Blog Archives

Farm Finances and Succession

Finances was the third week’s topic of the “Leaving a Lasting Legacy” series. A statistic was shared that surprised me. Did you know that only 27% of land is inherited or gifted? I was surprised this number wasn’t higher. It was suggested that with cost of living, nursing homes, etc., it may not be feasible for owners to “gift” land when they’re in their sunset years (meaning, the final years of a person’s life that may include retirement or “slowing down”). A UNL survey in 2017 asked farmers why they were retiring later: 62% said they can’t afford to retire. That’s a sad statistic as well.

Regarding the other ways land is obtained, 4% is purchased at an auction, 18% is purchased from a relative, with 50% being purchased from a non-relative. So, the question for those hoping to farm in the future becomes, How are you preparing yourselves to financially buy land…including buying out siblings, etc.?

For the owner generation, “sunsetting” means to step back and support without necessarily stepping away. It’s important to know your ultimate goal for the farm/ranch for the future. If you desire succession of the farm/ranch, documents need to be in writing and everyone on your team needs to know your goals and what the documents say. Your family also needs to know.

Your “team” can include people like a lawyer, tax professional, banker, financial planner, and others such as a facilitator/mediator. The key: You Know them, Like them, Trust them. These professionals should provide options but not tell you what to do. Your situation is unique. Not every tool in the toolbox is the right tool for you and your situation. Of importance, the term “financial advisor” is not regulated. They recommended to look for a designation called “Certified Financial Planner” (CFP).

Transitioning is a balancing act. The owner generation can’t bring the next generation into the operation at financial jeopardization of the owners. An income statement (profit-loss) statement is a way to know the profitability of the farm and the ability to support two families or not. This is not what is in the bank account. An income statement shows the net farm income, which is the profitability of the business.

