Blog Archives

JenResources 2/23/25

I’ve appreciated all the emails and phone calls related to the series of columns I did on the “Leaving a Lasting Legacy” series. There’s so much more I didn’t share in these columns. Comments have included how families are currently working through various issues and situations that I shared and also stories of heartbreak. I realized one thing I never cleared up was the difference between a succession plan and estate plan. Polly Dobbs, Attorney, shared,

“If you’re breathing, and deciding who takes over the farm operation as you slow down towards retirement, that’s a succession plan. For example, perhaps the successor is buying equipment, on installment over time. Or, perhaps you’re giving up some acres to the successor.

If you die, the plan about who gets what, that’s an estate plan. It must complement the succession plan. Does the successor have to keep buying the equipment, or just get it? Does the successor have a right to lease your land? Does the successor need to buy your land? Have option to buy?”

Has your successor put in sweat equity? Think of the succession plan as deferred compensation. If you don’t have a related successor, do you want to find an unrelated one? Income tax consequences of selling equipment and final harvest require a team approach with your CPA well ahead of retirement. Reminder: Returning to the Farm Workshop is March 7-8 in Hastings. Info: https://cap.unl.edu/rtf25.

Webinar: “How to pay for long-term care without selling the family farm or going broke!” is a free webinar being held this week on February 27, 2025 at Noon CST. Adam Dees is a practicing Kansas Elder Law attorney and will be sharing on this topic including: how to protect your spouse and family, health information and how to choose decision makers, and Medicaid essentials. He also authored a booklet, “The Consumer’s Guide to Supplemental Needs Planning” focused on helping people with families who have special needs plan for their care, and also educates people through seminars like “Estate Planning Secrets,” “Don’t Lose the Farm: How to pay for Long-Term care without going broke,” and “Doing Dementia Differently.” Registration is required at: https://us02web.zoom.us/webinar/register/WN_Ui5GgEWSTqemPu5uALZb2Q#/registration

Pruning Workshop March 1st: Many gardeners have questions at this time of year about spring pruning…

- Will early pruning cause fruit tree leaf and flower buds to develop earlier and possibly be damaged by normal spring frosts?

- Should pruning still be done in March and early April or should it be done earlier if conditions have been warm?

- What about shade trees? Should any adjustments in the time of pruning be made in response to warm conditions?

Join Sarah Browning Saturday, March 1, for the NRD’s annual Spring Gardening Workshop. The topic will be Mastering the Basics of Pruning. The free class will be held at the 4-H building at the York County Fairgrounds from 10 a.m. to noon. Walk-ins are welcome but pre-registration to 402-362-6601 is helpful for printing materials.

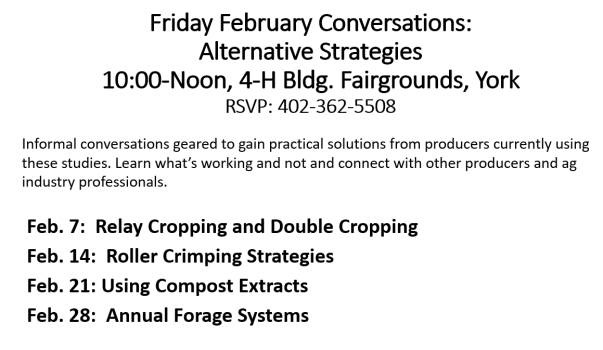

Also, our last Friday February conversation is this Friday, Feb. 28 from 10-Noon at the 4-H Bldg in York on Annual Forage Systems. Come hear from farmers making this work! Please RSVP to 402-362-5508.

Estate and Succession Planning

Transition/Estate Planning: This topic is perhaps one of the most important topics for all families to discuss, especially in agriculture. Many have shared stories of heartbreak with me. I’ve also heard an increasing number of farmers share with me they weren’t sure who the farm will transition to as there’s not an interested heir returning. The following are a few workshops to aid in beginning conversations and in the transition process. Perhaps this may be a goal for your farm the coming year? The first workshop allows for farm women (and in York I’m also encouraging couples) to gather to form connections and learn together. The second workshop is one my family participated in. It was special to connect with the other families who attended and talk through the questions/situations each family was facing and the advice/tools lawyers provided for varying situations. I’d highly encourage your family to consider attending one of these opportunities this winter if you haven’t started the farm transition discussion/process.

