns I did on the “Leaving a Lasting Legacy” series. There’s so much more I didn’t share in these columns. Comments have included how families are currently working through various issues and situations that I shared and also stories of heartbreak. I realized one thing I never cleared up was the difference between a succession plan and estate plan. Polly Dobbs, Attorney, shared,

“If you’re breathing, and deciding who takes over the farm operation as you slow down towards retirement, that’s a succession plan. For example, perhaps the successor is buying equipment, on installment over time. Or, perhaps you’re giving up some acres to the successor.

If you die, the plan about who gets what, that’s an estate plan. It must complement the succession plan. Does the successor have to keep buying the equipment, or just get it? Does the successor have a right to lease your land? Does the successor need to buy your land? Have option to buy?”

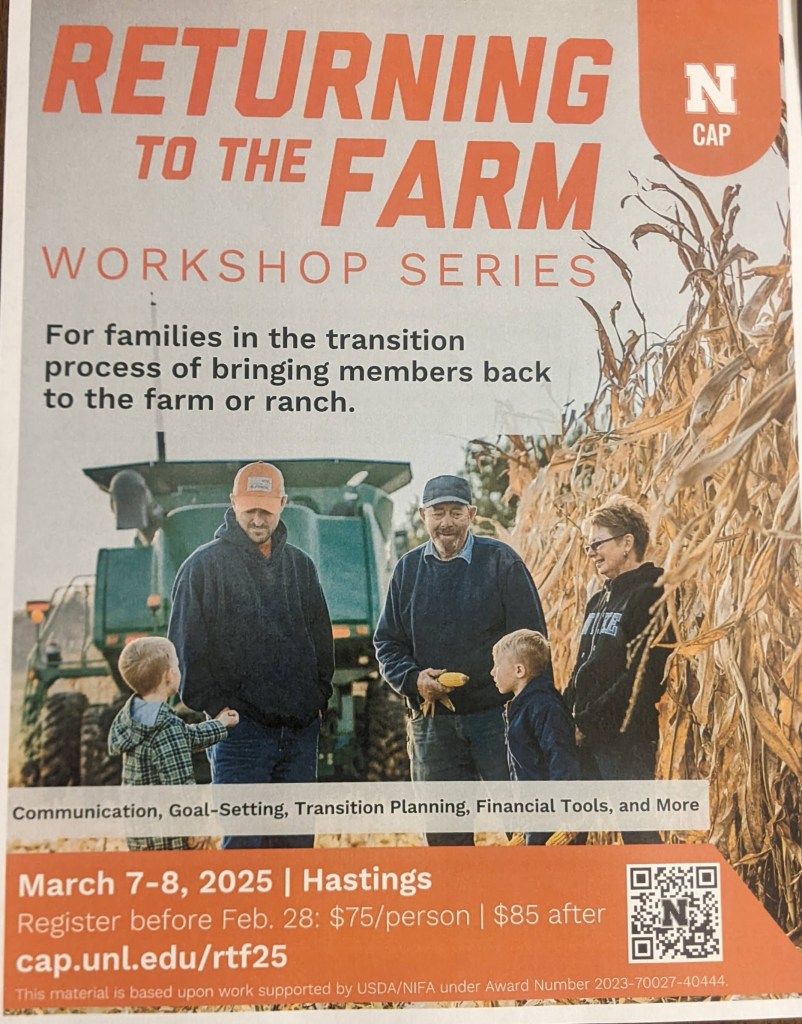

Has your successor put in sweat equity? Think of the succession plan as deferred compensation. If you don’t have a related successor, do you want to find an unrelated one? Income tax consequences of selling equipment and final harvest require a team approach with your CPA well ahead of retirement. Reminder: Returning to the Farm Workshop is March 7-8 in Hastings. Info: https://cap.unl.edu/rtf25.

Webinar: “How to pay for long-term care without selling the family farm or going broke!” is a free webinar being held this week on February 27, 2025 at Noon CST. Adam Dees is a practicing Kansas Elder Law attorney and will be sharing on this topic including: how to protect your spouse and family, health information and how to choose decision makers, and Medicaid essentials. He also authored a booklet, “The Consumer’s Guide to Supplemental Needs Planning” focused on helping people with families who have special needs plan for their care, and also educates people through seminars like “Estate Planning Secrets,” “Don’t Lose the Farm: How to pay for Long-Term care without going broke,” and “Doing Dementia Differently.” Registration is required at: https://us02web.zoom.us/webinar/register/WN_Ui5GgEWSTqemPu5uALZb2Q#/registration

Pruning Workshop March 1st: Many gardeners have questions at this time of year about spring pruning…

- Will early pruning cause fruit tree leaf and flower buds to develop earlier and possibly be damaged by normal spring frosts?

- Should pruning still be done in March and early April or should it be done earlier if conditions have been warm?

- What about shade trees? Should any adjustments in the time of pruning be made in response to warm conditions?

