Blog Archives

Farm Bill 2025

Farm Bill: Have received a number of calls the past few weeks on the farm bill election decisions. Normally I write this column in February, but the deadline this year is April 15, 2025 to make a determination on farm bill programs.

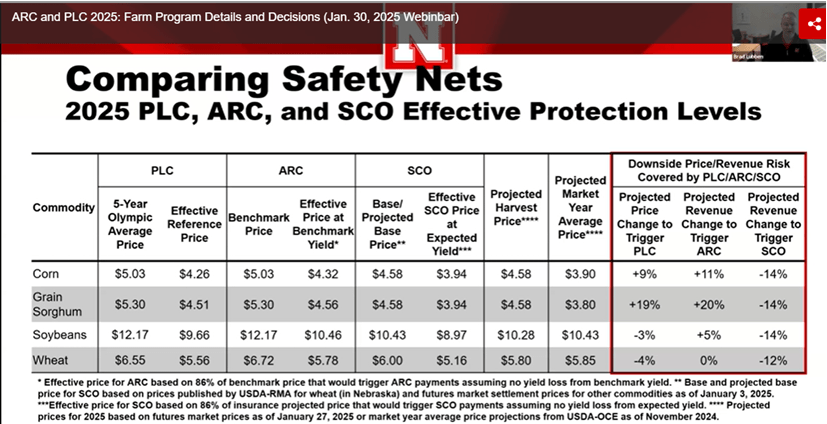

The greatest change for this year is the increase in the effective reference price again for all crops, which may impact on how decisions play out.

The following are PLC reference prices for commonly grown commodity crops in the area: Corn $4.26; Grain Sorghum: $4.51; Soybeans $9.66; Wheat $5.56.

The following are ARC-Co Effective Prices at Benchmark Yields for grown commodity crops in the area: Corn $4.32; Grain Sorghum $4.56; Soybeans $10.46; What $5.78.

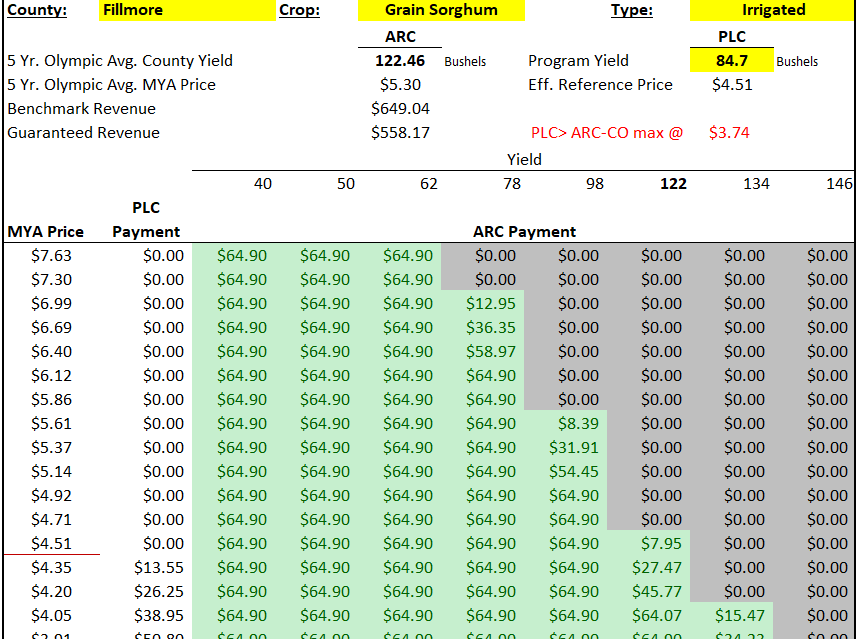

For those who are more visual like me, the easiest way for me to look at these decisions is via the K-State Ag Manager Spreadsheet tool found at: https://www.agmanager.info/ag-policy/2018-farm-bill/tradeoff-between-20252026-arc-and-plc. I added some photos of these decisions at jenreesources.com.

Please look at this for yourself for your specific state and county. When I look at it, because of the higher ARC-Co effective prices compared to PLC for all crops, ARC-Co is triggering before PLC, regardless of irrigation or not, for the counties in this area of the State. And, the payments increase rapidly hitting the cap with any potential for lower prices and/or county average yields. ARC-Co also triggers sooner if prices don’t tank but in the event of lower county-average yields due to drought, hail, etc.

So, this year, beyond considering crop insurance, the decision appears somewhat clearer in spite of not knowing for sure what will happen with market year average prices. Again, I would still recommend you try running the spreadsheet for yourself.

If you are concerned about spreading risk with your farm bill decision and you’re concerned about prices tanking, you could put your highest proven PLC yielding fields for different crops into PLC and the rest into ARC-Co. This is also a consideration if you’re concerned about hitting payment caps with ARC-Co.

As you make crop insurance decisions, the following webinar may be of help if you’re considering Supplemental Coverage Option (SCO) or Enhanced Coverage Option (ECO). SCO can only be used with PLC elections. https://www.agmanager.info/ag-policy/2018-farm-bill/making-farm-program-and-crop-insurance-decisions-2025-webinar-slides-and.