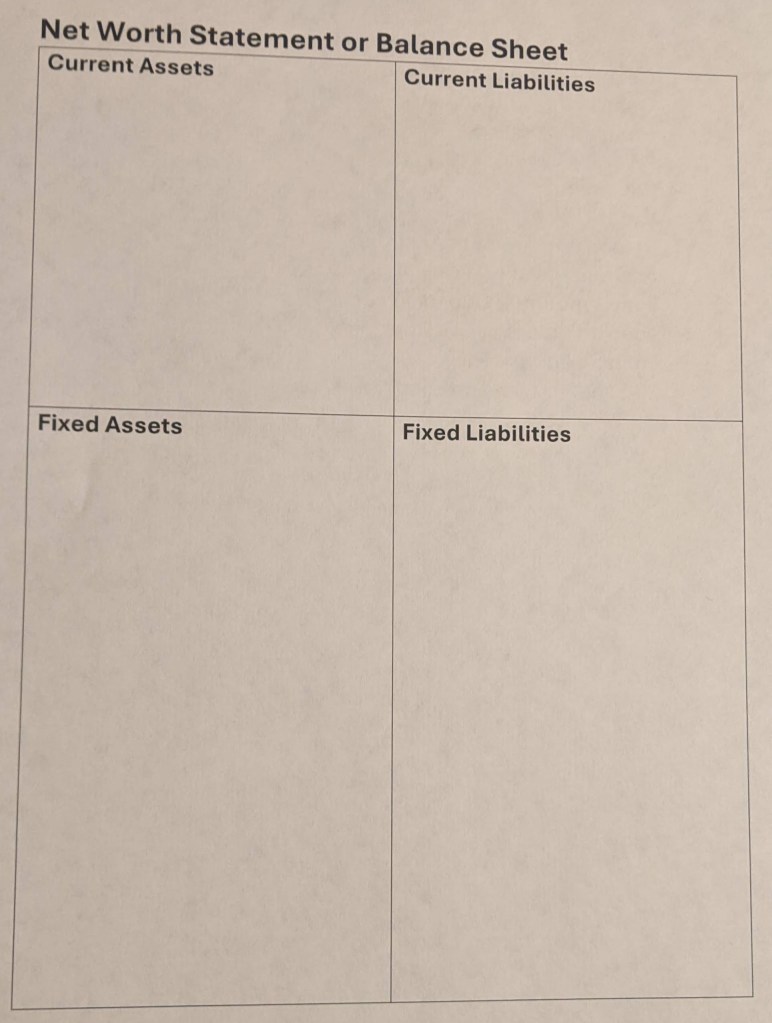

We also walked through balance sheets (also known as net worth statements). Balance sheets don’t show profitability; they show what we OWN (assets) or OWE (liabilities) and are a snapshot of the situation for a moment in time. While this may not be new to some, I appreciated a visual activity we did where we split assets and liabilities into quadrants that included current (the current year) or fixed (more than one year). I think for many not involved with the day-to-day operations of a farm or business, it’s hard to visualize the large numbers being mentioned. I have an example photo of this more visual way of looking at a balance sheet on my blog at jenreesources.com.

On-Farm Research Update will be held on February 18, 2025 at the Holthus Convention Center in York. It’s one of my favorite meetings of the year to hear from the farmers themselves about why they tried the studies they did and what they learned. Often the results will show no differences compared to the check treatment, which can frustrate people. However, that’s important information to test it on smaller acres first before investing a lot of money on larger acres. We did have some studies with promising results as well, though. If you’re interested in attending, please call (402) 362-5508 to pre-register as we need RSVP for lunch count.

Communication

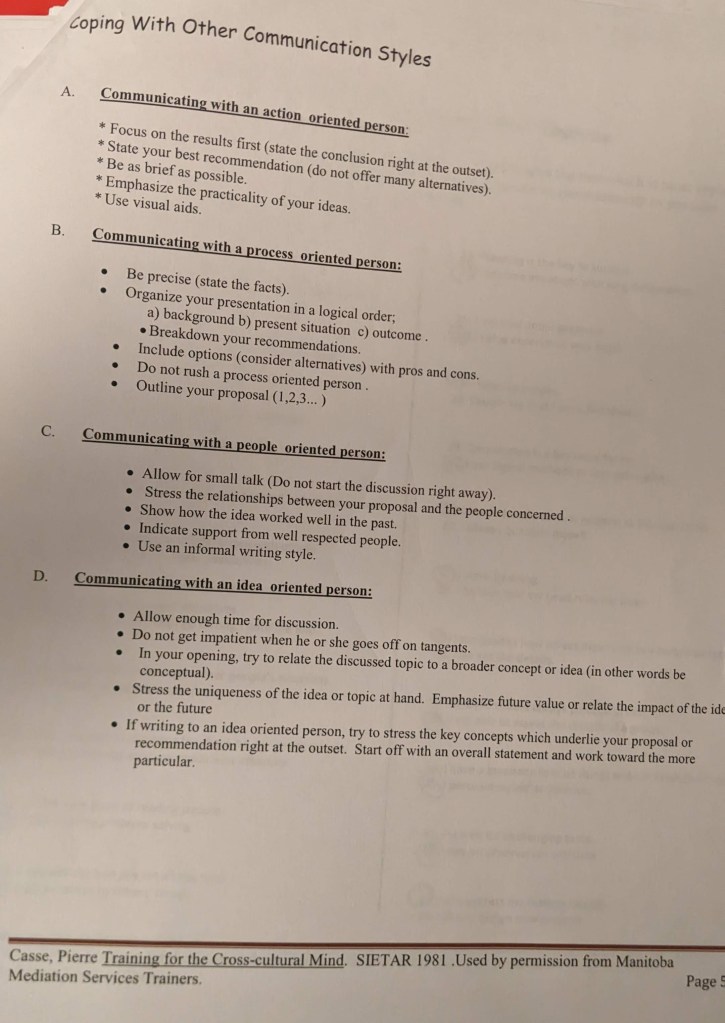

The information we’re learning about in the “Leaving a Lasting Legacy” program is important for every person. Communication was the topic of last week’s program. It’s so important as with each conversation we either build or break trust and relationships.