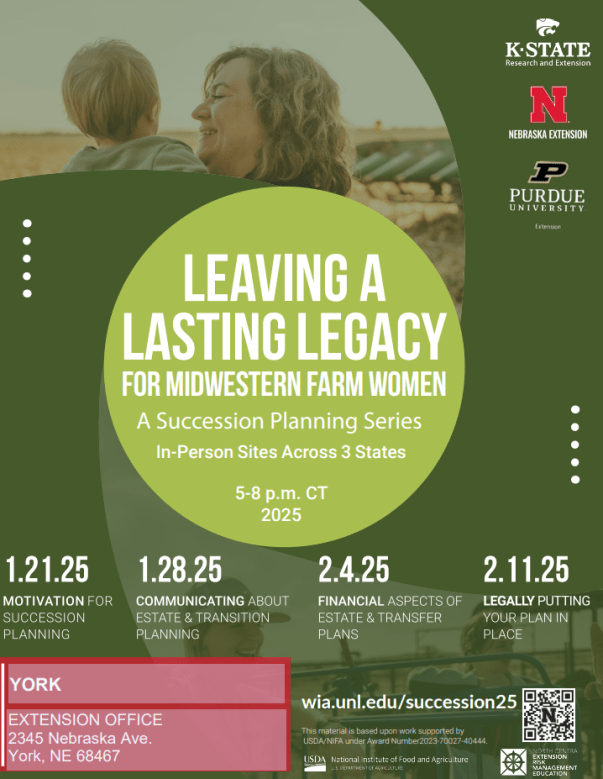

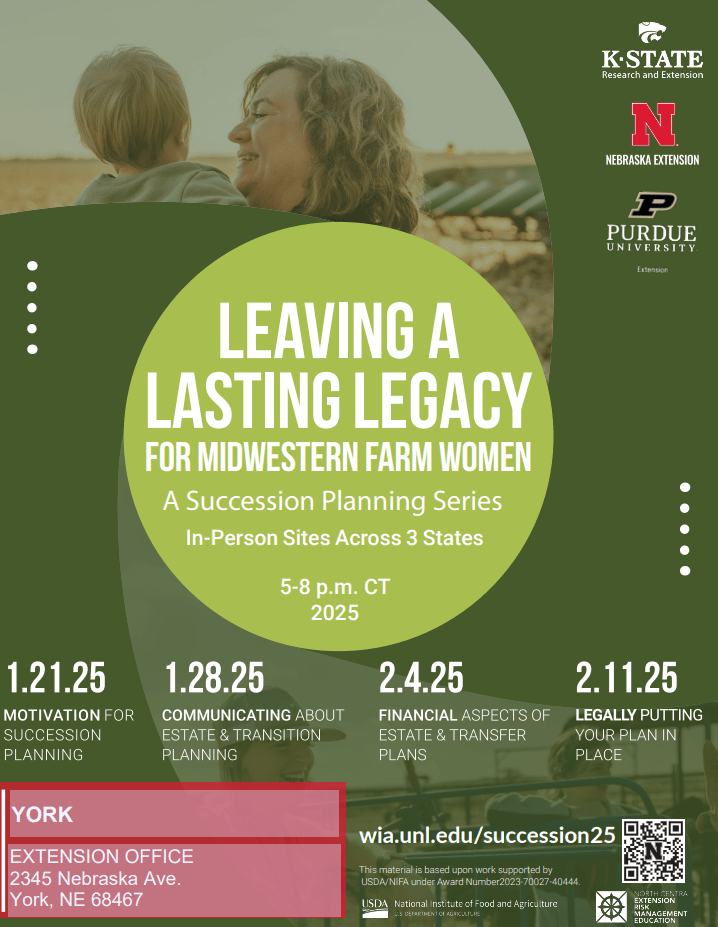

Succession Planning Workshop for Farm Women: This workshop is a 4-part series from 5-8 p.m. on Tuesday nights (Jan. 21, Jan. 28, Feb. 4 and Feb. 11). I will be hosting this workshop at the Extension Office in York and there are other area locations in Geneva, Lincoln, Central City, Columbus, Blue Hill, and Auburn. The workshop is geared towards women but men are also welcome, and I’d encourage couples to attend if it works. Topics covered will include motivation for succession planning, communicating with family, the financial aspects of estate and transition plans, and the legal aspects of putting a plan in place. A keynote speaker will be simulcast to every workshop location during each meeting, with time for questions and a hands-on activity for participants. A meal will be provided on each date.

The registration fee for in-person attendance is $60 before Jan. 13 and increases to $75 on or after Jan. 13. A virtual option is available for $75. Participants are encouraged to attend all four sessions. More information and registration is available on the Nebraska Women in Agriculture website, https://wia.unl.edu/succession25.

Returning to the Farm 2025 is a workshop series for families who are in the transition process of bringing members back to the farm or ranch. It will begin with a two-day workshop for multi-generational families on March 7 and 8, at Central Community College in Hastings, 550 S. Technical Blvd. The series also includes two follow-up workshops, to be held virtually after the in-person meetings.

The series assists families and agricultural operations with developing financial plans and successful working arrangements to meet their unique needs. It will guide families in developing estate and transition plans, setting personal and professional goals and improving the communication process between family members. Presenters will include extension experts as well as agribusiness and legal professionals.

