JenResources 5/11/25

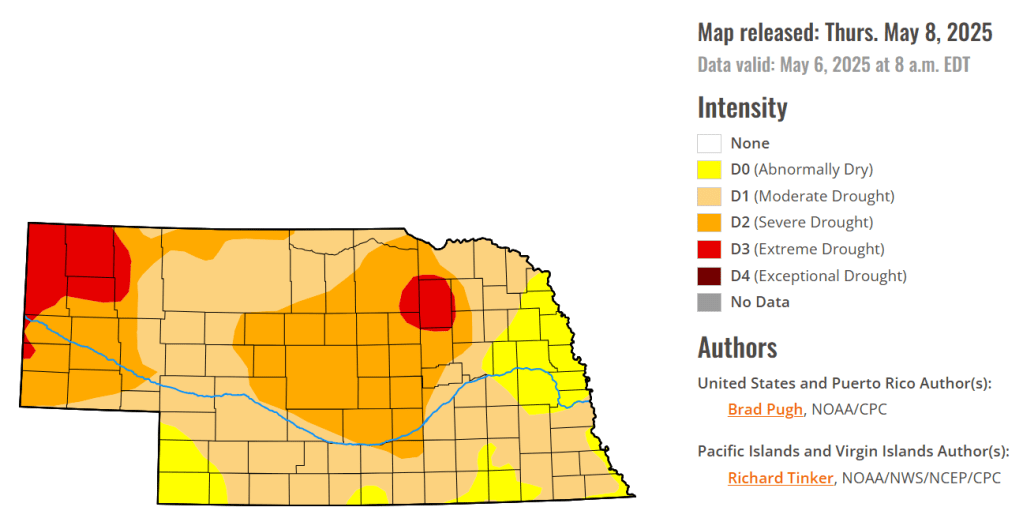

Drought: While it’s sometimes difficult to write a column each week, the record of information on my blog through the years has been of help to me. I was thinking about this spring…how the rye and pastures weren’t growing, and now how the rye and wheat went to head in non-irrigated ground weeks earlier than normal. Why are they heading so early this year? I think it’s because we’ve had such warm soil temperatures coupled with low surface and subsoil moisture in non-irrigated fields. I think the plants are stressed and went into reproductive mode.

I’m concerned that pastures will also be short and head out early too. It’s good to be prepared in the event that livestock producers need additional forage. In mid-April, a Drought Preparation Webinar was held and the recording can be found here: https://go.unl.edu/2025_drought_prep_webinar. There’s also a recent CropWatch article by Aaron Berger, Livestock Educator, sharing the economic tradeoffs of grazing wheat vs. taking it for grain for those with non-irrigated acres that are drought stressed or dealing with virus diseases. You can find the full article here: https://go.unl.edu/mrny.

I know irrigating crops like what is occurring is reminiscent of 2023 in watering crops up and activating herbicide. No one wants the irrigation season to start this early. For curiosity, I pulled the Drought Monitor maps from this week in 2023, 2024, and 2025. 2023 is the year I think of most closely to 2025 so far, even though the drought monitor map in 2023 was much more severe than what 2025 shows. For a planting season, 2025 reminds me more of 2012 with how early everything went into the ground with a warm growing season and no cold snaps. The drought monitor map for the area of the state I serve is similar to 2024, but we also know that mid- to late-May rains changed conditions from dry to too wet in areas north and east of here. Curious as to what year(s) any of you would compare this year to?

Ultimately, we’re not in control of the weather. For the livestock producers in particular, it may be wise to have a forage plan in place in the event that forage resources run short for your operation.

Seed Swap: On a lighter note, we have some interesting on-farm research projects this year! One we’re calling a Seed Swap. This will be my 10th year with the York Co. Corn Grower plot. Any extra seed that we vacuum out of planter boxes is mixed together and planted out. While it’s not a part of the official plot, that area has always beaten the highest yielding number in the plot by 5-10 bu/ac. And, it may not always work this way, but a handful of others also commented they’ve seen something similar. One farmer who had hosted the plot in the past had the idea of trying this via on-farm research. A group of farmers also liked the idea and they all decided on a “seed swap” where they each contributed a hybrid to be mixed together. The mix is compared to each farmer’s hybrid(s) of choice. So in 2025, we’ll have non-GMO and GMO seed swap studies. There’s also a grower who wanted to try this with soybeans, so he has a study combining different maturity groups.