How we speak counts more than what we say. I was reminded of that this past week.

- 7% is WHAT we say…the actual words

- 38% is the tone of voice…HOW we say it

- 55% is body language…also HOW communication comes across

Communication (or lack thereof) is the #1 issue raised by families in general. Why is family communication so difficult, especially when a family business is involved? Four potential reasons include: we don’t understand different perspectives, we’ve had difficult past experiences trying to talk about family and/or business affairs, the threat of loss of control, and a reluctance to change. How we can improve is by seeking to listen to understand and also understanding different personality traits and perspectives of others.

I find personality tests fascinating as I really like to know what makes each individual unique. One free tool that was recommended to us that is science-based was the DISC personality assessment at: https://www.123test.com/disc-personality-test/ . Perhaps consider each person in your family take this and then discuss your results as a family. These tools help provide insights into others.

When it comes to communicating with people of different generations, it’s important to know what they value. To engage Baby Boomers (born 1945-1964), encourage them to provide mentorship and learn together. Gen Xers (born 1965-1980) are independent, resilient, and adaptable. To engage them, give them opportunities for leadership. To engage Millennials (born 1981-1996), include them in management and allow autonomy and flexibility as family and social impact is important to them. Generation Z (born 1997-2015) are naturally adapted to technology and are financially driven. To engage them, show them opportunities for work-life balance and career advancement.

They spoke a lot about family meetings. Originally, I thought this was more complicated. However, it can be as simple as touching base via the phone or having breakfast/lunch together a few times a month. Family meetings can be as simple as talking through the coming week’s plans, any goals for the farm, prioritizing bills to pay, etc. It’s also really important to be a family beyond whatever role each person plays in the farm or business! Check out https://cap.unl.edu/succession/ for additional resources.

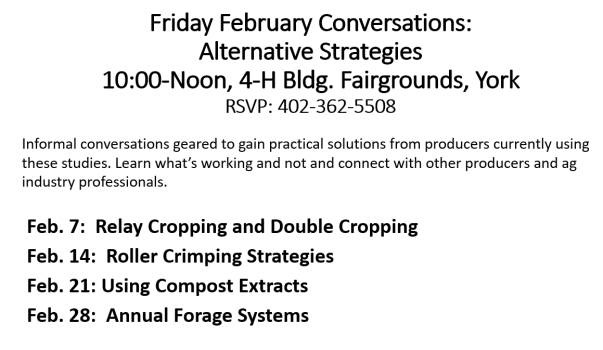

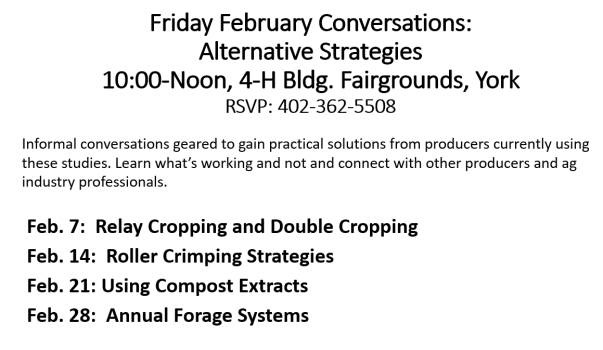

Friday February 7th Conversation: Relay Cropping and Double Cropping: There’s been increasing interest of how to improve the economics of small grains with either relay cropping or double cropping soybeans with either rye or wheat. Hear from growers who are trying this in a variety of ways and what they have learned. Conversations are held each Friday from 10 a.m.-Noon at the 4-H Building in York. Please RSVP to 402-362-5508

Nitrogen Challenge Meeting will be held Monday, February 10th at the Holthus Convention Center in York from 9 a.m.-Noon. Hear the latest on-farm research results, about the technology from Sentinel Nutrient Management, information about chemigation certification, and from a larger farmer panel. There’s no charge for this meeting, but please RSVP to (402) 362-5508.

