Blog Archives

Farm Finances and Succession

Finances was the third week’s topic of the “Leaving a Lasting Legacy” series. A statistic was shared that surprised me. Did you know that only 27% of land is inherited or gifted? I was surprised this number wasn’t higher. It was suggested that with cost of living, nursing homes, etc., it may not be feasible for owners to “gift” land when they’re in their sunset years (meaning, the final years of a person’s life that may include retirement or “slowing down”). A UNL survey in 2017 asked farmers why they were retiring later: 62% said they can’t afford to retire. That’s a sad statistic as well.

Regarding the other ways land is obtained, 4% is purchased at an auction, 18% is purchased from a relative, with 50% being purchased from a non-relative. So, the question for those hoping to farm in the future becomes, How are you preparing yourselves to financially buy land…including buying out siblings, etc.?

For the owner generation, “sunsetting” means to step back and support without necessarily stepping away. It’s important to know your ultimate goal for the farm/ranch for the future. If you desire succession of the farm/ranch, documents need to be in writing and everyone on your team needs to know your goals and what the documents say. Your family also needs to know.

Your “team” can include people like a lawyer, tax professional, banker, financial planner, and others such as a facilitator/mediator. The key: You Know them, Like them, Trust them. These professionals should provide options but not tell you what to do. Your situation is unique. Not every tool in the toolbox is the right tool for you and your situation. Of importance, the term “financial advisor” is not regulated. They recommended to look for a designation called “Certified Financial Planner” (CFP).

Transitioning is a balancing act. The owner generation can’t bring the next generation into the operation at financial jeopardization of the owners. An income statement (profit-loss) statement is a way to know the profitability of the farm and the ability to support two families or not. This is not what is in the bank account. An income statement shows the net farm income, which is the profitability of the business.

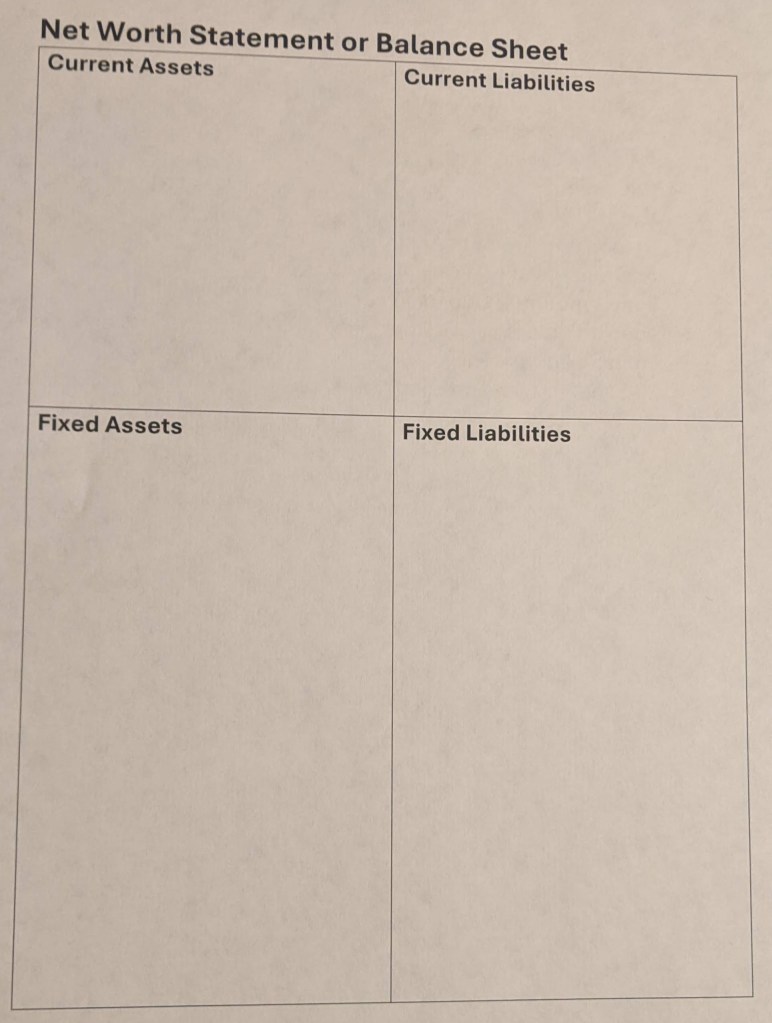

We also walked through balance sheets (also known as net worth statements). Balance sheets don’t show profitability; they show what we OWN (assets) or OWE (liabilities) and are a snapshot of the situation for a moment in time. While this may not be new to some, I appreciated a visual activity we did where we split assets and liabilities into quadrants that included current (the current year) or fixed (more than one year). I think for many not involved with the day-to-day operations of a farm or business, it’s hard to visualize the large numbers being mentioned. I have an example photo of this more visual way of looking at a balance sheet on my blog at jenreesources.com.

