Category Archives: farm transition

Legal Considerations for Planning

Our last session of the “Leaving a Lasting Legacy” series was with lawyer Polly Dobbs. She was a straight-shooter. Please talk with your trusted team about the following information.

Most Important: If a farm spouse has passed away in the past five years, she recommended to “use portability to avoid a potential multi-million dollar estate mistake”. A surviving spouse can make a portability election in order to “port” over any unused federal estate tax exclusion (called “Deceased Spousal Unused Exclusion Amount” DSUE) from the first spouse. Election MUST be made after the death of the first spouse, which requires filing a Form 706 Federal Estate Tax Return…she said it has been extended to five years till 2026. Many CPAs and lawyers are unaware of portability. Please, if your spouse/one of your parents died in the past 5 years, file a Form 706 and elect portability. I have examples that show why on my blog at jenreesources.com. And please share this with others you know!

There was a great deal of discussion about ignoring tax changes. The current tax law (until 2026) says upon death, up to $13.99 million will pass exempt from Federal Estate Tax ($27.98 million for a married couple). During lifetime, you may give away up to $13.99 million of your assets ($27.98 million if married) exempt from Federal gift tax, which would reduce the amount of your exemption remaining at death. The estate tax reverts to half this level in 2026, but anything could happen between now and then. You may have a false sense of security that your total assets are under the estate tax threshold. What’s your farm ground really worth today? Also, life insurance proceeds count towards the total assets of the estate! Another tool, ask your advisors about SLAT (Spousal Lifetime or Limited Access Trust) yet in 2025.

A common mistake made is treating all kids exactly the same. She stressed that “fair” doesn’t mean “equal” ownership amongst kids. Equal tenants in common ownership will set the stage for a family feud. Partition actions can allow one tenant in common to trigger a court ordered auction, no matter how small an interest he/she owns. She stressed if your kids aren’t in business together during life, don’t throw them in business together after death.

Do “off farm children get bought out?” If the decision is yes, then set the price and terms. If the successor has put in sweat equity and earned a break, one can think of the succession plan and estate plan like Deferred Comp. It’s OK for the sale to be at a discount with payment on installment over time. If the decision is no, it’s OK to give operating business assets to the successor child and give different assets (lesser value) to the other children, or not. Fair doesn’t have to be equal.

Like the previous speakers, she stressed a team approach with the others on your team: accountant, banker, lawyer, financial planner, insurance agent, etc. She said you will save time and money if they’re talking to each other. She also stressed that income tax consequences require team approaches with CPA well ahead of retirement. Also, not every estate plan attorney knows elder law. It’s important to price long term care insurance and consult with an elder law attorney to learn of options to avoid the nursing home taking the farm. Elder Law attorneys: https://www.naela.org/FindALawyer.