The workshop fee is $75 per person on or before Feb. 28. March 1, the fee increases to $85 per person. Registration includes dinner on March 7 and lunch on March 8. It also includes two follow-up workshops, to be held virtually (dates/times TBD). Hotel accommodations are not included. https://cap.unl.edu/rtf25.

The In-Season Nitrogen Publication I had mentioned in the previous columns has now been published and can be found: https://go.unl.edu/tp7c.

JenREES 2/20/22

I’ve so greatly appreciated the discussions and learning opportunities at meetings this past winter! We have one final cover crop meeting this Friday, Feb. 25 from 10-Noon at the 4-H Building in York. The topic is discussing the economics of cover crops. I’m often asked about this and have ideas, but don’t have answers, so am seeking a discussion around it. We know grazing often is the one way (not always, but often) where cover crops will pay. Looking forward to a deeper discussion on additional ways to look at economics of cover crops, such as assigning a dollar value to any soil changes over time. Please join us if you’re interested!

Estate Planning Workshop March 8: We’re excited to offer an estate planning workshop for farmers and ranchers from 1:30-4:00 p.m. on March 8 at the Seward County Extension Office (322 S. 14th St. in Seward). My colleague, Allan Vyhnalek, an extension educator for farm and ranch transition and succession, will offer tools and strategies to effectively plan, start and complete estate plans, offer background on common mistakes during the process, and highlight essential considerations for creating and carrying out estate and succession plans.

He also asked Tom Fehringer, an attorney based in Columbus, to present during the workshop. Fehringer specializes in estate planning, business planning and trust administration, among other areas of practice. It’s just a great opportunity to learn more and ask questions (especially of an attorney) for free! Please RSVP by March 7th at 402-643-2981.

K-Junction Solar Project Public Meeting Feb. 24: EDF Renewables is inviting the public to a meeting to learn more about the K-Junction Solar Project on Thursday, Feb. 24 from 5:00-7:30 p.m. at the Stone Creek Event Center in McCool Junction. Food and beverages will be provided.