On-Farm Research Update will be held on February 18, 2025 at the Holthus Convention Center in York. It’s one of my favorite meetings of the year to hear from the farmers themselves about why they tried the studies they did and what they learned. Often the results will show no differences compared to the check treatment, which can frustrate people. However, that’s important information to test it on smaller acres first before investing a lot of money on larger acres. We did have some studies with promising results as well, though. If you’re interested in attending, please call (402) 362-5508 to pre-register as we need RSVP for lunch count.

Communication

The information we’re learning about in the “Leaving a Lasting Legacy” program is important for every person. Communication was the topic of last week’s program. It’s so important as with each conversation we either build or break trust and relationships.

How we speak counts more than what we say. I was reminded of that this past week.

- 7% is WHAT we say…the actual words

- 38% is the tone of voice…HOW we say it

- 55% is body language…also HOW communication comes across

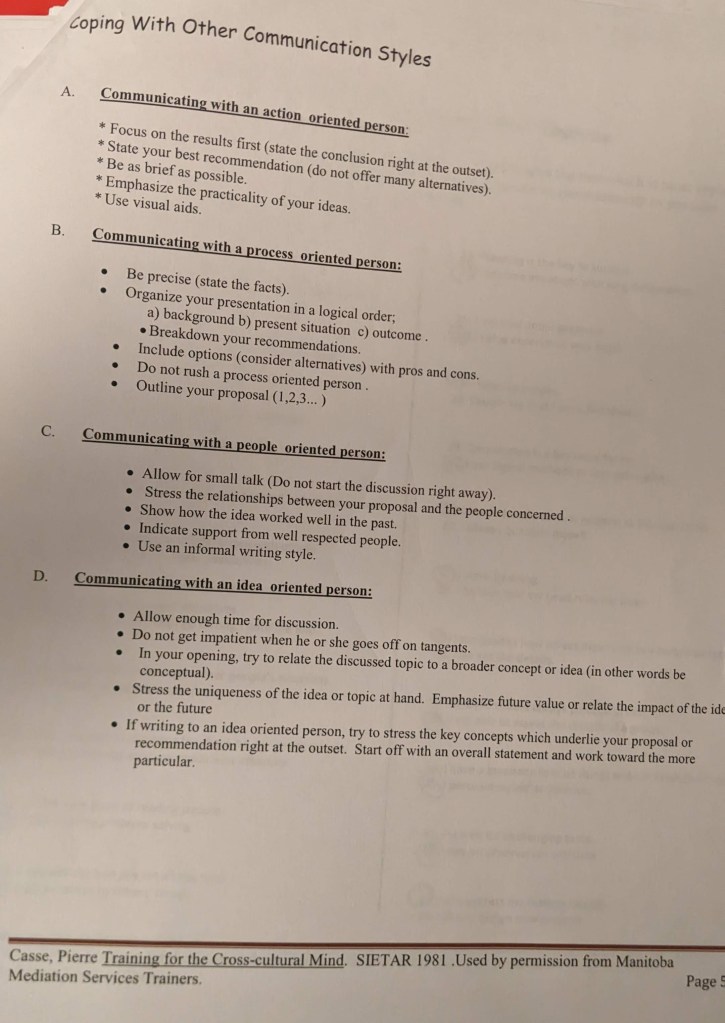

Communication (or lack thereof) is the #1 issue raised by families in general. Why is family communication so difficult, especially when a family business is involved? Four potential reasons include: we don’t understand different perspectives, we’ve had difficult past experiences trying to talk about family and/or business affairs, the threat of loss of control, and a reluctance to change. How we can improve is by seeking to listen to understand and also understanding different personality traits and perspectives of others.

I find personality tests fascinating as I really like to know what makes each individual unique. One free tool that was recommended to us that is science-based was the DISC personality assessment at: https://www.123test.com/disc-personality-test/ . Perhaps consider each person in your family take this and then discuss your results as a family. These tools help provide insights into others.

When it comes to communicating with people of different generations, it’s important to know what they value. To engage Baby Boomers (born 1945-1964), encourage them to provide mentorship and learn together. Gen Xers (born 1965-1980) are independent, resilient, and adaptable. To engage them, give them opportunities for leadership. To engage Millennials (born 1981-1996), include them in management and allow autonomy and flexibility as family and social impact is important to them. Generation Z (born 1997-2015) are naturally adapted to technology and are financially driven. To engage them, show them opportunities for work-life balance and career advancement.