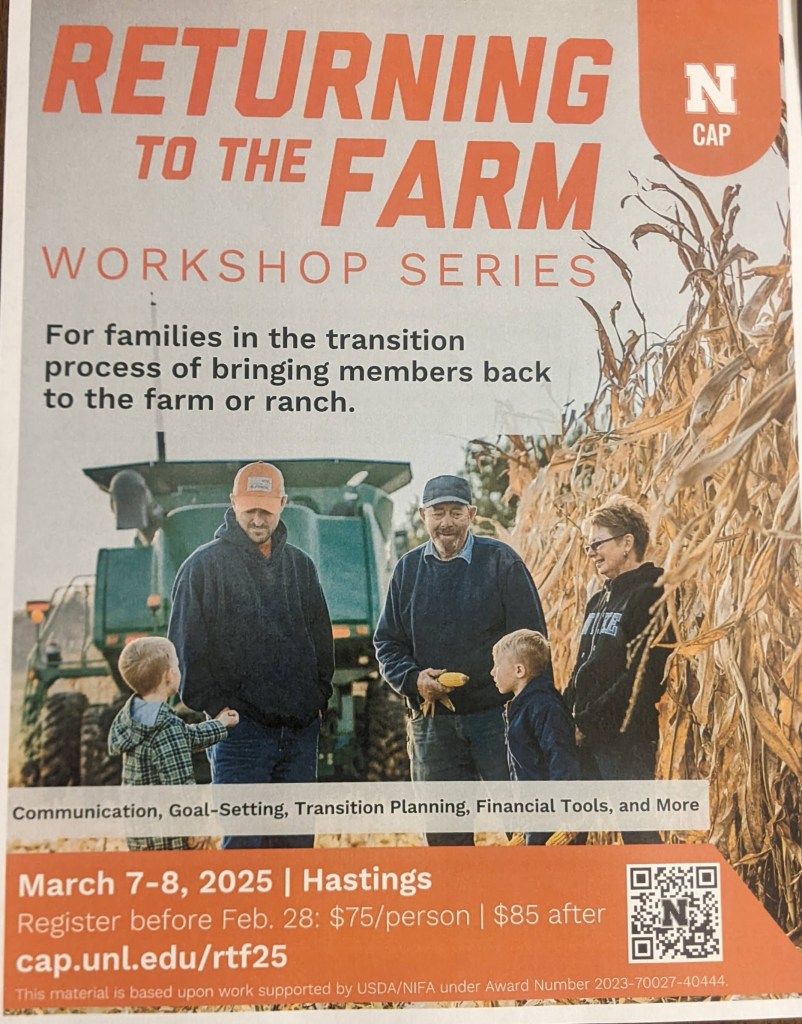

For all operators, consider asking your landlords about “first right of refusal”. This allows the farm to not be sold without first being offered to the holder of the first right. Additional Resources at: https://cap.unl.edu/succession/. And, consider the Returning to the Farm Workshop at: https://cap.unl.edu/rtf25/.

Reminder of On-Farm Research Meetings beginning this week https://on-farm-research.unl.edu/about/2025-meeting-information/ and the Friday discussion on Compost Extracts from 10-noon at the 4-H Building in York.

The following are slides that were shared about portability and the important tax implications to the successor generation if this is not made in the previous generation. Please talk with your trusted team about this.

Farm Finances and Succession

Finances was the third week’s topic of the “Leaving a Lasting Legacy” series. A statistic was shared that surprised me. Did you know that only 27% of land is inherited or gifted? I was surprised this number wasn’t higher. It was suggested that with cost of living, nursing homes, etc., it may not be feasible for owners to “gift” land when they’re in their sunset years (meaning, the final years of a person’s life that may include retirement or “slowing down”). A UNL survey in 2017 asked farmers why they were retiring later: 62% said they can’t afford to retire. That’s a sad statistic as well.

Regarding the other ways land is obtained, 4% is purchased at an auction, 18% is purchased from a relative, with 50% being purchased from a non-relative. So, the question for those hoping to farm in the future becomes, How are you preparing yourselves to financially buy land…including buying out siblings, etc.?

For the owner generation, “sunsetting” means to step back and support without necessarily stepping away. It’s important to know your ultimate goal for the farm/ranch for the future. If you desire succession of the farm/ranch, documents need to be in writing and everyone on your team needs to know your goals and what the documents say. Your family also needs to know.

Your “team” can include people like a lawyer, tax professional, banker, financial planner, and others such as a facilitator/mediator. The key: You Know them, Like them, Trust them. These professionals should provide options but not tell you what to do. Your situation is unique. Not every tool in the toolbox is the right tool for you and your situation. Of importance, the term “financial advisor” is not regulated. They recommended to look for a designation called “Certified Financial Planner” (CFP).

Transitioning is a balancing act. The owner generation can’t bring the next generation into the operation at financial jeopardization of the owners. An income statement (profit-loss) statement is a way to know the profitability of the farm and the ability to support two families or not. This is not what is in the bank account. An income statement shows the net farm income, which is the profitability of the business.