Results of Xyway™ LFR® Fungicide in Furrow: Last week at the on-farm research update, three area farmers and I presented the results of our on-farm research Xyway™ LFR® studies. This fungicide, applied at planting, translocates within the plant providing disease protection for a period of time. In 2021, Xyway™ LFR® was tested at 8 on-farm locations in Buffalo, Hall, York, and Seward counties. Emergence counts taken at 4 locations in Buffalo/Hall counties showed better emergence with Xyway in one of the locations and slower emergence with Xyway in the other three locations. Early season stand counts were taken at all 8 locations. Of these, one location showed better stand with Xyway compared to the check, two showed less stand with Xyway, and the others showed no differences. Three of the 8 locations showed a yield reduction with Xyway compared to the check while the other five locations showed no difference. Half of the locations showed reduced profitability while there was no difference in the other half. At the two York locations, I also did disease ratings. In spite of it being a low-disease year, in one of the two locations, Xyway reduced gray leaf spot pressure on the plants compared to the check. At neither location was there a difference in overall southern rust severity. In general, the growers who tried this felt it was helpful from the standpoint their fields are near towns or powerlines where it’s difficult for arial applications. FMC recommended during the meeting to move the Xyway™ LFR® product away from the seed for those trying it in 2022.

Our Crop Science Investigation Youth (CSI) group worked with Jerry and Brian Stahr on their Xyway study as part of the Nebraska Corn Board’s Innovative Youth Challenge. It was a great way for youth to utilize the scientific method while learning about crop scouting and participating in on-farm research! The youth won first place and share their results in the following video: https://youtu.be/B87xqr0pWMk. If you know of youth interested in science and plants who may want to join us for CSI, please let me know! We meet monthly throughout the year. Next meeting is Mar. 15.

JenREES 11-18-18 Farm Transition

Wishing everyone a blessed Thanksgiving with family and friends! We have much for which to be thankful!

Last week we held a farm transition meeting in York. I was thinking back to a family gathering we had shortly after one of my dad’s farm accidents. We were grateful he was going to be ok. In talking about what needed to be done on the farm, I asked something like, “Does anyone here know what your wishes or plan is for the farm if this had been more serious?” It wasn’t the best time and I didn’t do this correctly. It did allow for discussion as we never talked about what would happen to the farm before that. I’m grateful my parents responded over time asking each of us kids our intentions/values regarding the farm. They then put their estate plan together and at Christmas one year, went through everything with everyone including any spouses that were present. What I appreciate the most is that they were intentional and there is no secret.

The fact that estate plans can be secret was a common frustration among attendees at the workshop…and as I talk with various farmers. Dave Goeller, emeritus Farm Transition Specialist, shared a sad story about a man in his late 60’s whose 90+ year old dad still hadn’t transitioned management of the ranch to him. When he asked his dad about the opportunity to manage the ranch in the future, the dad didn’t wish to talk and said not to worry. I won’t go into the details but when the parents passed away, the ranch was sold. What’s sad is that, most likely, the outcome is not what the parents intended, and certainly not what the son hoped. We need to get away from estate plans being a secret.

Consider these questions:

- Have you been able to talk to your parents about what is happening with their estate plans? If not, why?

- What is your biggest concern/anxiety/fear(s)? What are you afraid you might find out?

- What is the biggest obstacle in your family dynamics?

- What do you love about your family business?

- What is the worst situation you can think of which might happen in the future?

- What could you learn that can help you?

- What is your mission statement for your farm/ranch? What is your vision for the farm/ranch?

- What are your goals for your farm/ranch? What will you do to make your vision happen?

Dave shared that while a person may feel like a ‘vulture’ when asking about the estate plan (as asking can come across as greed), it can really be a question over shared values. As I think about my immediate family, our shared values are faith, family, hard work, sacrifice, maintaining our family farm. I should’ve broached the subject using shared values instead:

“Dad, I’m so grateful God protected you and you’re going to be ok! You and mom have worked so hard and sacrificed so much for us kids and for this farm. We as your children wish to see your legacy live on in keeping the farm in our family. May we please discuss what your and mom’s goals and dreams are for the farm in the future?”

For those who have asked me how to have this conversation, perhaps some of these questions found in the Workbook at http://go.unl.edu/FarmRanchTransition may help? I also have copies of this workbook in the Extension Office. The questions cover a range of topics from understanding common values, asking if there are written documents, what is long term health care plan to protect the farm/ranch, contribution of all heirs, etc. Please also consider the Nebraska Farm Hotline at 800-464-0258 as a valuable and free resource for you! This hotline is a confidential resource for talking about stress, anxiety, financial concerns, and also for scheduling a time to meet with Dave Goeller and Joe Hawbaker (Attorney) for free to discuss estate plans and farm transitions. All you need to do is call 800-464-0258. For those interested in meeting regarding estate plans/farm transition, Dave and Joe have promised to come back to York to meet individually with families once they receive at least 5 calls. So, if this is of interest to you, please mention this when you call the hotline.