A 2009 study in Ohio compared 5 hybrids vs. mixes of the hybrids. “No significant difference was seen when comparing the yield of a mixed hybrid stand to the average of the two hybrids that were used in the mixed planting. However, there was an observed tendency for the mixed hybrid treatments to out yield their single hybrid counterparts by an average of 4.2 bushel per acre.”

I realize the concept perhaps goes against what many are trying to do with increasing uniformity in fields. My hypothesis in what we’ve seen in the corn grower plot is that the range of maturities (110-120 days) allowed to catch any stragglers for pollination, there was increased diversity in disease/insect packages in combination with more defensive and racehorse hybrids. For those interested in soil health, I also think there’s something to diversity of root structures resulting in more sharing of nutrients and different microbial associations with roots. Those are just hypotheses and we’ll share what we see for results next winter!

JenResources 5/4/25

Crop Updates: I was reminding myself to count my blessings that we have received any rain falling from the sky! The rainfall has been spotty and I can appreciate it’s been frustrating and tiring with the winds and lack of rainfall. We’ve also been blessed with incredible planting conditions this season. It’s interesting to hear a number of farmers share they were completely done with planting in April this year. It’s also nice to see the green crops emerging in fields.

Have heard reports of alfalfa weevils being higher incidence in Kansas and the southern border counties of Nebraska. Please be scouting alfalfa. More info. here: https://crops.extension.iastate.edu/encyclopedia/alfalfa-weevil.

For wheat, there’s been very little rust (stripe or leaf rust) found in Kansas through Texas. With recent rains and dew, it’s good to be scouting for these diseases. While I’m not aware that we have any wheat flowering yet, wheat development does vary throughout the area receiving this information. To check on the Fusarium Head Blight (scab) risk, check out this tool: https://www.wheatscab.psu.edu/.

I’ve had some questions on what to expect for insects this year. No one can know for sure, but our Extension entomologists shared on this topic a few weeks ago in a CropWatch article found here: https://go.unl.edu/2zmn. The following are some excerpts from the article:

“Soil Temperatures: Despite frigid temperatures in February 2025, Nebraska soil temperatures at insect overwintering depths (around 4 inches) remained relatively stable due to insulating snow cover and crop residue. The cold event likely had minimal impact on most overwintering insect pests, as the soil didn’t freeze deep enough or stay cold long enough to kill them.

Unfortunately, temperatures at most locations where western corn rootworm, western bean cutworm, and wheat stem sawfly typically overwinter have not reached sustained periods of low enough temperatures to cause considerable mortality. The exception would be the chance for higher mortality of WCR and WBC in January in the Scottsbluff region.

We recommend that scouting and management practices are continued as planned in 2025, and as informed by pest pressures observed in 2024, rather than relying upon this winter’s weather to provide adequate control of pests. However, weather between now and summer could still impact insect survival; for example, very wet soil conditions in spring can reduce WCR survival as larvae hatch out and potentially drown.”

Crabgrass preventer in lawns: With the warm soil temperatures, it’s time to get crabgrass preventer on lawns if you’re interested in doing this and haven’t already done so.

Field bindweed has been another pest people have asked about. It produces deep roots and it spreads by seeds, rhizomes and stolons. For homeowners, Kelly Feehan shared that “If hand-pulling or hoeing is the chosen control, studies show if bindweed is pulled before it grows five leaves, you may have better success. It may take up to three or four growing seasons to kill a plant, but it’s possible if one stays on top of removing plants before they have five leaves. If herbicides are used, spot treat weeds before they bloom and avoid getting herbicide on desirable plants. Tryclopyr and glyphosate can be used carefully in landscapes on bindweed.” Another tip has been to apply glyphosate to a nitrile glove and run the gloved hand on the vine so the herbicide is applied to the vine and not the desirable plant. That also takes diligence but can help over time.