Join Sarah Browning Saturday, March 1, for the NRD’s annual Spring Gardening Workshop. The topic will be Mastering the Basics of Pruning. The free class will be held at the 4-H building at the York County Fairgrounds from 10 a.m. to noon. Walk-ins are welcome but pre-registration to 402-362-6601 is helpful for printing materials.

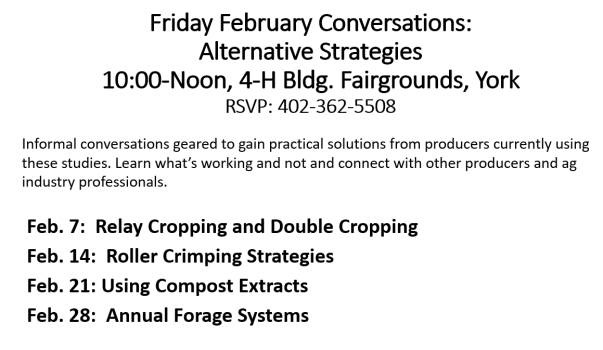

Also, our last Friday February conversation is this Friday, Feb. 28 from 10-Noon at the 4-H Bldg in York on Annual Forage Systems. Come hear from farmers making this work! Please RSVP to 402-362-5508.

Legal Considerations for Planning

Our last session of the “Leaving a Lasting Legacy” series was with lawyer Polly Dobbs. She was a straight-shooter. Please talk with your trusted team about the following information.

Most Important: If a farm spouse has passed away in the past five years, she recommended to “use portability to avoid a potential multi-million dollar estate mistake”. A surviving spouse can make a portability election in order to “port” over any unused federal estate tax exclusion (called “Deceased Spousal Unused Exclusion Amount” DSUE) from the first spouse. Election MUST be made after the death of the first spouse, which requires filing a Form 706 Federal Estate Tax Return…she said it has been extended to five years till 2026. Many CPAs and lawyers are unaware of portability. Please, if your spouse/one of your parents died in the past 5 years, file a Form 706 and elect portability. I have examples that show why on my blog at jenreesources.com. And please share this with others you know!

There was a great deal of discussion about ignoring tax changes. The current tax law (until 2026) says upon death, up to $13.99 million will pass exempt from Federal Estate Tax ($27.98 million for a married couple). During lifetime, you may give away up to $13.99 million of your assets ($27.98 million if married) exempt from Federal gift tax, which would reduce the amount of your exemption remaining at death. The estate tax reverts to half this level in 2026, but anything could happen between now and then. You may have a false sense of security that your total assets are under the estate tax threshold. What’s your farm ground really worth today? Also, life insurance proceeds count towards the total assets of the estate! Another tool, ask your advisors about SLAT (Spousal Lifetime or Limited Access Trust) yet in 2025.

A common mistake made is treating all kids exactly the same. She stressed that “fair” doesn’t mean “equal” ownership amongst kids. Equal tenants in common ownership will set the stage for a family feud. Partition actions can allow one tenant in common to trigger a court ordered auction, no matter how small an interest he/she owns. She stressed if your kids aren’t in business together during life, don’t throw them in business together after death.

Do “off farm children get bought out?” If the decision is yes, then set the price and terms. If the successor has put in sweat equity and earned a break, one can think of the succession plan and estate plan like Deferred Comp. It’s OK for the sale to be at a discount with payment on installment over time. If the decision is no, it’s OK to give operating business assets to the successor child and give different assets (lesser value) to the other children, or not. Fair doesn’t have to be equal.

Like the previous speakers, she stressed a team approach with the others on your team: accountant, banker, lawyer, financial planner, insurance agent, etc. She said you will save time and money if they’re talking to each other. She also stressed that income tax consequences require team approaches with CPA well ahead of retirement. Also, not every estate plan attorney knows elder law. It’s important to price long term care insurance and consult with an elder law attorney to learn of options to avoid the nursing home taking the farm. Elder Law attorneys: https://www.naela.org/FindALawyer.

For all operators, consider asking your landlords about “first right of refusal”. This allows the farm to not be sold without first being offered to the holder of the first right. Additional Resources at: https://cap.unl.edu/succession/. And, consider the Returning to the Farm Workshop at: https://cap.unl.edu/rtf25/.

Reminder of On-Farm Research Meetings beginning this week https://on-farm-research.unl.edu/about/2025-meeting-information/ and the Friday discussion on Compost Extracts from 10-noon at the 4-H Building in York.

The following are slides that were shared about portability and the important tax implications to the successor generation if this is not made in the previous generation. Please talk with your trusted team about this.

Farm Finances and Succession

Finances was the third week’s topic of the “Leaving a Lasting Legacy” series. A statistic was shared that surprised me. Did you know that only 27% of land is inherited or gifted? I was surprised this number wasn’t higher. It was suggested that with cost of living, nursing homes, etc., it may not be feasible for owners to “gift” land when they’re in their sunset years (meaning, the final years of a person’s life that may include retirement or “slowing down”). A UNL survey in 2017 asked farmers why they were retiring later: 62% said they can’t afford to retire. That’s a sad statistic as well.