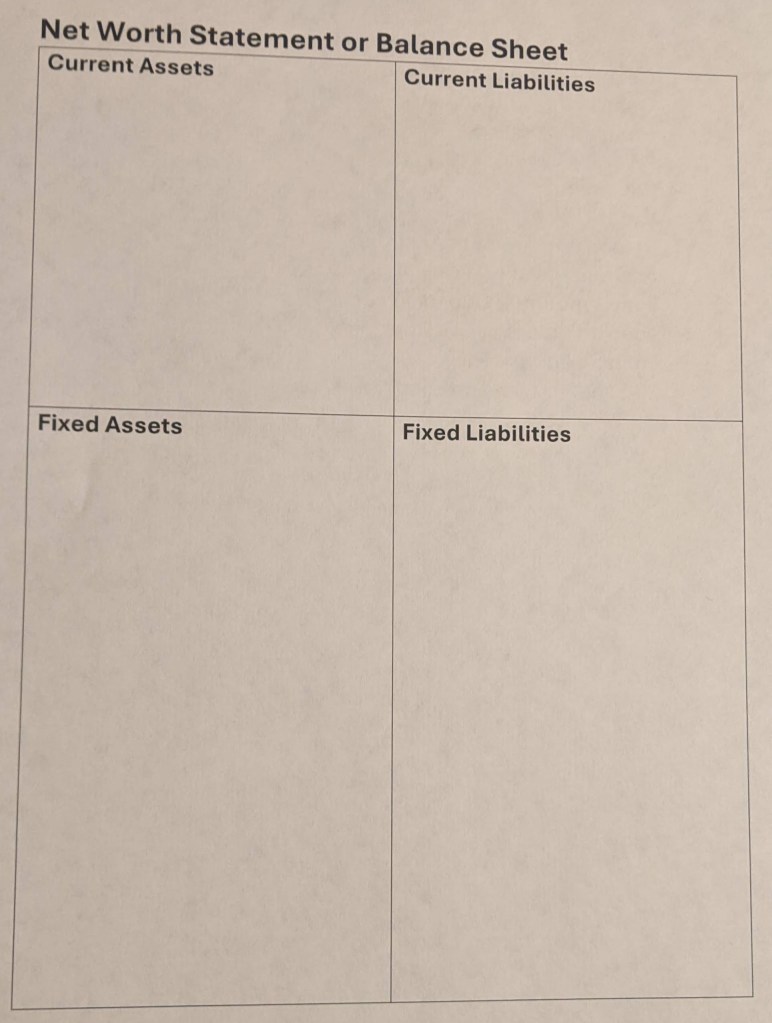

We also walked through balance sheets (also known as net worth statements). Balance sheets don’t show profitability; they show what we OWN (assets) or OWE (liabilities) and are a snapshot of the situation for a moment in time. While this may not be new to some, I appreciated a visual activity we did where we split assets and liabilities into quadrants that included current (the current year) or fixed (more than one year). I think for many not involved with the day-to-day operations of a farm or business, it’s hard to visualize the large numbers being mentioned. I have an example photo of this more visual way of looking at a balance sheet on my blog at jenreesources.com.

On-Farm Research Update will be held on February 18, 2025 at the Holthus Convention Center in York. It’s one of my favorite meetings of the year to hear from the farmers themselves about why they tried the studies they did and what they learned. Often the results will show no differences compared to the check treatment, which can frustrate people. However, that’s important information to test it on smaller acres first before investing a lot of money on larger acres. We did have some studies with promising results as well, though. If you’re interested in attending, please call (402) 362-5508 to pre-register as we need RSVP for lunch count.

Ambiguous Loss & Farming — Views from VanDeWalle

Sharing this post from my colleague Brandy VanDeWalle with Fillmore County Extension. You can read the remainder of it by clicking on the link to her blog below.

Picture this scenario. A young farmer in his thirties is looking forward to taking over the family farm someday. Suddenly the father is impacted by a life-changing health incident that leaves him mentally incapacitated and unable to explain the workings of the farm or other advice for the son. Or… imagine being the wife who […]

Ambiguous Loss & Farming — Views from VanDeWalle

JenREES 11-18-18 Farm Transition

Wishing everyone a blessed Thanksgiving with family and friends! We have much for which to be thankful!