JenResources 4/27/25

The weather and soil temperatures have been incredible for planting progress in this part of the State! The main agronomic question I’ve received the past few weeks has been from those with small grain cover crops around termination timing. We share more details in this article, although decisions are based on individual producers’ goals and the situation in each individual field: https://cropwatch.unl.edu/2021/cover-crop-termination-tradeoffs/.

It’s been a very different spring with small grain and pasture growth. In some ways, it reminds me of 2023, but in others, it seems worse. There was a period of time I was watching small grains, especially in non-irrigated fields, just “set” and not grow. Pastures were doing the same thing. Now in non-irrigated fields, I’m seeing rye that’s fairly short and in boot to heading stage, far earlier than it should be. My biggest concern for non-irrigated fields is soil moisture. It’s a field by field assessment and I recommend that growers be digging in fields to have a better idea of soil moisture and depth of moisture. Even for some growers that typically plant green, we’ve made the call to terminate prior to planting or at planting to conserve what moisture we can.

For the irrigated fields, the rye is also maturing quicker than expected, and for some, has gotten taller than they had desired before planting. For those who were planning on planting soybeans green into the rye, I’m not concerned about the rye “getting too tall”. You will observe the soybeans “stretching” for sunlight once they emerge. They will be longer between the soil surface and the cotyledons and also first unifoliates compared to if they were planted without a small grain. My concerns would be:

- Ensuring the soybean is planted into even moisture or able to be irrigated after planting. If you’re concerned about soil moisture and won’t get beans planted this week, you can always terminate before planting.

- The seed vee is closed if a PRE herbicide is applied. Sometimes I’ve seen difficulty in getting the seed vee closed and if that’s the case, avoid a PRE herbicide to avoid injury to the seed/germinating seedlings. Often I don’t recommend a PRE herbicide when planting green due to the tradeoff in cost between the PRE and the cost of cover crop seed and seeding. But for those who still want to use one, it’s important to ensure that seed vee is closed.

- For both corn and soybean, be aware that the taller the rye gets, the greater the Carbon:Nitrogen ratio becomes. This ratio impacts nutrient tie-up and results in longer break-down time of the small grain. For corn, it’s important to add nitrogen some way during planting to help off-set the nutrient tie-up early on in that seedling’s life. For both corn and beans, sulfur is also tied up. Purdue University found adding 20 lbs of sulfur anytime from pre-plant to V3 resulted in a yield increase. Oh, and when planting green with taller rye, we’ve found it helpful to not use residue removers.

Alfalfa Weevils: I’ve also been noticing alfalfa weevils at low incidence in alfalfa fields thus far and recommend scouting your fields. Cut 10 stems at ground level at 5 different sites in the field. Then, beat the stems in a 5 gallon bucket and count the total number of larvae with a black head. Determine the average number of larvae per stem. There’s a couple of charts with economic thresholds at: https://crops.extension.iastate.edu/encyclopedia/alfalfa-weevil. There’s also a tradeoff of harvesting early vs. spraying depending upon when economic thresholds are reached.