JenREES 11-18-18 Farm Transition

Wishing everyone a blessed Thanksgiving with family and friends! We have much for which to be thankful!

Last week we held a farm transition meeting in York. I was thinking back to a family gathering we had shortly after one of my dad’s farm accidents. We were grateful he was going to be ok. In talking about what needed to be done on the farm, I asked something like, “Does anyone here know what your wishes or plan is for the farm if this had been more serious?” It wasn’t the best time and I didn’t do this correctly. It did allow for discussion as we never talked about what would happen to the farm before that. I’m grateful my parents responded over time asking each of us kids our intentions/values regarding the farm. They then put their estate plan together and at Christmas one year, went through everything with everyone including any spouses that were present. What I appreciate the most is that they were intentional and there is no secret.

The fact that estate plans can be secret was a common frustration among attendees at the workshop…and as I talk with various farmers. Dave Goeller, emeritus Farm Transition Specialist, shared a sad story about a man in his late 60’s whose 90+ year old dad still hadn’t transitioned management of the ranch to him. When he asked his dad about the opportunity to manage the ranch in the future, the dad didn’t wish to talk and said not to worry. I won’t go into the details but when the parents passed away, the ranch was sold. What’s sad is that, most likely, the outcome is not what the parents intended, and certainly not what the son hoped. We need to get away from estate plans being a secret.

Consider these questions:

- Have you been able to talk to your parents about what is happening with their estate plans? If not, why?

- What is your biggest concern/anxiety/fear(s)? What are you afraid you might find out?

- What is the biggest obstacle in your family dynamics?

- What do you love about your family business?

- What is the worst situation you can think of which might happen in the future?

- What could you learn that can help you?

- What is your mission statement for your farm/ranch? What is your vision for the farm/ranch?

- What are your goals for your farm/ranch? What will you do to make your vision happen?

Dave shared that while a person may feel like a ‘vulture’ when asking about the estate plan (as asking can come across as greed), it can really be a question over shared values. As I think about my immediate family, our shared values are faith, family, hard work, sacrifice, maintaining our family farm. I should’ve broached the subject using shared values instead:

“Dad, I’m so grateful God protected you and you’re going to be ok! You and mom have worked so hard and sacrificed so much for us kids and for this farm. We as your children wish to see your legacy live on in keeping the farm in our family. May we please discuss what your and mom’s goals and dreams are for the farm in the future?”

For those who have asked me how to have this conversation, perhaps some of these questions found in the Workbook at http://go.unl.edu/FarmRanchTransition may help? I also have copies of this workbook in the Extension Office. The questions cover a range of topics from understanding common values, asking if there are written documents, what is long term health care plan to protect the farm/ranch, contribution of all heirs, etc. Please also consider the Nebraska Farm Hotline at 800-464-0258 as a valuable and free resource for you! This hotline is a confidential resource for talking about stress, anxiety, financial concerns, and also for scheduling a time to meet with Dave Goeller and Joe Hawbaker (Attorney) for free to discuss estate plans and farm transitions. All you need to do is call 800-464-0258. For those interested in meeting regarding estate plans/farm transition, Dave and Joe have promised to come back to York to meet individually with families once they receive at least 5 calls. So, if this is of interest to you, please mention this when you call the hotline.

Final thought, this past year in particular, several farmers have shared with me their children would like to see them retire. I sense a variety of feelings about that from them as I listened. I also asked several questions including, “What does retirement look like to them? What does it look like to you?” Perhaps those and other questions could be asked in an honest conversation together?