Regarding the other ways land is obtained, 4% is purchased at an auction, 18% is purchased from a relative, with 50% being purchased from a non-relative. So, the question for those hoping to farm in the future becomes, How are you preparing yourselves to financially buy land…including buying out siblings, etc.?

For the owner generation, “sunsetting” means to step back and support without necessarily stepping away. It’s important to know your ultimate goal for the farm/ranch for the future. If you desire succession of the farm/ranch, documents need to be in writing and everyone on your team needs to know your goals and what the documents say. Your family also needs to know.

Your “team” can include people like a lawyer, tax professional, banker, financial planner, and others such as a facilitator/mediator. The key: You Know them, Like them, Trust them. These professionals should provide options but not tell you what to do. Your situation is unique. Not every tool in the toolbox is the right tool for you and your situation. Of importance, the term “financial advisor” is not regulated. They recommended to look for a designation called “Certified Financial Planner” (CFP).

Transitioning is a balancing act. The owner generation can’t bring the next generation into the operation at financial jeopardization of the owners. An income statement (profit-loss) statement is a way to know the profitability of the farm and the ability to support two families or not. This is not what is in the bank account. An income statement shows the net farm income, which is the profitability of the business.

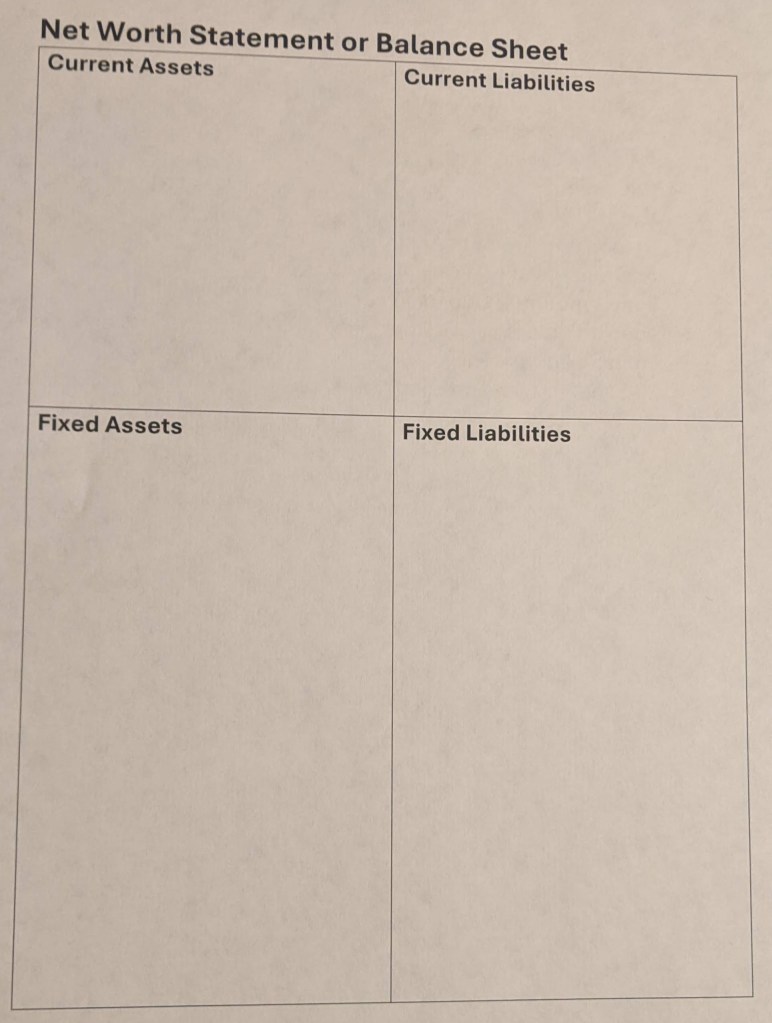

We also walked through balance sheets (also known as net worth statements). Balance sheets don’t show profitability; they show what we OWN (assets) or OWE (liabilities) and are a snapshot of the situation for a moment in time. While this may not be new to some, I appreciated a visual activity we did where we split assets and liabilities into quadrants that included current (the current year) or fixed (more than one year). I think for many not involved with the day-to-day operations of a farm or business, it’s hard to visualize the large numbers being mentioned. I have an example photo of this more visual way of looking at a balance sheet on my blog at jenreesources.com.

On-Farm Research Update will be held on February 18, 2025 at the Holthus Convention Center in York. It’s one of my favorite meetings of the year to hear from the farmers themselves about why they tried the studies they did and what they learned. Often the results will show no differences compared to the check treatment, which can frustrate people. However, that’s important information to test it on smaller acres first before investing a lot of money on larger acres. We did have some studies with promising results as well, though. If you’re interested in attending, please call (402) 362-5508 to pre-register as we need RSVP for lunch count.