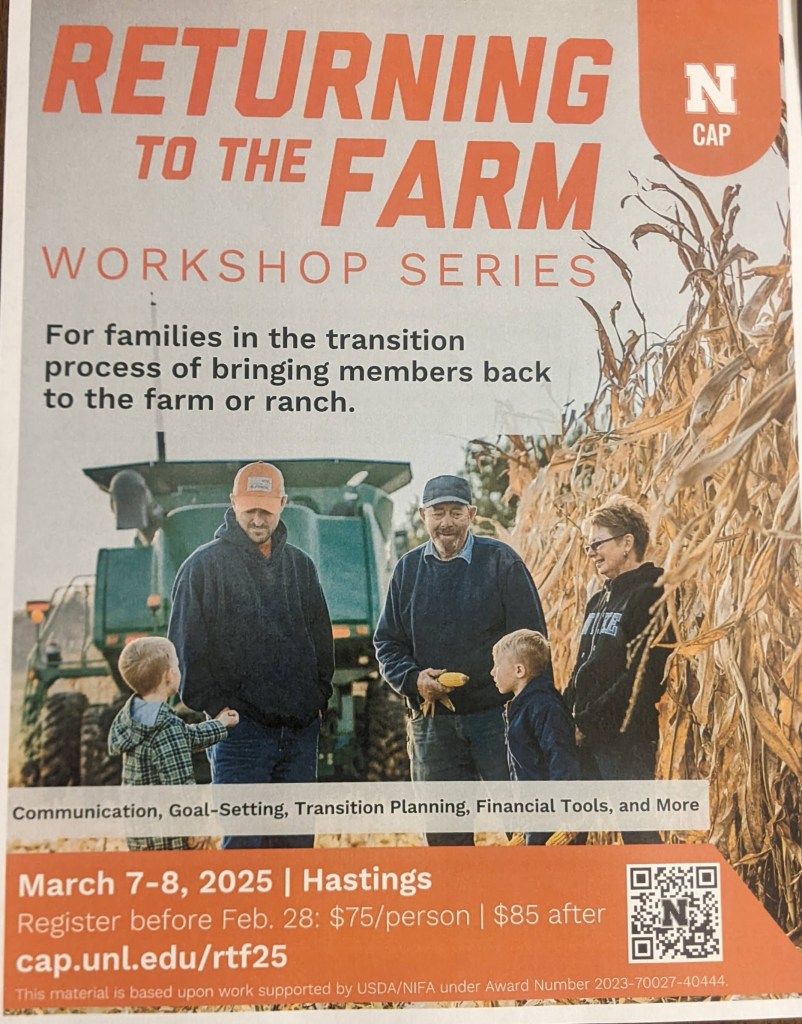

They spoke a lot about family meetings. Originally, I thought this was more complicated. However, it can be as simple as touching base via the phone or having breakfast/lunch together a few times a month. Family meetings can be as simple as talking through the coming week’s plans, any goals for the farm, prioritizing bills to pay, etc. It’s also really important to be a family beyond whatever role each person plays in the farm or business! Check out https://cap.unl.edu/succession/ for additional resources.

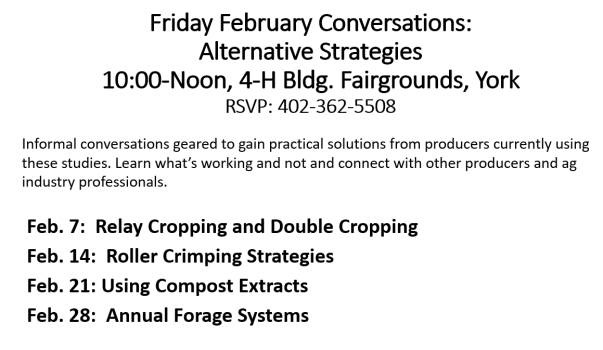

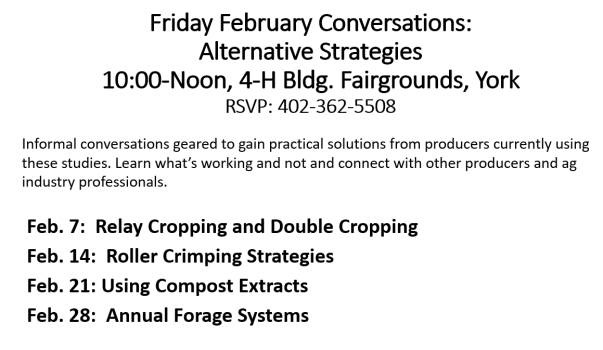

Friday February 7th Conversation: Relay Cropping and Double Cropping: There’s been increasing interest of how to improve the economics of small grains with either relay cropping or double cropping soybeans with either rye or wheat. Hear from growers who are trying this in a variety of ways and what they have learned. Conversations are held each Friday from 10 a.m.-Noon at the 4-H Building in York. Please RSVP to 402-362-5508