Last week we held a farm transition meeting in York. I was thinking back to a family gathering we had shortly after one of my dad’s farm accidents. We were grateful he was going to be ok. In talking about what needed to be done on the farm, I asked something like, “Does anyone here know what your wishes or plan is for the farm if this had been more serious?” It wasn’t the best time and I didn’t do this correctly. It did allow for discussion as we never talked about what would happen to the farm before that. I’m grateful my parents responded over time asking each of us kids our intentions/values regarding the farm. They then put their estate plan together and at Christmas one year, went through everything with everyone including any spouses that were present. What I appreciate the most is that they were intentional and there is no secret.

The fact that estate plans can be secret was a common frustration among attendees at the workshop…and as I talk with various farmers. Dave Goeller, emeritus Farm Transition Specialist, shared a sad story about a man in his late 60’s whose 90+ year old dad still hadn’t transitioned management of the ranch to him. When he asked his dad about the opportunity to manage the ranch in the future, the dad didn’t wish to talk and said not to worry. I won’t go into the details but when the parents passed away, the ranch was sold. What’s sad is that, most likely, the outcome is not what the parents intended, and certainly not what the son hoped. We need to get away from estate plans being a secret.

Consider these questions:

- Have you been able to talk to your parents about what is happening with their estate plans? If not, why?

- What is your biggest concern/anxiety/fear(s)? What are you afraid you might find out?

- What is the biggest obstacle in your family dynamics?

- What do you love about your family business?

- What is the worst situation you can think of which might happen in the future?

- What could you learn that can help you?

- What is your mission statement for your farm/ranch? What is your vision for the farm/ranch?

- What are your goals for your farm/ranch? What will you do to make your vision happen?

Dave shared that while a person may feel like a ‘vulture’ when asking about the estate plan (as asking can come across as greed), it can really be a question over shared values. As I think about my immediate family, our shared values are faith, family, hard work, sacrifice, maintaining our family farm. I should’ve broached the subject using shared values instead:

“Dad, I’m so grateful God protected you and you’re going to be ok! You and mom have worked so hard and sacrificed so much for us kids and for this farm. We as your children wish to see your legacy live on in keeping the farm in our family. May we please discuss what your and mom’s goals and dreams are for the farm in the future?”

For those who have asked me how to have this conversation, perhaps some of these questions found in the Workbook at http://go.unl.edu/FarmRanchTransition may help? I also have copies of this workbook in the Extension Office. The questions cover a range of topics from understanding common values, asking if there are written documents, what is long term health care plan to protect the farm/ranch, contribution of all heirs, etc. Please also consider the Nebraska Farm Hotline at 800-464-0258 as a valuable and free resource for you! This hotline is a confidential resource for talking about stress, anxiety, financial concerns, and also for scheduling a time to meet with Dave Goeller and Joe Hawbaker (Attorney) for free to discuss estate plans and farm transitions. All you need to do is call 800-464-0258. For those interested in meeting regarding estate plans/farm transition, Dave and Joe have promised to come back to York to meet individually with families once they receive at least 5 calls. So, if this is of interest to you, please mention this when you call the hotline.

Final thought, this past year in particular, several farmers have shared with me their children would like to see them retire. I sense a variety of feelings about that from them as I listened. I also asked several questions including, “What does retirement look like to them? What does it look like to you?” Perhaps those and other questions could be asked in an honest conversation together?

Much of our identity, right or wrong, is found in what we do for a living. After all, we tend to ask this question when we meet new people. Through life’s circumstances, I’ve had to learn to seek my identity in who I am. Dave mentioned to think of retirement not as no longer working on the farm or being an important player, but retiring the management to the next generation. So, perhaps work out a transition plan that fits your situation where the first perhaps 3-10 years, the older generation is the primary manager in a mentor role explaining why he/she made the decisions a certain way to the next generation. The next 3-10 years, decision making is shared between the older and next generation. After that, decision making is transitioned to the next generation. And, during this entire process, the older generation needs to consider what he/she will be “retiring to”…what purpose or meaning can be found to occupy the time that was once spent in managing the farm?

Ultimately, estate planning and farm transition…relationships…are too important to not talk about these topics. Let’s no longer keep them a big secret!