Blog Archives

Estate and Succession Planning

Transition/Estate Planning: This topic is perhaps one of the most important topics for all families to discuss, especially in agriculture. Many have shared stories of heartbreak with me. I’ve also heard an increasing number of farmers share with me they weren’t sure who the farm will transition to as there’s not an interested heir returning. The following are a few workshops to aid in beginning conversations and in the transition process. Perhaps this may be a goal for your farm the coming year? The first workshop allows for farm women (and in York I’m also encouraging couples) to gather to form connections and learn together. The second workshop is one my family participated in. It was special to connect with the other families who attended and talk through the questions/situations each family was facing and the advice/tools lawyers provided for varying situations. I’d highly encourage your family to consider attending one of these opportunities this winter if you haven’t started the farm transition discussion/process.

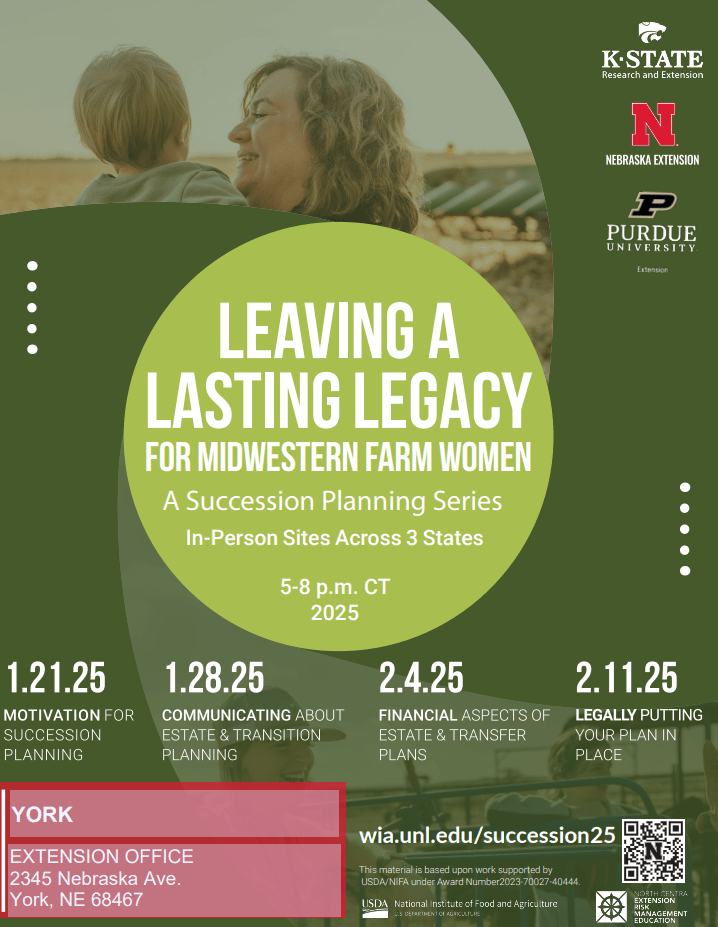

Succession Planning Workshop for Farm Women: This workshop is a 4-part series from 5-8 p.m. on Tuesday nights (Jan. 21, Jan. 28, Feb. 4 and Feb. 11). I will be hosting this workshop at the Extension Office in York and there are other area locations in Geneva, Lincoln, Central City, Columbus, Blue Hill, and Auburn. The workshop is geared towards women but men are also welcome, and I’d encourage couples to attend if it works. Topics covered will include motivation for succession planning, communicating with family, the financial aspects of estate and transition plans, and the legal aspects of putting a plan in place. A keynote speaker will be simulcast to every workshop location during each meeting, with time for questions and a hands-on activity for participants. A meal will be provided on each date.

The registration fee for in-person attendance is $60 before Jan. 13 and increases to $75 on or after Jan. 13. A virtual option is available for $75. Participants are encouraged to attend all four sessions. More information and registration is available on the Nebraska Women in Agriculture website, https://wia.unl.edu/succession25.

Returning to the Farm 2025 is a workshop series for families who are in the transition process of bringing members back to the farm or ranch. It will begin with a two-day workshop for multi-generational families on March 7 and 8, at Central Community College in Hastings, 550 S. Technical Blvd. The series also includes two follow-up workshops, to be held virtually after the in-person meetings.

The series assists families and agricultural operations with developing financial plans and successful working arrangements to meet their unique needs. It will guide families in developing estate and transition plans, setting personal and professional goals and improving the communication process between family members. Presenters will include extension experts as well as agribusiness and legal professionals.

The workshop fee is $75 per person on or before Feb. 28. March 1, the fee increases to $85 per person. Registration includes dinner on March 7 and lunch on March 8. It also includes two follow-up workshops, to be held virtually (dates/times TBD). Hotel accommodations are not included. https://cap.unl.edu/rtf25.

The In-Season Nitrogen Publication I had mentioned in the previous columns has now been published and can be found: https://go.unl.edu/tp7c.