JenResources 4/21/25

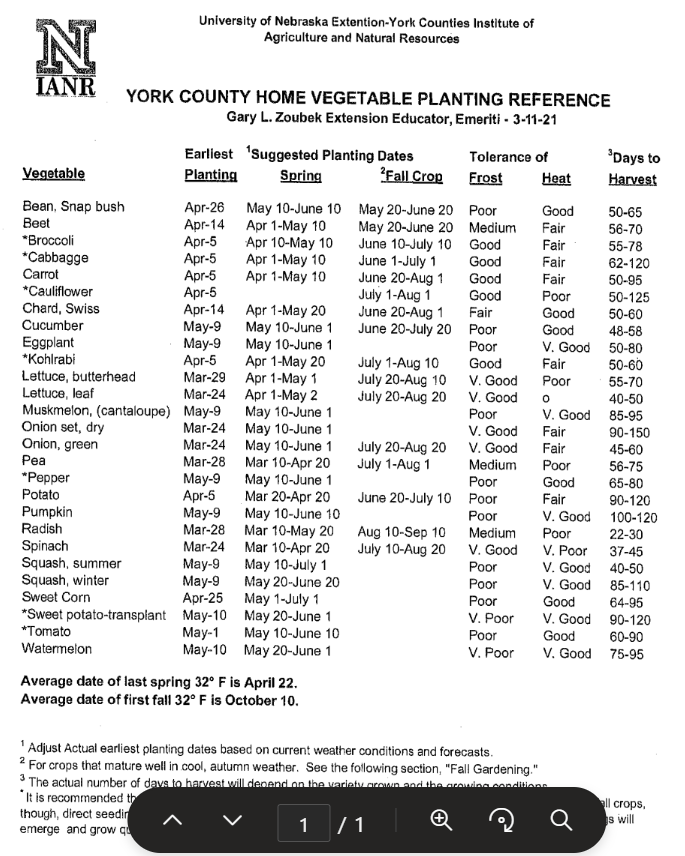

Hope you had a blessed Easter with your families/friends! It was wonderful for those who also received some rain! Quite a bit got planted last week with the warmer soil temperatures. Continue to monitor soil moisture for individual fields to have proper seeding depth into moisture. Eric Hunt, Extension Meteorologist, mentioned March 2025 had the highest wind gusts on record in Nebraska. That’s not a desirable stat, but it does help explain why so many asked if it’s normally this windy, why the surface soil moisture dried so quickly, and why small grains and pastures haven’t grown much in spite of warm soil temps. For vegetable gardens, I placed the planting guide at: https://jenreesources.com/2025/04/14/vegetable-planting-reference/.

Crabgrass Preventer for lawns is best applied when soil temps have been 55F at 4” depth for several days. Last week we were fairly close; watch soil temperatures this week at: https://cropwatch.unl.edu/soil-temperature/. For new lawn seedings, there’s options of a couple products to prevent crabgrass. Siduron (commonly sold as Tupersan) and mesotrione (found in Scotts Turf Builder Triple Action Built for Seeding) are available options.

Roundup Products for Homeowners: It’s important to read the active ingredients on the label when shopping for products. “Typical Roundup” contains the active ingredient glyphosate which is non-selective and will kill any green plants not resistant to it. Any product containing glyphosate that is sprayed on the lawn will kill the lawn.

The product labeled “Roundup for Lawns” does not contain glyphosate, which can be confusing. Active ingredients in this product include MCPA, quinclorac, dicamba and sulfentrazone. These herbicides are effective on a broad range of weeds that might infest the lawn such as dandelion, crabgrass and nutsedge, without harming the lawn when used properly.

“Roundup 365” is a product that contains glyphosate, imazapic, and diquat. This product can provide 12 month control of weeds and is labeled for use on driveways, patios, sidewalks, and gravel areas. Just know that nothing can be safely planted back into that area for at least 12 months.

To remove undesirable trees that grow within evergreen trees or hedges like lilacs, use glyphosate instead of Tordon on the cut stumps. This is because the glyphosate doesn’t have additional soil activity and stays within the root system of the plant it’s been applied to. Just be careful to only use a product with glyphosate with nothing else added to it. Ultimately, please read the labels to ensure you’re using a product that is labeled for the place you wish to use it, for any restrictions on the product, and what pests it lists to control.

Tree Planting: With Arbor Day this week, it’s important to not plant trees too deep. Kelly Feehan shares, “If a tree is planted at the same depth it was in its container, and the soil in the planting hole beneath the root ball is loosened, odds are very good the tree will be planted too deep. Since planting trees at the same depth they are in their containers and loosening soil in the bottom of planting holes is often done, too deep of planting occurs frequently. To plant a tree at the correct depth, wait to dig the hole until after a tree’s first lateral root at the base of the trunk is located. Soil may need to be scraped off the top of the root ball to do this. Only then dig the hole just deep enough so the root ball will sit on firm, undisturbed soil and the first root is just below ground level. Dig planting holes one to two times wider than the root balls diameter to loosen soil and encourage outward tree root growth.”