Final thought, this past year in particular, several farmers have shared with me their children would like to see them retire. I sense a variety of feelings about that from them as I listened. I also asked several questions including, “What does retirement look like to them? What does it look like to you?” Perhaps those and other questions could be asked in an honest conversation together?

Much of our identity, right or wrong, is found in what we do for a living. After all, we tend to ask this question when we meet new people. Through life’s circumstances, I’ve had to learn to seek my identity in who I am. Dave mentioned to think of retirement not as no longer working on the farm or being an important player, but retiring the management to the next generation. So, perhaps work out a transition plan that fits your situation where the first perhaps 3-10 years, the older generation is the primary manager in a mentor role explaining why he/she made the decisions a certain way to the next generation. The next 3-10 years, decision making is shared between the older and next generation. After that, decision making is transitioned to the next generation. And, during this entire process, the older generation needs to consider what he/she will be “retiring to”…what purpose or meaning can be found to occupy the time that was once spent in managing the farm?

Ultimately, estate planning and farm transition…relationships…are too important to not talk about these topics. Let’s no longer keep them a big secret!

Women in #ag #farm Transition

Last week I attended the Women in Ag Conference in Kearney. It’s always a great conference to see many friends and meet  new ones who live and work in agriculture! I also enjoyed teaching a very engaged group of women the second day about crop science investigation. It was fun for me to see them dig into the hands-on activities!

new ones who live and work in agriculture! I also enjoyed teaching a very engaged group of women the second day about crop science investigation. It was fun for me to see them dig into the hands-on activities!

The first session I attended was by Dave Specht from the UNL Ag Economics Dept. He does a great job of relating to the audience and talked about “Woman’s Influence-the Key to Generational Business Transitions”. Dave has a consulting business on the side and as part of that business he meets with families to develop a farm transitional plan based on the Continuity Quotient he developed. The Quotient contains 7 parts and I’ll share some key highlights via questions he raised that stuck out to me. Perhaps they’ll raise more questions for you as well.

1-Business/Estate Planning: The goal of the business/estate plan is to reduce the number of surprises to the farm and family members upon death of the farm owner. Is your plan coordinated with all the advisers in the operation and does it consider the perspectives of all the generations involved in the operation? Is it even documented and has it been communicated to the entire family before the owner passes away?

2-Communication: Are family members able to openly discuss the farm and what it means to them?

3-Leadership Development: No one is ever “ready to take ownership”; it is learned along the way. Opportunities for the next generation to make decisions need to be allowed. Often we hear of exit plans, but is there an “entrance plan”-a strategy to invite the next generation back to the farm?

4-I didn’t catch the name of this point but essentially Dave was saying that if the next generation is always asking his/her parents for a bailout, that it delays the trust that the person can someday operate the farm. How the next generation handles personal finances is important in showing he/she can someday run the operation.

5-Personal Resilience: How does the next generation handle challenges? Does the person retreat and avoid them or does the person look for ways to overcome them and use it as a growing experience? If the person retreats, he/she may not be wired for ownership in the future.

6-Retirement/Investment Planning: When will the older generation plan to retire? How much will the farm support (meaning how many people)? Where will retirement cash flow come from? The goal is to not rely on the next generation to generate your entire retirement income.

7-Key non-family employees: Sometimes the most valuable family business asset goes by a different name! Is the vision for the family farm communicated to these employees? How you talk about employees to next generation and how you talk to next generation about the employees is important in dictating future partnerships; someday the employees and next generation will be partners.

I would recommend checking out Dave’s Web site at http://www.davespecht.com for more information. He provides communication and consultation about farm transition and financial planning. Life is so short! Make sure you have a plan in place that follows the keys Dave provided above!