Nitrogen Challenge Meeting will be held Monday, February 10th at the Holthus Convention Center in York from 9 a.m.-Noon. Hear the latest on-farm research results, about the technology from Sentinel Nutrient Management, information about chemigation certification, and from a larger farmer panel. There’s no charge for this meeting, but please RSVP to (402) 362-5508.

Winter Meetings Week Jan. 12th

Tis the season for winter programming! The following are a few upcoming meetings occurring this week. Winter program brochures were mailed a few weeks ago, so please check those for additional meetings. Looking forward to seeing you at upcoming meetings this winter! A reminder that if you plan to attend any of the upcoming Crop Production Clinics, that you need to register online by 3:00 p.m. the previous day of the clinic. Crop Production Clinics this week will be held in Kearney on Tuesday the 13th and at York on the 14th.

Farm & Ranch Business Succession & Estate Planning Workshops: This is a very important topic for farm families to consider! Two workshops will be held in our area; one in Blue Hill at the Community Center on January 13th and one in York at the Country Club on January 15th. The workshop will go from 9:00 a.m. to 2:30 p.m. There is no charge for the workshops, but you need to register by calling the Rural Response Hotline at 1-800-464-0258. Please register by January 10 for Blue Hill and January 12 for York.

The workshop is intended to be useful for established farm and ranch owners, for their successors, and for beginners. Topics include: the stages of succession planning, contribution & compensation, balancing the interests of on-farm and off-farm heirs; the importance of communication, setting goals, analyzing cash flow, and balancing intergenerational expectations and needs; beginning farmer loan and tax credit programs; the use of trusts, wills, life estate deeds and business entities (such as the limited liability company) in family estate and business succession planning; buy-sell agreements, asset protection, taxation (federal transfer taxes, Nebraska inheritance tax, basis adjustment), and essential estate documents. Presenters are Dave Goeller, Deputy Director, Northeast Center for Risk Management Education at UNL and Joe Hawbaker, Agricultural Law attorney from Omaha.

This workshop is made possible by the Nebraska Network for Beginning Farmers & Ranchers, the Farm and Ranch Project of Legal Aid of Nebraska, National Institute of Food and Agriculture, the Nebraska Department of Agriculture’s Farm Mediation, and the University of Nebraska Extension. More information can be found here.

Farm Bill Education Training January 14th: For those of you that would like to learn more about the Texas A&M Agricultural Food Policy Center comprehensive Farm Bill Decision Aid computer program, a hands-on training will be held Wednesday, January 14, 2015 at the new Nebraska Innovation Campus Conference Center, 2021 Transformation Drive in Lincoln, Nebraska. Workshop presenters will be Dr. James Richardson, Ag. Economist from Texas A&M and Dr. Brad Lubben, UNL Extension Ag. Economist. Dr. Richardson is the author of new, cutting edge, computer decision tool, endorsed by USDA. Those attending will learn how to use the Texas A&M Computer Decision Aid, how to interpret the results and how managing risk is integrated into the model. Participants are encouraged to bring their own iPad, tablet or laptop computer. For information about the workshop go to: http://bit.ly/1wh96bm. Participants need to pre-register at http://go.unl.edu/farmbill. The workshop will be from 9:00 a.m. to 4:00 p.m. with morning registration and refreshments available starting at 8:15 a.m. at the new NIC auditorium. There is a $30.00 registration fee which includes the noon meal, refreshments and meeting materials. Web links to the meeting can also be purchased by contacting the Saline County Extension Office at (402) 821-2151. For additional information about the farm bill go to: http://farmbill.unl.edu.

Next Heuermann Lecture will be Jan. 13th at 7:00 p.m. at Nebraska Innovation Campus (2021 Transformation Drive in Lincoln, Nebraska) on the topic of “Genetically Modified Animals: the Facts, the Fear Mongering, and the Future”. Presenter will be: Alison Van Eenennaam, University of California – Davis, 2014 Borlaug CAST Communication Awardee. For more information, go to: http://heuermannlectures.unl.edu/. If you cannot make it to Lincoln, you can watch it live via video at the website link.