For those who have put their faith, trust, and repentance in Christ alone for salvation, Easter, and every single day, holds gratitude of the price that was paid in full for sin. We serve a Risen King! “All Praise to the Name Above All Names!”

Planting 2025 Considerations

Planting Considerations: The warmer air, wind, and warming trend of soil temperatures are allowing for planting to begin. The winds have removed a great deal of surface moisture making for dry conditions where seed will be placed. I recommend putting corn and soybeans in the ground at 2” (our research recommends 1.75” for soybean). This allows for buffered soil moisture and temperature conditions when planting. Bob Nielsen, emeritus professor at Purdue said corn can be seeded 2.5-3” deep if that’s where uniform soil moisture is located in order to achieve uniform germination and emergence, particularly for non-irrigated fields. In the droughts of 2023 and 2024, we had farmers successfully plant corn at 3.5” deep just to be in uniform soil moisture. We don’t recommend planting soybean deeper than 2.5”.

Seed germination occurs in two stages. The first is imbibition in which the seed takes up water quickly. Soybean needs to uptake 50% of its seed weight during this stage and this typically occurs in less than 24 hours if the seed is placed into good soil moisture. Corn uptakes 35% of its seed weight which can occur in 48 hours when placed into good soil moisture. It’s this phase where we get concerned if we receive a cold rain or snow within 24-48 hours of planting as the soil temperature can be reduced the seed can imbibe cold water leading to cold shock, reduced germination, and potentially death.

The second phase of germination is the osmotic phase. In this phase, a much slower uptake of water occurs. Seedlings in this phase are quite tolerant of soil temps as low as 35-40°F. Extended low temperatures and/or saturated excess moisture can lengthen the germination to emergence timeframe and can lead to greater soil-borne pathogens.

Agronomically we’ve come a long way with genetics and seed treatments. Because of this, some don’t worry about soil temps. Yet every year I think most agronomists would say we can trace various problems back to a specific planting date(s) or planting window. So, I still feel they’re an important consideration.

We often hear a preference of planting corn and soybeans in as close to 50°F or greater soil temperatures as possible. Below 50°F, I prefer to see corn planted on a warming trend of 5-7 days. The consideration is for soil temps in the mid-40’s on a warming trend with no chance of a cold snap (cold rain/snow) within 8-24 hours for soybean and 48 hours for corn. The time-frame is due to the imbibition (critical water uptake) time-frame for corn and soybean mentioned above. Soil temps for your field can be monitored by using a thermometer or checking out CropWatch soil temps at: https://cropwatch.unl.edu/soiltemperature.

Since 2004, we’ve shared the importance of planting soybean early (mid- to late-April or first week of May) to increase yields. We’ve seen a shift to planting soybean earlier than corn or at least at the same time as corn, which is encouraging to me. A question I have and that an increasing number of producers have, is around soybean seed treatments. With tight economics and reasons including impacts to pollinators, some growers have tested full seed treatments vs. a biological seed treatment vs. untreated seed. We have 6 site-years of data in York, Seward, Polk, and Hamilton Counties thus far showing no yield differences between these treatments. Planting dates ranged from May 2 to May 22. I’m hoping to have more studies on this topic in 2025. Please let me know if you’re interested in trying a few strips of untreated or biological treated soybeans compared to your treated seed so we can obtain more local data.

JenResources 4/6/25

Storm Damaged Trees have been an increasing concern for homeowners. The cedar windbreaks seem to be the greatest affected and it’s hard to know how much damage has been done until you start the cleanup process. This is a resource from the Nebraska Forest Service on storm damaged trees: https://nfs.unl.edu/snow-and-ice-damage-trees/ and https://nfs.unl.edu/immediate-care-storm-damaged-trees/. Additional resources: https://nfs.unl.edu/pruning-large-trees/ and all Forest Service Resources at: https://nfs.unl.edu/nfs-publications/.