Much of our identity, right or wrong, is found in what we do for a living. After all, we tend to ask this question when we meet new people. Through life’s circumstances, I’ve had to learn to seek my identity in who I am. Dave mentioned to think of retirement not as no longer working on the farm or being an important player, but retiring the management to the next generation. So, perhaps work out a transition plan that fits your situation where the first perhaps 3-10 years, the older generation is the primary manager in a mentor role explaining why he/she made the decisions a certain way to the next generation. The next 3-10 years, decision making is shared between the older and next generation. After that, decision making is transitioned to the next generation. And, during this entire process, the older generation needs to consider what he/she will be “retiring to”…what purpose or meaning can be found to occupy the time that was once spent in managing the farm?

Ultimately, estate planning and farm transition…relationships…are too important to not talk about these topics. Let’s no longer keep them a big secret!

JenREES 11-4-18

Last week I had the opportunity to attend and speak at the Weed Science School. It was an interesting day of learning, discussion, even reflection. Dr. Amit Jhala, Weed Science Specialist, did a really nice job of organizing the day and creating opportunities to hear from University, Industry, and Nebraska Dept. of Ag (NDA) speakers in addition to providing hands-on activities. While dicamba was a topic that was discussed, we didn’t hear about EPA’s ruling till the following day that the RUP products for soybean will be re-registered. Tim Creger with NDA shared that 6 other dicamba products, most with pre-mixes, will be registered this year. He also shared there are 40 ag labeled dicamba products that are not restricted use pesticides, and as long as they aren’t registered for soybean use, he doesn’t anticipate they will become restricted use pesticides. Comparing NDA claims from 2017 to 2018, they received 95 claims (24 investigated due to lack of resources) in 2017 compared to 106 (50 investigated but only 31 resulted in full investigations due to desire of the person filing the complaint) in 2018. Of the 106 claims in 2018, 17 were non-ag related.

In last week’s column, in sharing about fall burndown apps, I had mentioned that 60% of marestail (horseweed) in Nebraska germinated in the fall. An updated number of 90-95% fall germination for Eastern Nebraska was shared. This once again emphasizes the importance of considering fall apps for fields with marestail pressure.

marestail (horseweed) in Nebraska germinated in the fall. An updated number of 90-95% fall germination for Eastern Nebraska was shared. This once again emphasizes the importance of considering fall apps for fields with marestail pressure.

Dr. Kevin Bradley from University of Missouri shared on 7 points he’s learned from 15 years of researching waterhemp. They included: Never underestimate waterhemp (I’d say the same for palmer); Era of simple, convenient, quick control is over; Use full herbicide rates and pre-emergence herbicides with residual; Overlap pre + post applications (which we also see with palmer-put that post on a week earlier than you think you need it); Glufosinate, dicamba, and 2,4-D may work now but they’re tools being abused; New traits won’t solve the problem; and Get rid of herbicide-centric way of thinking-we need an integrated approach. He thought he was sharing something shocking in that last statement, but I’d say several of us seek an integrated system’s approach to what we do, including weed management. So ultimately, herbicides aren’t the answer for weed control and we need to be thinking about management from a system’s perspective including crop rotation, use of cover crops, residue management, seed destruction, etc. Especially as from the industry perspective presented, it takes an average of 12 years and average investment of $250 million for a new chemistry to be developed. They are seeking chemistries now that work on specific sites of action (how targets within plant) within the mode of action (specific group or chemistry number).

On November 14th, we’re hosting a Farm/Ranch Transition workshop at the 4-H building in York. This is the closest location for our area. The workshop will focus on the needs of the “sandwich generation” between parents who still own land and children who might want to join the operation, on whom farm/ranch transition and transfer often falls. The Gen2, or Sandwich Generation, will learn how to communicate with family to understand the transition and practice asking difficult questions. Legal topics will include elements of a good business entity, levels of layers for on-farm heirs control and access, and turning agreements into effective written leases. Joe Hawbaker, estate planning attorney, and Allan Vyhnalek, Nebraska Extension transition specialist, will share stories and experiences to successfully plan on the legal side. Dave Goeller, financial and transition specialist, will cover financial considerations, retirement, and compensation versus contribution. Cost is $20 per person. If more than two people are attending per operation, the cost is $15/person. Pre-register at (402) 362-5508 or jrees2@unl.edu for meal count. Funding for this project was provided by the North Central Extension Risk Management Education Center, the USDA National Institute of Food and Agriculture Award Number 2015-49200-24226.