When I look at each tree situation, I look at the overall structure of the tree, if there’s any shelf fungi (look like dinner plates) on the trunk or main branches (indicator of heart rot), any other major signs of decay/disease, and seek to visualize how the tree will look upon being properly pruned. I’m not a forester, but these are quick things I’m looking for. Most of the trees I’ve recommended to keep unless they had obvious heart rot or other issues. Of key importance is to trim the trees back to the bark branch collar to allow for sealing over the pruning cut. There are places in trees with large gaping wounds from the sheer weight of branches tearing and falling. I don’t know how they will all heal and seal, but trees are pretty amazing at what they can withstand. Some of these trees have an odd-shape after pruning, but you can always make the decision to remove them later.

There have been some fungus gnat outbreaks after removing trees, especially entire windbreaks. The decaying organic matter in the soil in addition to exposed moist soil can allow for fungus gnats to thrive. They typically only live 7-10 days, but in that time-frame, the female can unfortunately lay hundreds of eggs multiple times. Thus, why a few are reporting “millions” of gnats in their farm yards. I don’t have a good answer for you on managing this. Numbers will be reduced once the soil dries out in the top two inches or so. Unfortunately, this situation will most likely take three to four weeks to potentially resolve until the gnats find a new home and/or die. If they get into your home, you can use yellow sticky traps to catch them and also shallow pans of dishwater.

Vegetable Planting Guide that was compiled by emeritus Extension Educator Gary Zoubek can be found at: https://go.unl.edu/vegetableguide.

Ground covers: The following is information from April’s ProHort Update at:https://hles.unl.edu/update042025/. Ground covers can be a great alternative to mulching the landscape bed while providing habitat for pollinators and season-long interest. They will spread and cover the ground via rhizomes or stolons while also reducing soil erosion. That makes them a great option instead of grass on a steep slope where it is hard to maintain turf. There are many native or well adapted groundcovers to choose from. Here are a few groundcover options for spring color:

- Prairie smoke (Geum triflorum), grows great in sunny, dry locations, blooms from May to July

- Sweet woodruff (Galium odoratum), grows great in dry shade, blooms April-May

- Carpet bugleweed (Ajuga reptans), grows in moist shade with blue blooms from May to June

- Creeping phlox (Phlox stolonifera), good bloomer in shade with purple blossoms in spring

- Pasque flower (Pulsatilla patens), very early spring bloomer with purple blossoms in full sun

- Candytuft (Iberis sempervirens), showy April-May bloomer in full sun

- Lungwort (Pulmonaria officinalis), small pink-blue blooms in April-May in part to full shade

Garden Tips

Garden Tips: This past week we got onions in the ground. Something new I tried, after hearing Kelly Feehan, Extension horticultural educator and Gary Zoubek, Extension educator emeritus recommend it, was to start onions from transplants instead of sets. It’s a tip for growing large onions that store well. Onions are biennials. In year one, they grow leaves and bulb and then set seed in year two. Sets grown for sale removes one season from the growth, so when we plant sets in our gardens, they want to go to seed, so you may see blooming in mid-summer, which limits the onion bulb size. If you do grow onions from sets, look for dime size or smaller sets as they would be less likely to bloom. This year, I’m looking forward to seeing what the transplants do.

Kelly Feehan shares, “Late March through April is typically the time to plant cool season vegetables. These vegetables germinate and grow in cooler soils and can tolerate light frosts. They include onions, potatoes, radish, lettuce, carrots, beets, peas, broccoli, and cabbage.

Potatoes are planted in April, sometimes late March or early May. A tip for increasing potato yields is hilling potatoes after they begin to grow. Once they are 12 to 20 inches tall, carefully scrape soil up around the plant to create a hill. Potato tubers grow on stolons, underground stems, above the roots. Hilling provides more space for tubers to grow and maintains cooler soil temperatures, especially if hills are mulched. As a cool season crop, cooler soil will increase tuber production.

If potato hills are spaced closer together, tubers grow smaller. If hills are spaced farther apart, tubers grow larger. The recommended spacing is 12 inches between hills and 3 feet between rows. The 12-inch spacing will result in smaller tubers. An 18 to 24 inch spacing will result in larger tubers.”

Soil Temperatures can be found at: https://cropwatch.unl.edu/soiltemperature. This is helpful for knowing when to plant vegetables, when to plant crops, and what the soil temp is when applying fertilizer to fields. It’s also helpful for homeowners to wait to apply crabgrass preventer for lawns until soil temps are at least 50-55F for 5-7 days straight. In spite of the warmer temps, it’s too early for crabgrass preventers (normally we wait for last week of April to early May)!

Lawn Seedings: For those who didn’t seed or overseed turf grass last August-September due to the dry conditions, aim to seed or overseed as soon as possible.

Household Hazardous Waste Collection will occur on April 12, 2025 from 8 a.m.-Noon at the City of Seward Storage Lot (880 S. Columbia Ave. in Seward) and 1:30-4:30 p.m. at the Butler Co. Fairgrounds in David City (62 L Street, North Entrance). Items accepted include: acids, cyanide, fluorescent bulbs, lead acid batteries, pain/stain/varnish, poisons, banned pesticides, antifreeze, flammables, Gas/oil, mercury, pesticides, and yard fertilizers. Farm chemicals will be allowed in quantities less than 150 lbs/55 gal. Please have your items in boxes (paint in one box and other materials in a separate box). The event in Seward is also taking additional items including electronics, etc. so please check out https://www.cultivatesewardcounty.com/news/seward-annual-clean-up-day/ for info. on that clean up location. For general questions, please contact the Four Corners Health Dept. at (402) 362-2622.

Reflections

This past week’s blizzard event is one that will forever be etched in our memories. We truly have so much for which to be thankful! Grateful for the way neighbors and others checked in on each other and helped in the midst of power outages. Grateful for all the linemen, city and county road crews, and first responders! Many shared with me stories from 1976 and there will no doubt be many stories shared for decades to come from this storm too. Continuing in prayer for those without power and for all the linemen continuing to restore power.

Last week I shared a column on Celebrating Ag Week. Strong agriculture and a strong ag economy are incredibly important as a backbone to any nation.

As an Extension Educator, my role has been to serve Nebraskans to the best of my ability in answering questions and sharing research-based information. I’ve also shared my observations, particularly when it comes to what I’m seeing in the field and when research doesn’t yet exist.

Throughout my nearly 21-year career, plenty of controversial issues have been faced with the people I serve. I’ve sought to listen to all sides of issues, serve as a moderator at meetings, and share what I hear from both sides and share the research, when it was available. For the past six months, I’ve been asked to bring in groups and moderate discussions on industrial scale solar, but I have refused these requests.

There is a meeting on Monday, March 31st from 7-8 p.m. at the Holthus Convention Center in York. You can also RSVP for a zoom link at this website: https://neconserve.org/news-events/event-calendar.html/event/2025/03/31/the-changing-landscape-of-renewable-energy-in-nebraska/519078. It’s being hosted by Conservation Nebraska and is titled, “The Changing Landscape of Renewable Energy in Nebraska”. My colleague John Hay, Extension Educator specializing in energy, renewable energy and biofuels will be the main speaker. John is a great colleague and friend of mine. He does a great job of knowing the research and answering questions. I also wish to be very clear that locally, as a Nebraska Extension Educator, I’m not involved with this meeting, nor am I partnering on it. I plan to attend.

As your local Extension Educator, I’ve listened to the stories of why people chose to sign leases and chose not to, listened to research and debate…and I’ve shared both perspectives and other information in news columns. I can appreciate the “why’s” on both sides and I have friends and acquaintances on both sides. Ultimately, I serve you all. But since last summer, I’ve been quiet on this issue. In addition to my career as an Extension Educator, I’m also human.