November 15th is the York County Corn Grower Banquet at Chances ‘R in York. Social time begins at 6:30 p.m. with a wonderful meal at 7:00 p.m. We will hear from Nate Blum, LEAD 36, on his international trip. We will also hear from local and state directors. Tickets are only $10 and can be obtained from any of the local Corn Grower directors or from the Extension Office at (402) 362-5508. The winner of the Yeti cooler from guessing plot yields will be announced, and those who guessed need to be present in order to have a chance to win. Plot results can be obtained from the Extension Office. Hope to see you there for a nice evening with a wonderful meal to hopefully celebrate the end of harvest season!

JenREES 10-7-18

Grateful for the crops that have been harvested thus far! Also grateful for so many paying attention to grain quality coming out of the fields! That’s been a large part of the past 10 days for me…obtaining grain samples and pictures to answer grain quality questions from quite an area. So I did a quick literature review to better understand the conditions when various ear rot fungi grow and also put together a blog post to hopefully help all of us better diagnose what we’re seeing in grain samples-whether corn or soybean. You can find it at: https://jenreesources.com/2018/10/08/grain-observations/.

Fungal growth in storage is based on moisture, humidity, and temperature. I’ve heard various numbers being used for grain storage and I’m not a grain storage expert. I can also appreciate it costs you more and takes time with the current weather conditions to dry corn. In general, most Extension publications throughout the U.S. recommend getting grain dried to 15% as quickly as possible and maintaining grain in long-term storage at 13%. Briefly, in looking through the literature, the reason for this advice is because various ear rot fungi can continue to grow on and inside those kernels. There’s over 25 species of ear rot fungi with most of them ceasing growth at 15%. The main exception is Aspergillus which has species that can continue from just below 13 to above 14%. Thankfully we don’t have a problem with Aspergillus this year. We are seeing a lot of Fusarium and some Gibberella (which may increase with this rain). But we’re also seeing some Diplodia and other lesser ear rot fungi such as Penicillium, Cladosporium, and Nigrospora. The thing is that each fungal species has a temperature and moisture range in which they continue to grow. So if one is growing in a kernel, it gives off heat and moisture allowing for changes in temperature, humidity, and moisture within that area which can allow for other fungal species to grow. Fungi grow from one infected kernel to adjacent kernels. Having more ‘fines’, cob pieces, etc. can increase potential for fungal growth in the bin. Insects also give off heat which changes localized dynamics. Because of these reasons, our recommendation is to get grain dried to 15% as quickly as possible to help stop fungal growth we’re experiencing this year, particularly from Fusarium species. We’re not saying you need to get the grain dried to 13% immediately. It’s only a consideration down the road if you’re storing the grain till next summer. The following NebGuide is a great resource: Management of In-Bin Natural Air Grain Drying Systems to Minimize Energy Costs: http://extensionpublications.unl.edu/assets/pdf/ec710.pdf. Our grain storage resource page can be found at: https://cropwatch.unl.edu/grain-storage-management.

Also, there’s a new app called “Mycotoxins” and it’s another resource with ear rot pictures and mycotoxin information put out by several Universities produced for both Apple and Android devices.

Farm/Ranch Transition When You Aren’t in Control Nov. 14 York: Passing the farm/ranch on to the next generation is a tough job, especially if the next generation is unsure of what will happen when their parents pass. It is especially for those people, who are wondering what is going on, that a series of farm and ranch transition workshops are planned at Valentine, Ainsworth, O’Neill, Norfolk and York from Oct. 23 to Nov. 14.