I am against utility scale solar farms removing agricultural ground from production. Solar can have a variety of uses, including in ag, but I’m against replacing farm ground with thousands of acres of solar panels for industrial scale solar. It has eaten at me to serve as your agricultural Extension Educator and not feel I could take a stand, but I can’t consciously do that any longer. I think about the potential impacts this could have on all of York/Fillmore County ag and surrounding counties in the future…the precedent set. I agree with the York County Zoning Committee’s setbacks that have been proposed. I also believe landowners have the right to choose what they do with their land. It’s difficult when it involves removing farm ground from production at this scale in a very strong Ag County such as York County. What tears me up the most are the damaged relationships as a result of this issue. Praying for wisdom for those making decisions, for the outcome, and that ultimately, relationships can one day be restored.

Ag Week 2025

Happy National Ag Week and National Ag Day (March 18)! What happens in ag impacts all Nebraskans as 1 in 4 Nebraska jobs are connected to ag. A strong ag economy (Nebraska ranks #1 in farm cash receipts of all commodities/capita) helps Nebraska’s overall economy. In 2023, Nebraska agriculture generated $31.6 billion in sales, with livestock accounting for 58% and crops for 42%. In 2024, Nebraska had 44,300 farms and ranches, the average size of which was 993 acres. The following are from the 2025 Ag Facts card: https://nda.nebraska.gov/facts.pdf and brochure: https://nda.nebraska.gov/publications/ne_ag_facts_brochure.pdf.

#1: Nebraska’s largest ag sector is beef production with Nebraska leading the nation in beef and veal exports and commercial cattle slaughter. We are #2 in all cattle/calves, commercial red meat production, and all cattle on feed. “Calves born on one of Nebraska’s 17,000 cow/calf ranches typically spend the majority of their lives on grass before being sent to a feedlot for finishing.”

#1: Nebraska regained the top production in popcorn, is 1st in Great Northern bean production, and has the most irrigated acres in the nation at 7.86 million. We are 2nd for pinto bean production and 4th in the nation for all dry edible bean, dry edible peas, and light red kidney bean production.

#2: Nebraska is #2 in ethanol production capacity. Nebraska produces around 2.3 billion gallons of ethanol annually from 24 ethanol plants. Nebraska is also #2 in bison production, no-till cropland acres, proso millet and alfalfa hay production.

#3: Nebraska is #3 in corn production and exports, cash receipts of all farm commodities, and jumped up to #3 in all hay production.

#4-7: Nebraska is ranked #4 land in farms and ranches, in sorghum and sunflower production, and for cover crop acres. We rank 5th in soybean exports and production. One bushel of soybeans can make 1.5 gallons of biodiesel. We also rank 6th for production of sugar beets. Nebraska is 6th for all hogs and pigs on farms and in commercial hog slaughter. “Six of the most common cuts of pork have, on average, 16 percent less fat and 27 percent less saturated fat than 20 years ago.” Nebraska ranks 7th in pastureland acres.

Nebraska is the 11th largest winter wheat producing state. “The average bushel of wheat weighs 60 pounds and can make 64 loaves of bread.” We are also ranked 11th in potato production with 1/3 of the state’s potatoes being made into potato chips. We are ranked 12th for organic cropland acres.

Nebraska ranks 14th nationally in egg production with more than 9.1 million birds in commercial egg laying facilities producing more than 2.6 billion eggs a year. We rank 25th in total milk production. There are around 78,000 sheep and lambs raised in Nebraska and also more than 24,000 meat goats and around 3,500 dairy goats.

Nebraska has more than 30 wineries and tasting rooms located across the state. There are more than 575 produce growers in Nebraska and we have “approximately 100 farmers markets, 167 roadside stands and 33 u-pick operations.” There are also approximately 39,000 bee colonies in Nebraska. There’s so much to be proud of regarding agriculture in Nebraska! May we seek to celebrate and support ag now and in the future! Happy National Ag Week! Reminder of the Seward County Ag Banquet on Monday evening, March 24th at the Fairgrounds in Seward (5:30 p.m. social hour, 6:30 p.m. meal and program) to celebrate ag locally!