The workshops will focus on the needs of the “sandwich generation” between parents who still own land and children who might want to join the operation, on whom farm/ranch transition and transfer often falls. Lack of communication often hinders transitions. The Gen2, or Sandwich Generation, will learn how to communicate with family to understand the transition and practice asking difficult questions.

Legal topics presented at the workshops will center around Gen2 needs, including elements of a good business entity, levels of layers for on-farm heirs control and access, and turning agreements into effective written leases. Joe Hawbaker, estate planning attorney, and Allan Vyhnalek, Nebraska Extension transition specialist, will share stories and experiences to successfully plan on the legal side. Dave Goeller, financial and transition specialist, will cover financial considerations, retirement, and compensation versus contribution.

Many families struggle to split assets fairly between on-ranch and off-ranch heirs, while continuing the ranch as a business. Goeller will discuss the family side and what to consider when dividing assets. Vyhnalek will also cover less-than-ideal situations, negotiating, and looking for other business options. The times are 9 a.m.-4:30 p.m. at each location. The closest location to this area is November 14 in York at the 4-H Building. Cost is $20 per person. If more than two people are attending per operation, the cost is $15/person. Pre-register at (402) 362-5508 or jrees2@unl.edu for meal count.

Funding for this project was provided by the North Central Extension Risk Management Education Center, the USDA National Institute of Food and Agriculture Award Number 2015-49200-24226.

Women in #ag #farm Transition

Last week I attended the Women in Ag Conference in Kearney. It’s always a great conference to see many friends and meet  new ones who live and work in agriculture! I also enjoyed teaching a very engaged group of women the second day about crop science investigation. It was fun for me to see them dig into the hands-on activities!

new ones who live and work in agriculture! I also enjoyed teaching a very engaged group of women the second day about crop science investigation. It was fun for me to see them dig into the hands-on activities!

The first session I attended was by Dave Specht from the UNL Ag Economics Dept. He does a great job of relating to the audience and talked about “Woman’s Influence-the Key to Generational Business Transitions”. Dave has a consulting business on the side and as part of that business he meets with families to develop a farm transitional plan based on the Continuity Quotient he developed. The Quotient contains 7 parts and I’ll share some key highlights via questions he raised that stuck out to me. Perhaps they’ll raise more questions for you as well.

1-Business/Estate Planning: The goal of the business/estate plan is to reduce the number of surprises to the farm and family members upon death of the farm owner. Is your plan coordinated with all the advisers in the operation and does it consider the perspectives of all the generations involved in the operation? Is it even documented and has it been communicated to the entire family before the owner passes away?

2-Communication: Are family members able to openly discuss the farm and what it means to them?

3-Leadership Development: No one is ever “ready to take ownership”; it is learned along the way. Opportunities for the next generation to make decisions need to be allowed. Often we hear of exit plans, but is there an “entrance plan”-a strategy to invite the next generation back to the farm?

4-I didn’t catch the name of this point but essentially Dave was saying that if the next generation is always asking his/her parents for a bailout, that it delays the trust that the person can someday operate the farm. How the next generation handles personal finances is important in showing he/she can someday run the operation.

5-Personal Resilience: How does the next generation handle challenges? Does the person retreat and avoid them or does the person look for ways to overcome them and use it as a growing experience? If the person retreats, he/she may not be wired for ownership in the future.

6-Retirement/Investment Planning: When will the older generation plan to retire? How much will the farm support (meaning how many people)? Where will retirement cash flow come from? The goal is to not rely on the next generation to generate your entire retirement income.

7-Key non-family employees: Sometimes the most valuable family business asset goes by a different name! Is the vision for the family farm communicated to these employees? How you talk about employees to next generation and how you talk to next generation about the employees is important in dictating future partnerships; someday the employees and next generation will be partners.

I would recommend checking out Dave’s Web site at http://www.davespecht.com for more information. He provides communication and consultation about farm transition and financial planning. Life is so short! Make sure you have a plan in place that follows the keys Dave provided above!